|

About five months ago (Jan 2025), we put out this article:20x PE for Oriental Kopi IPO? Food Empire’s 8x Looks Like a Steal in Comparison It highlighted the relatively low valuation of Food Empire compared to IPO aspirant Oriental Kopi and peers in coffee-related businesses. |

CEO Sudeep Nair with executive chairman Tan Wang Cheow.

CEO Sudeep Nair with executive chairman Tan Wang Cheow.

| Growth across major segments |

Other key markets also saw positive growth in 1Q25.

The Ukraine, Kazakhstan, and CIS markets grew by 14.9% year-on-year to USD33.9m, largely driven by Kazakhstan, which now includes the contribution from Tea House LLP.

|

Market Segment |

YoY Revenue Growth in 1Q2025 |

|

Southeast Asia |

33.8% |

|

– Vietnam |

44.6% |

|

South Asia |

31.7% |

|

Ukraine, Kazakhstan & CIS |

14.9% |

|

– Kazakhstan |

29.0% |

|

– Ukraine |

9.9% |

|

Russia |

0.5% |

South Asia (mainly India) also performed well, up 31.7% year-on-year, with high demand for coffee from production facilities running at full capacity.

Even Ukraine posted a 10% increase in revenue.

This widespread growth highlights Food Empire's ability to manage various market conditions, partly through adjusting prices to handle rising costs.

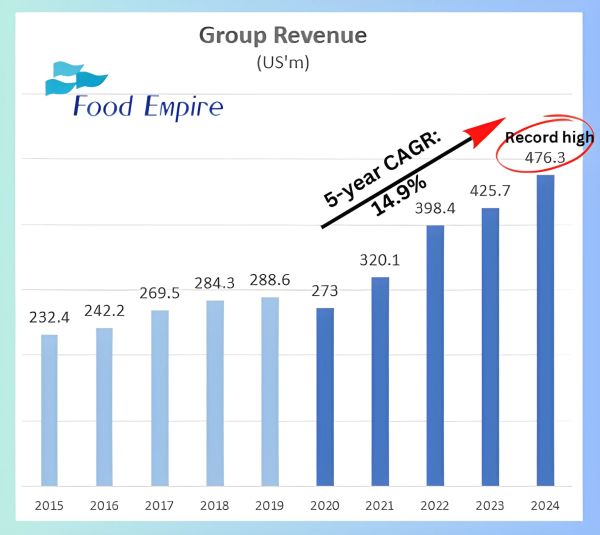

After a record year of sales in 2024, analysts project another record in 2025.

After a record year of sales in 2024, analysts project another record in 2025.

Looking ahead, Asia is expected to be the primary engine of growth.

Food Empire has some serious expansion plans underway in the region to boost capacity:

|

• In Vietnam, it's building a freeze-dried soluble coffee facility that's set to finish by 2028. This will make Food Empire a major player of instant coffee across Asia. |

These investments and the successful move away from heavy reliance on Russia are seen as key reasons why investors are taking a shine to Food Empire.

These investments and the successful move away from heavy reliance on Russia are seen as key reasons why investors are taking a shine to Food Empire.

Historically, being largely dependent on Russia meant Food Empire's shares traded at a lower price-to-earnings (P/E) ratio compared to its peers.

"With Russia no longer the dominant contributor and its Asia expansion plans in place, we believe the successful diversification justifies a P/E re-rating with a lower discount to its peers," said Jarick Seet of Maybank Research.

Analysts have now set higher price targets for the stock.

|

Analyst |

Target Price |

P/E (Year) |

|

CGS International |

S$1.95 |

13.4× (FY26) |

|

UOB Kay Hian |

S$1.98 |

15× (FY25) |

|

Maybank |

S$2.00 |

13× (FY25) |

*based on $1.70 stock price |

The analyst reports are here:

CGS International, UOB Kay Hian and Maybank Research.