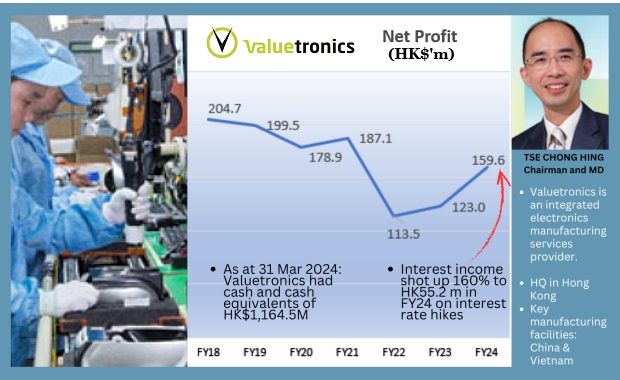

• If there's a reason investors seem to be uncertain over Valuetronics, it's that its revenue has been falling for 6 consecutive years. The 42% drop over that period is alarming. • Yet there are factors that should cheer investors, especially new ones entering at the current price of 63 cents. As UOB KH points out, Valuetronics' final dividend for FY23 represents a generous 64.6% payout ratio and 6.7% yield. And given its large cashpile, Valuetronics' PE is just 2X (ex-cash). • On top of that, Valuetronics has achieved higher profit y-o-y for 2 years in a row (see chart). And things could get even better in the current FY25.  As UOB KH points out, Valuetronics has new customers with "high growth potential and more favourable margins" which means Valuetronics "is likely to reap earnings growth in FY25." • UOB KH's report is a follow-up to a recent JV that Valuetronics entered into. Its financial impact is negligible but the longer-term implications (think AI) may be interesting. Read more below.... |

Excerpts from UOB KH report

Analysts: John Cheong & Heidi Mo

Valuetronics (VALUE SP)

VALUE is entering the AI industry via a JV with SinnetCloud Group to provide GPU and AI related value-added services in Hong Kong. VALUE’s JV partner had started presales to a group of potential clients even before forming this JV. VALUE is looking to make further investments in this new business in the near term if it does well. VALUE sees good growth opportunities given limited competition in Hong Kong and the JV partner’s strong capabilities. Maintain BUY. Target price: S$0.78. |

WHAT’S NEW

• Foray into AI industry with established JV partner. On 24 Jun 24, Valuetronics (VALUE) announced that it was entering the AI industry via a partnership with the SinnetCloud Group, which is an experienced graphics processing unit (GPU) and AI solutions provider and affiliated to Shenzhen-listed Beijing Sinnet Technology Co (300383.SZ).

| VALUETRONICS | |

| Share price: 63 c | Target: 78 c |

VALUE will invest HK$7.7m in cash for a 55% interest in the JV, Trio AI, to provide GPU and AI related value-added cloud services.

VALUE will acquire the GPU-enabled servers and ancillary hardware required for the JV and lease them back to Trio AI for a term of 60 months at a rent calculated to principally cover the preliminary equipment acquisition cost not exceeding HK$60m.

• Plans to invest further to grow the JV if it gains traction. VALUE expects to fully deploy the targeted investments in the next few months and will invest more monies if there is good demand.

We understand that SinnetCloud Group has already started pre-selling the GPU and AI related value-added cloud services even before the formation of this JV.

It is targeting Hong Kong-based customers including start-up, fintech, health tech and media tech.

• Positive industry dynamics in the GPU and AI related value-added cloud services in Hong Kong. There is limited competition in this space at this point due to western sanctions on the GPU being sold to the HK China market.

Demand for these services is also good due to limited ability by the smaller start-ups to access costly GPU infrastructure, data rationalisation and development of large language models.

In addition, VALUE will be sourcing for GPUs locally by leveraging on the strong network of the JV, which will be cheaper than the GPUs from overseas markets.

• Expect share buyback and attractive dividend payout to continue, which serve as indicators of positive future performance.

Right after the announcement of the JV partnership, VALUE bought back 593,100 shares on 25 Jun 24, which is a positive signal on its prospects.

Also, to recap, for FY24, VALUE proposed a final dividend of 9 HK cents/share and a special dividend of 8 HK cents/share.

This brings total dividend to 25 HK cents/share, translating to an attractive 64.6% payout ratio and 6.7% yield.

STOCK IMPACT

• The JV partnership presents an opportunity for VALUE to enter the AI industry. It seeks to learn more about AI-related hardware, potentially opening a window to manufacturing opportunities for such hardware, including hardware assembly, high-performance computing cooling solutions, and more — all of which fall within the existing manufacturing capabilities of the Group.

• Positive outlook from first full-year contributions from new customers. VALUE has successfully diversified its customer base, with new customers like a Canada-based ICE customer providing network access solutions and a CE customer supplying electronic products to a leading global entertainment conglomerate.

| New high-growth customers "These new customers have contributed in 2HFY24 and will make their first full-year contributions in FY25. With their high growth potential and more favourable margins, VALUE is likely to reap earnings growth in FY25." |

These new customers have contributed in 2HFY24 and will make their first full-year contributions in FY25.

With their high growth potential and more favourable margins, VALUE is likely to reap earnings growth in FY25.

• Potential new customers with Vietnam plant as leverage. Amid geopolitical uncertainties, VALUE’s newly constructed Vietnam campus strategically positions it to meet changing customer needs.

We believe that this manufacturing facility will aid VALUE in its customer diversification efforts.

As of end-FY24, VALUE’s new Vietnam plant operates at around 50% utilisation rate, suggesting further upside potential moving forward.

EARNINGS REVISION/RISK

• We maintain our FY25/26 earnings forecasts while adding FY27 forecasts.

VALUATION/RECOMMENDATION John Cheong, analyst• Maintain BUY and PE-based target price of S$0.78, pegged to 10.8x PE for FY25. John Cheong, analyst• Maintain BUY and PE-based target price of S$0.78, pegged to 10.8x PE for FY25.This is based on 1SD above VALUE’s historical PE mean to account for potential strong demand from its four new customers. • VALUE has strong cash balance of HK$1.1b that is equivalent to around 80% of its market cap. VALUE is currently trading at only 2x FY24 ex-cash PE and offers an attractive FY25 dividend yield of around 7%. |

SHARE PRICE CATALYST

• Winning of more new customers and higher-than-expected contributions of new customers.

• Higher-than-expected dividends and share buybacks.

Read more...