|

Excerpts from DBS report

Analysts: Jim AU & Lee Keng LING

| Great Wall of Robots: A self-sustained rise |

|

• China's humanoid robot market is projected to reach RMB574bn by 2035 (47% CAGR), as 50% adoption could cut labour costs by 45% |

China’s humanoid robot market expected to soar, in line with global growth.

With Tesla aiming for mass production of humanoid robots by late 2025, global peers are ramping up investments in this area.

| Building China's independent humanoid robot ecosystem Humanoid robots represent a critical competitive frontier among global powers, alongside advanced semiconductors and AI, due to their transformative impact on manufacturing and potential military applications. Given escalating geopolitical tensions, particularly with the US, export bans on humanoid robots and related technologies are likely to be imposed. -- DBS report |

Manufacturing, especially in labour-intensive China, will lead the adoption.

At 50% penetration, labour costs could fall by up to 45%.

We project China’s humanoid robot market to reach RMB574bn in value by 2035, with a 2025-35 CAGR of 47%, in line with global growth of 45%.

China’s humanoid robot market is still in early development, with over 60 manufacturers and no clear dominant leader.

Although UBTECH and XPeng enjoy early market presence and first-mover advantages, it is the ability to manufacture and deploy robots for diverse applications that ultimately determines success.

Significant overlap in supply chains of consumer electronics and humanoid robots, with robots using more optic sensors than EVs, benefiting supply chain players.

China’s electronics hub is shifting to robotics, with Xiaomi and BYDE leading the transition.

Xiaomi has the best chance to commercialise humanoid robots among Chinese players, leveraging its expertise in heavy manufacturing, AI investment, and ecosystem integration.

Its humanoid robots could cut labour costs by c.22% in FY26.

BYDE’s internal deployment could boost FY26F earnings by 4%, while Xiaomi may gain 9%.

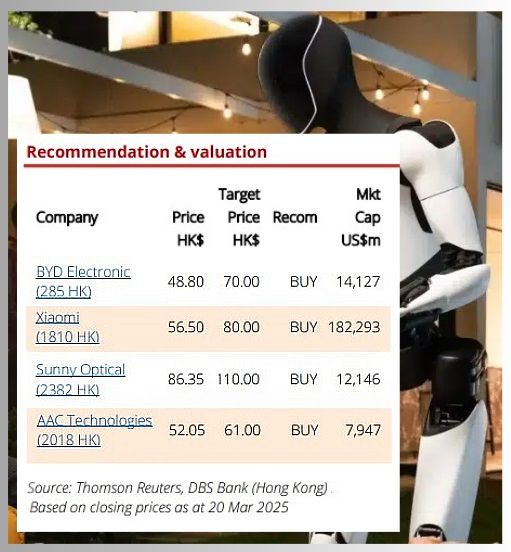

| Robotics valuations still attractive amid boom. Despite AI stocks doubling since AI’s rise at 2019, humanoid robotics valuations remain reasonable, with Chinese players trading at ~33x forward P/E. Xiaomi is trading at 1.2 FY25 PEG vs. 1.6 for global peers. BYDE and supply chain players like AAC and Sunny are trading at 13-27x P/E with 31%-40% FY24- 26F earnings CAGR, more attractive vs global peer Keyence’s c.35x P/E and 9% CAGR. |

Full report here.

Watch ...