• CGS analyst William Tng wrote a bullish report on Food Empire in January 2025 when the stock was trading at 99 cents, giving it a target price of $1.53. It was the highest among analysts covering the stock.  • He was bullish even when recognising several challenges besetting Food Empire. (See:FOOD EMPIRE: Rising coffee prices and other issues -- but analyst ups stock target price, expects ~5% dividend yield) Six months on, the stock has risen to $1.82, but now he maintains in an unusually lengthy (12 pages) pre-results report that the re-rating story is not over yet. • A 17-year veteran analyst at CGS, William Tng argues that the stock still hasn’t fully reflected the full earnings potential from several drivers:

These will support higher revenues and margins. • Importantly, he adds, a major new freeze-dried coffee plant in Vietnam, set to start in 2028, could add US$40–60 million in annual revenue. • Follwing the release of CGS' report, the stock rose to $1.90 last Friday, lifting its market cap above the $1-billion level for the first time in its history, which may put it on the radar screen of more fund managers. • CGS is expecting a positive surprise from Food Empire's 1H2025 results to be released in August. Read more below ... |

Excerpts from CGS International's report

Analyst: William Tng, CFA

■ FEH’s share price has appreciated 80% year-to-18 Jun 2025. In our view, there is room for further share price re-rating in 2H25F.

■ We believe re-rating catalysts include potential earnings (core net profit) surprise when FEH reports its 1H25F results in Aug. ■ Investors yet to fully consider potential earnings uplift when its new Vietnam freeze dried coffee powder production commences in FY28F, in our view. ■ We think FEH could re-rate higher to its 2 s.d. above avg. P/E multiple of 14.2x, leading to a higher S$2.28 TP on our revised FY26F EPS forecast. |

||||

Sudeep Nair has been CEO since 2012 while Executive Chairman Tan Wang Cheow is the founder of the Group and took the company public in 2000.

Sudeep Nair has been CEO since 2012 while Executive Chairman Tan Wang Cheow is the founder of the Group and took the company public in 2000.

| 1H25F earnings could surprise on the upside |

In our view, 1H25F core net profit, supported by strong revenue performance and sharper focus on profit margin, could surprise on the upside, leading to upwards earnings revisions by Bloomberg consensus.

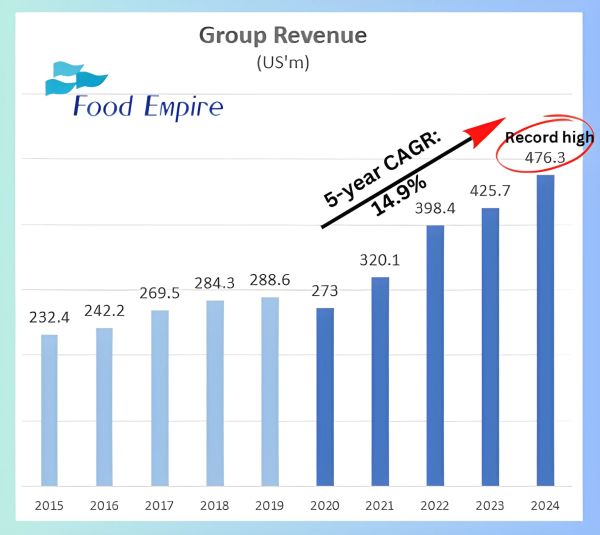

We raise our FY25-27F revenue forecasts by 3.7-7.2% due to higher revenue assumptions for Vietnam as well as its snacks and non-dairy creamer (NDC) business leading to 11.4-12.8% increase in our FY25-27F core net profit.

Our new FY25F/FY26F/FY27F net profit forecasts of US$60.0m/US$65.7m/US$71.0m are now 6.2%/7.4%/8.7% above Bloomberg consensus adj+ average forecasts as at 18 Jun 2025.

However, FEH could record a non-operational revaluation loss in 1H25F arising from its REN with Ikhlas Capital.

We urge investors to focus on FEH’s core net profit and not be distracted by this non-operational issue.

Earnings outlook for FY28-30F not priced in yet

Management has already announced its growth plan for FY28-30F.

In Sep 2024, FEH announced that the group will invest US$80m in a new Vietnam freeze-dried soluble coffee manufacturing facility with construction slated to begin in FY25F and completion expected by early-2028.

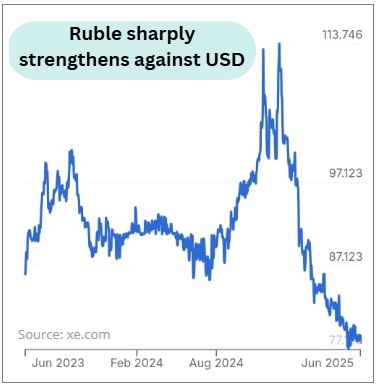

The Russian ruble has strengthened significantly from its Dec 2024 levels. This means Food Empire's revenue from Russia will be stronger on a USD basis, an important point considering Russia contributed 30% of revenue in 2024.This will be its second manufacturing facility for freeze dried soluble coffee.

The Russian ruble has strengthened significantly from its Dec 2024 levels. This means Food Empire's revenue from Russia will be stronger on a USD basis, an important point considering Russia contributed 30% of revenue in 2024.This will be its second manufacturing facility for freeze dried soluble coffee.

Based on discussions with management, we think the new plant could have a planned capacity of 5,500 tonnes p.a., 25% higher than the current 4,400 tonne p.a. capacity of its freeze-dried coffee plant in India.

In our view, full utilisation of the new capacity could generate US$40m-60m revenue p.a. over FY28-30F, depending on product specifications and coffee prices then.

Given that its freeze-dried coffee capacity expansion has been announced, we think FEH would next consider expanding its current 6,000 tonnes p.a. spray-dried coffee production capacity (currently located in India) which could further help grow FY28-30F revenue if such expansion materialises.

|

Full report here.