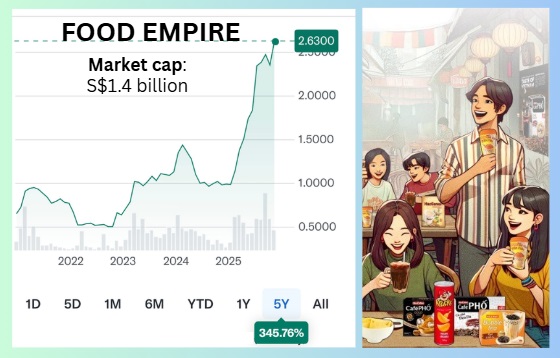

Food Empire didn't just have a good quarter; it had a record quarter. This strong performance was largely thanks to continued brand investments, successful pricing tweaks, and massive demand across its core markets. |

Here's a snapshot of analysts' forecasts:

|

Analyst / Source |

Target Price |

FY25 Net Profit Forecast (US$m) |

FY26 Net Profit Forecast (US$m) |

|

UOB KH |

$3.00 |

33.9 (Net profit) |

66.0 (Net profit) |

|

Maybank |

$2.92 |

65 (Core net profit)* |

71 (Core net profit) |

|

CGS Int'l |

$3.18 |

31.24 (Net Profit) |

72.60 (Net Profit) |

*Excludes a one-off, non-cash, fair value loss on Reedeemable Exchangeable Notes

The Analyst Lovefest

Given this stellar performance and strong future plans, it’s no surprise that the analysts are feeling bullish.

All three sources maintain positive ratings:

John Cheong, analystUOB Kay Hian: Maintains a BUY rating with an unchanged target price of S$3.00, noting the stock trades at a deep 35% discount to regional peers.

John Cheong, analystUOB Kay Hian: Maintains a BUY rating with an unchanged target price of S$3.00, noting the stock trades at a deep 35% discount to regional peers.

Analysts John Cheong and Heidi Mo raised their 2025-27F revenue and earnings forecasts due to the strong 3Q25 showing. Jarick Seet, analystMaybank: Maintains a BUY rating with a target price of SGD2.92.

Jarick Seet, analystMaybank: Maintains a BUY rating with a target price of SGD2.92.

Analyst Jarick Seet even floated the possibility of a bonus share issue and special dividends to improve liquidity and reward shareholders for what he expects to be another record year. William Tng, analystCGS International: Analyst William Tng recommends Add and raised his target price to S$3.18, noting the strong brand presence and growth prospects.

William Tng, analystCGS International: Analyst William Tng recommends Add and raised his target price to S$3.18, noting the strong brand presence and growth prospects.

| The Secret Sauce: Multi-Market Momentum |

It's a multi-market success story, but two regions stand out:

-

Russia, Ukraine, Kazakhstan & CIS: Despite geopolitical issues, this region is driving serious numbers.

Revenue from Russia alone surged 49% yoy in 3Q25.

The Ukraine, Kazakhstan, and CIS segment wasn't far behind, growing 39% yoy in 3Q25.

This was fueled by consumer promotions, volume increases, and expanded distribution networks. Russia remains a huge piece of the puzzle, accounting for 31% of the 9M25 revenue by geography. -

CafePho is a top seller for Food Empire in Vietnam. The Asian Boom (Vietnam and India): Southeast Asia (SEA) maintained a strong trajectory, with revenue up 13% yoy in 3Q25.

CafePho is a top seller for Food Empire in Vietnam. The Asian Boom (Vietnam and India): Southeast Asia (SEA) maintained a strong trajectory, with revenue up 13% yoy in 3Q25.

Vietnam is the powerhouse here, contributing over 60% of the SEA segment revenue by capturing market share.

Meanwhile, the South Asia segment jumped 20% yoy for 9M25, benefiting from its soluble coffee sales and India’s plants running at optimal capacity.

| Future Focus: Investing Big |

Food Empire is investing significantly for more multi-year growth.

The company is constructing a new coffee-mix facility in Kazakhstan (slated for completion by the end of 2025) and planning a freeze-dried coffee plant in Vietnam (expected by 2028).

Then there is the US$37 million investment to expand the India spray-dried coffee facility, boosting its capacity by 60% by the end of 2027.

For the Vietnam facility specifically, management is also planning to increase production capacity by 15% through automation in 2026, followed by another 30% increase in 2027.

These moves are strategically positioning the group to capture the rising regional coffee consumption.

Analyst reports suggest that margins should continue to climb as lower raw material (coffee bean) prices start flowing through to the company’s cost structure.

It’s also worth noting that Food Empire received major recognition, being named “Company of the Year” at The Edge Billion Dollar Club Awards 2025, sweeping all key performance categories under the Consumer Defensive sector. |