| Have you noticed the Singapore stock market warming up in recent weeks and even months? Could it be traced to newsflow surrounding the Monetary Authority of Singapore's strategic plan to inject S$5 billion into stock purchases? Pretty soon (sometime during this 3Q) the Authority will unveil the fund managers selected to manage this S$5 billion. The actual firepower would be bigger, even double, if fund managers are required to co-invest, ie put in their own money too. This initiative is expected to exclude blue chips and big cap stocks, emphasising instead mid- to small caps -- ie, the minimum market cap for investment could be S$250 million or S$300 million. |

Among the many mid-to small caps that have made strong moves in the past month are three Chinese companies.

One key trait they share: They are simply cash rich, which reflects the resilience of their business and their ability to continue to pay dividends.

Briefly here are other reasons:

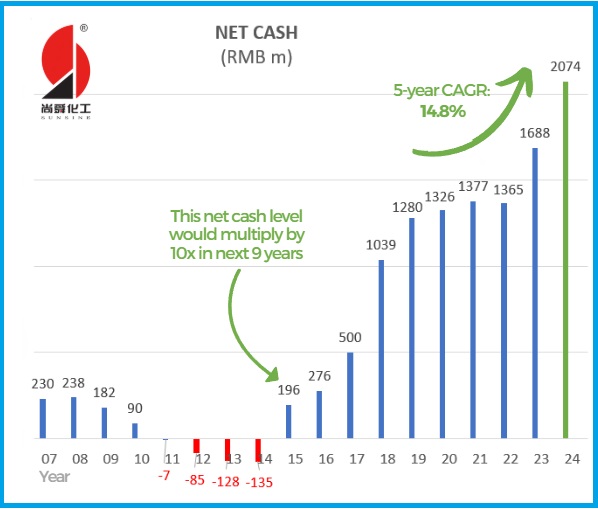

China Sunsine (64.5 cents, +19.4%)

There is sustained analyst optimism in this company (market cap: S$615 million), with UOB Kay Hian maintaining a BUY rating despite China Sunsine reporting selling price pressures.

Yet it has demonstrated resilience in competitive markets.

A 1Q2025 sales and 27% profit jump to RM108 million boosted investor confidence, alongside its strong financial health rating.

For more on the company, see CHINA SUNSINE: Has Paid a Ton of Dividends, But Its Growing Cash Pile Sparks Debate

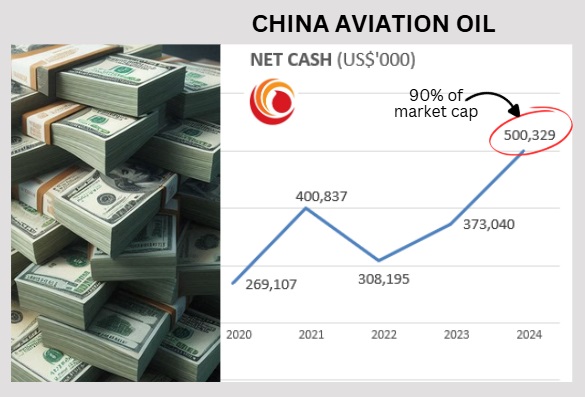

China Aviation Oil ($1.00, +13.6%)

Like China Sunsine, China Aviation Oil (market cap: S$860 million) is deeply cash rich.

It reported a 33.8% jump in FY2024 net profit to US$78.09 million.

Lim & Tan Securities included CAO as one of its top 2025 picks given its significant net cash position (US$500mln), and forecasted US$84-85 million net profit for FY2025.

For more on the company, see CHINA AVIATION OIL: Will Activist Elliott Push BP To Sell Its Stake in CAO?

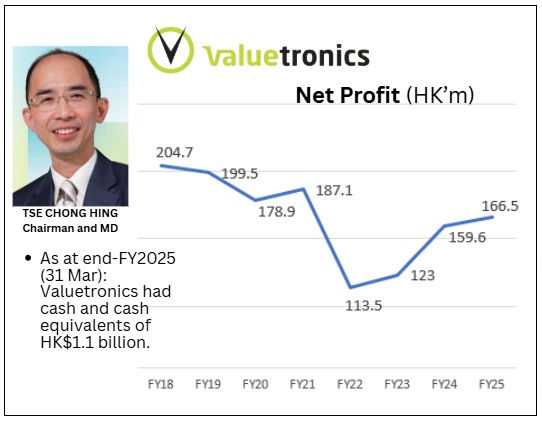

Valuetronics (78.5 cents, +13.8%)

The S$318 million market capped company's recently-released FY 2025 results (ended March 2025) weren't studded with surges in performance (profit rose 6.5%) but it's the future that matters, right?

DBS Research expects Valuetronics' future earnings growth to be supported by a shift toward higher-margin customers and more complex products following the phase-out of legacy consumer electronics business.

For more on the company, see VALUETRONICS: Classic Value Play? It Offers Consistent Dividends, Robust Balance Sheet, Margin Upside