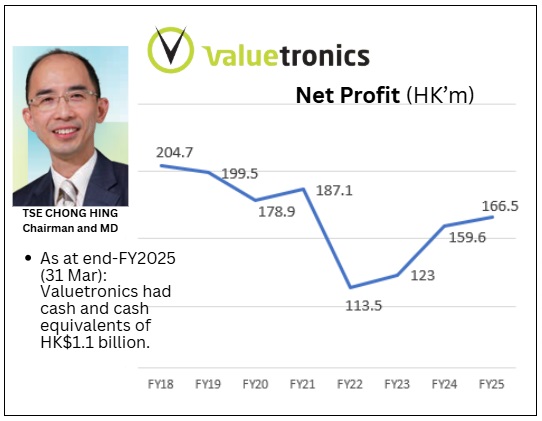

• UOB Kay Hian is telling investors to pay attention to Singapore’s small and mid-cap stocks, especially with the Monetary Authority of Singapore about to roll out a massive S$5 billion Equity Market Development Programme later this year. Basically, the thinking is: with all that money about to hit the market, there’s a good chance for quality small/mid-cap names to shine. • UOB Kay Hian's top picks for June? Food Empire, Frencken, and Valuetronics. • Why Valuetronics Stands Out: a) Gross profit margin is trending up: 17.2% in 2HFY25 versus 13.6% in 2HFY23. b) Cash Rich, No Debt, and Shareholder-Friendly.Valuetronics is sitting on a lot of cash (over HK$1 billion, or about S$180 million), has zero debt, and keeps rewarding shareholders.  • UOBKH has a “BUY” call on Valuetronics with a target price of S$0.83, which is about 18% above where it’s trading now. Lim & Tan Securities is also positive, telling investors to “Accumulate on Weakness”. • For more, read excerpts of their reports below .... |

Excerpts from UOB KH report

Analysts: Heidi Mo & John Cheong

| • Small/mid-cap stocks back in focus as MAS’ S$5b deployment nears. With final proposals for the S$5b Equity Market Development Programme (EMDP) submitted last week and shortlisted fund managers to be announced in 3Q25, funds could be deployed as early as 4Q25. This makes it a timely opportunity for retail investors to revisit quality SGX small/mid-cap names, which are expected to be a key focus of the programme. • Our latest small/mid-cap picks for Jun 25. We highlighted three stocks with strong management, consistent earnings growth and attractive valuations: a) Food Empire Holdings (FEH) (an instant beverage market leader with a robust expansion pipeline and proven dividend track record), b) Valuetronics (growth in contributions from new customers capacity expansion and attractive dividend yield), and c) Frencken (a global tech solutions provider with a wide manufacturing footprint and local-for-local model). More details can be found on the next page. |

| Valuetronics (VALUE SP/BUY/Target: S$0.83) |

• FY26 outlook remains resilient.

|

VALUETRONICS |

|

|

Share price: |

Target: |

VALUE expects to stay profitable in FY26 despite global trade uncertainties. Its Vietnam manufacturing base and China operations offer strong operational flexibility.

• Vietnam expansion signals strong demand.

VALUE is expanding its Vietnam facility by adding a fourth floor, increasing capacity by ~30% to support future growth.

This reflects strong demand and rising contributions from new customers. Heidi Mo, analyst• Robust cash position supports shareholder returns. VALUE maintains a strong net cash position of HK$1.1b (~S$180m), or about 65% of its market cap, with no debt.

Heidi Mo, analyst• Robust cash position supports shareholder returns. VALUE maintains a strong net cash position of HK$1.1b (~S$180m), or about 65% of its market cap, with no debt.

Despite a formal dividend policy of 30–50%, actual payouts have been consistently higher at 68%/64%/65% for FY23–25 respectively.

• Our PE-based target price of S$0.83 is pegged to 11x FY26F PE, which reflects 1SD above the historical mean.

Management also plans to continue its HK$250m share buyback programme in FY26 (HK$107.1m utilised to date).

VALUE trades at only 3x FY26 ex-cash PE and offers an attractive 6.8% FY26 dividend yield.

At its last traded price of 69.5 cents, Valuetronics is capitalized at $282mln and trades at 10x PE, 1x book and 6.3% dividend yield. |

Full report here.