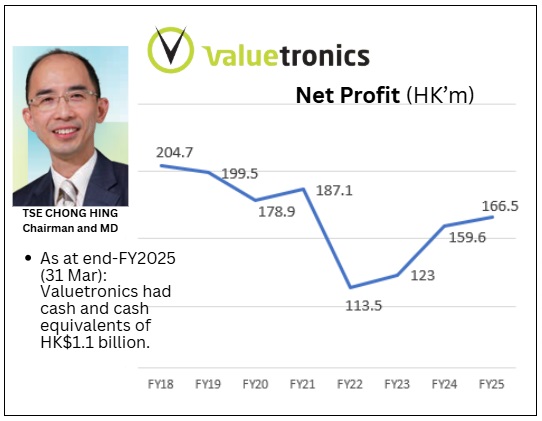

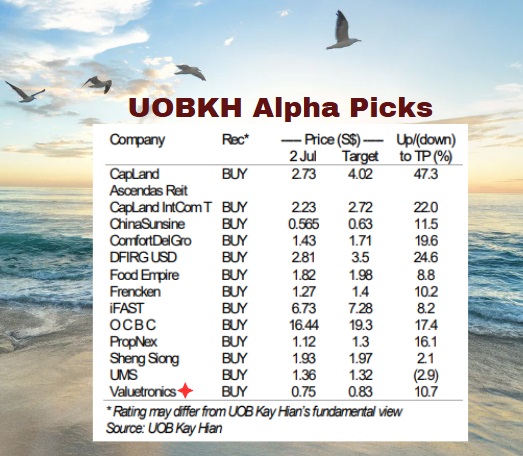

• Looking at Valuetronics' profits of the past few years, it doesn't look at all like a fast grower. Even the latest FY25 (ended March) result (+4.3%) does nothing to change that view. Much more likely, it is a classic value stock -- true to its name.  • Still, Valuetronics appears to be tapping on the accelerator and may yet deliver more growth than before. There's much to be said about its robust fundamentals, which DBS Research did in a recent report, giving it a fair value (95 cents) that is much higher than other brokers. UOB Kay Hian, which also rates the stock favourably, has a target price of 85 cents, and includes it in its Alpha Picks Portfolio. DBS' report highlights the following:

|

Excerpts from DBS Group Research report

Analysts: Amanda TAN & Lee Keng LING

• Expect margin accretion from high-margin customer wins as the company exits low-value legacy CE

• War chest of cash (60% market cap) to support potential special dividend; share price supported by 6% yield and buybacks • Superior margins vs. peers given value added design capabilities • Fair value estimate of SGD0.95, based on a 13x FY27F earnings. |

|||||

| The business |

Valuetronics offers a differentiated EMS (Electronic Manufacturing Services) model with higher margins.

Unlike conventional box-build contract manufacturers focused on scale and cost, Valuetronics has positioned itself as a strategic partner in industrial and commercial electronics, offering customised solutions underpinned by engineering expertise.

Future earnings growth supported by a shift toward higher-margin customers and more complex products following the phase-out of legacy CE revenues.

| NOT LIABLE FOR TARIFFS |

| "Given that Valuetronics ships more than 50% of its products to North America, it is particularly sensitive to tariffs imposed on China and Vietnam, which are its key manufacturing sites. "However, Valuetronics sells on a FOB basis, meaning it is not liable for import duties or tariffs. These costs are borne by the customer, and any tariff-related impact is unlikely to be absorbed by the company." -- DBS Research |

The company secured new accounts in the entertainment and network access segments, which are expected to be margin accretive due to higher engineering content.

Management intends to continue this strategy while phasing out low-margin legacy consumer electronics, shifting the mix toward more profitable industrial and commercial electronics.

Strong balance sheet supports potential for special dividends and continued share buybacks.

Valuetronics remains financially sound with a debt-free balance sheet and HKD1.1bn in net cash (60% of mkt cap or c.SGD0.44/ share).

Valuetronics has maintained consistent dividend payout ratio above 60% (incl special dividend) in recent years, suggesting a sustainable yield of >6%.

Fairly valued at SGD0.95. Our fair value is based on a 13x FY27F earnings multiple (pegged to the previous four-year high and Venture’s current valuation given its similar margin profile), close to +2SD of the historical mean on structurally higher margins from improved product mix and growth from new customers, as well as a rerating within Singapore small-mid caps due to MAS’ equity market development programme. |

Full report here.