NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

LATEST

ANALYSTS SAY: Buy, Sell, Hold (25 Apr)

AEM'S Journey From R&D to Reality: Big Leaps in Chip Testing, As Told at 2024 AGM

ANALYSTS SAY: Buy, Sell, Hold (24 Apr)

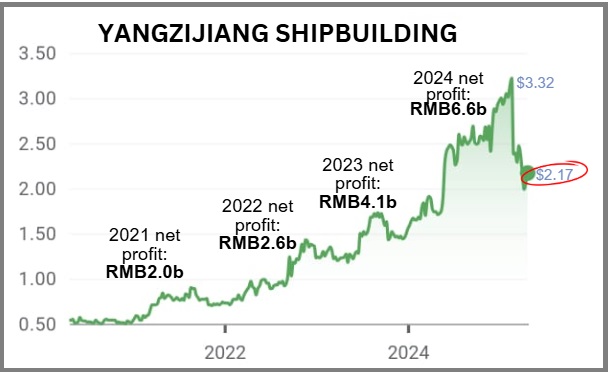

YANGZIJIANG SHIPBUILDING: US scales back port fees, DBS Research reiterates high stock target price

MOST READ

YANGZIJIANG SHIPBUILDING: US scales back port fees, DBS Research reiterates high stock target price

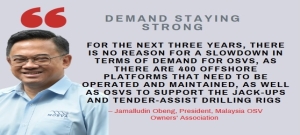

Tariff-Immune: Vessel Supply’s Tight, Charter Rates Look Bright

WEE HUR: Dormitories & Dividends. This Developer is Unrattled by Tariffs

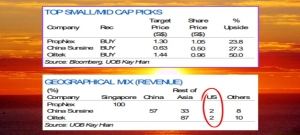

3 Top Small/Mid Caps Shielded from Trump Tariffs, Tantrums

GRAND VENTURE TECH: "Tariffs? No problem". This Company Invested Through Uncertainty, Gets Major Project Wins

NAM CHEONG: This Singapore Listco Bags Multi-Year Vessel Charters Worth Up To RM1.54 Billion

Search Result

- 1. FOOD EMPIRE: Surging coffee bean costs? No problem: This company has record sales, bigger dividends, and growth plan

- (2025)

- Food Empire Brews Success Amidst Rising Coffee Bean Costs Since the release of its FY2024 results after market on 25 Feb, the share price of Food Empire has risen 17% (ie 16.5 cents) to $1.14, ...

- Created on 24 February 2025

- 2. FOOD EMPIRE: Analysts Say "Buy": Here’s Why This Company is Worth Watchin

- (2025)

- Post-2024 results, we published: Surging coffee bean costs? No problem: This company has record sales, bigger dividends, and growth plan. It was largely reporting on Food Empire CEO's discussion ...

- Created on 17 February 2025

- 3. FOOD EMPIRE: Rising coffee prices and other issues -- but analyst ups stock target price, expects ~5% dividend yield

- (2025)

- THE CONTEXT • Food Empire's business has proven to be resilient through the Covid pandemic and past supply chain disruptions and forex volatility. Some challenges have passed for ...

- Created on 18 January 2025

- 4. 20x PE for Oriental Kopi IPO? Food Empire’s 8x Looks Like a Steal in Comparison

- (2025)

- THE CONTEXT • So, there’s this popular café chain in Johor and in various parts of Malaysia called Oriental Kopi. If you’re a Singaporean foodie, you must have been there many ...

- Created on 08 January 2025

- 5. FOOD EMPIRE: 3Q revenue is +11%, aiming for more as it deploys > US$110 m capex

- (2024)

- Food Empire's business of producing and selling 3-in-1 coffee tends to be resilient, and relies on organic growth usually. Not surprisingly, the stock ($1.04) of the Singapore listco has relatively ...

- Created on 12 November 2024

- 6. Coffee, choc prices at high points. What's next for Delfi, Food Empire

- (2024)

- ... price hikes in 2024. • Similarly, for Nescafe, as coffee bean prices have risen. These are not isolated examples. Throughout the food industry, higher coffee and cocoa ingredients (chart below) have ...

- Created on 06 September 2024

- 7. FOOD EMPIRE: Which kopi seller is cheaper & better? The market leader in Malaysia or Singapore?

- (2024)

- Thriving across the Causeway is Power Root, a Bursa Malaysia listco that shares a number of business similiarities with Food Empire Holdings listed on the Singapore Exchange. Power Root's key ...

- Created on 14 August 2024

- 8. FOOD EMPIRE: Coffee bean prices are up, this stock is down. Where to from here?

- (2024)

- Food Empire manufactures instant coffee for sale in over 60 markets -- mainly Russia, Vietnam, Eastern Europe, North Asia.• Has your cup of coffee cost more in recent weeks? If it has not, maybe ...

- Created on 12 May 2024

- 9. FOOD EMPIRE: It has S$120+ M cash. Well, expect higher dividends (if it's shareholder-friendly

- (2024)

- • After a 30+% gain over the last 12 months, Food Empire's stock price has been catching a breather of late. What can investors look to for a further re-rating of the stock? • Well, that's exactly ...

- Created on 28 March 2024

- 10. FOOD EMPIRE: Just keeps making more money despite forex challenges, etc

- (2024)

- The chart shows the remarkable long-term rise in the profitability of Food Empire. It brings to mind Warren Buffett's saying "Time is the friend of the wonderful business, the enemy of the mediocre". ...

- Created on 29 February 2024

- 11. SAMUDERA, FOOD EMPIRE: These 2 just surprised with juicy dividends

- (2024)

- UPCOMING DIVIDENDS Dividends FY23 Final FY23 Special SGD cents 5 5 Food Empire: Flushed with cash, in part from the 2022 ...

- Created on 27 February 2024

- 12. FOOD EMPIRE: Forget media headlines, what's the real deal about 3Q results

- (2023)

- A Singapore newspaper's headline read: "Food Empire Q3 net profit falls 30.6% to US$15.7 million". Another publication: "Food Empire posts earnings of US$15.7 mil for 3QFY2023, down 30.6%". CEO ...

- Created on 11 November 2023

- 13. FOOD EMPIRE: Expect positive 3Q results but weak ruble may impact

- (2023)

- • Food Empire's stock has done very well, rising from 65 cents at the start of the year to $1.07 recently. The market looks persuaded that Food Empire's business of selling 3-in-1 coffee is resilient. ...

- Created on 01 November 2023

- 14. FOOD EMPIRE: 3 key takeaways you shouldn't miss from 24-page CIMB initiation repor

- (2023)

- Many readers would be familiar with, or at least have some idea of, Food Empire Holdings' business which we have regularly reported on. Food Empire Share price: $1.13 Target: ...

- Created on 04 October 2023

- 15. FOOD EMPIRE: Analysts' takeaways from Viet visit

- (2023)

- The populous (nearly 100 million) Vietnamese market is important, and increasingly so, to Food Empire Holdings which achieved FY22 sales of US$50 million in the country. FOOD EMPIRE ...

- Created on 05 September 2023

- 16. FOOD EMPIRE: Higher selling prices for its coffee, continuing share buybacks

- (2023)

- • A certain resilience in Food Empire's instant coffee sales came through strongly during the Covid years. It showed up in its strong sales and profits. USD’m 2022 2021 ...

- Created on 14 August 2023

- 17. FOOD EMPIRE: Expect 1H2023 to be stronger than 1H2022, says Maybank KE

- (2023)

- • After an outstanding 2022 result (despite the Ukraine war supply chain disruptions), which led to a corresponding rise in its share price, Food Empire continued to do well in 1Q. The momentum ...

- Created on 28 June 2023

- 18. FOOD EMPIRE: "We are upbeat on this stock," says RH

- (2023)

- Company Profile Food Empire (FEH) is a global F&B company that manufactures and markets instant beverages, frozen convenience food, confectionery and snack food. The company’s products can be found in ...

- Created on 21 May 2023

- 19. FOOD EMPIRE: Likely to resume share buyback as stock is "cheap

- (2023)

- Yes, Food Empire did deliver robust 1Q2023 earnings as forecast by analysts. And by all accounts, there's more resilience and growth ahead given its established instant coffee brands in markets ...

- Created on 14 May 2023

- 20. FOOD EMPIRE: Another analyst report. Strong 1Q profit expected

- (2023)

- Food Empire is on a roll. After UOB KH's report (FOOD EMPIRE: Higher earnings and margins to come?), Maybank had a report out as well (see below). Both basically say that 1Q2023 results to be released ...

- Created on 05 May 2023

Total: 56 results found.

RECENTLY

More In 2025