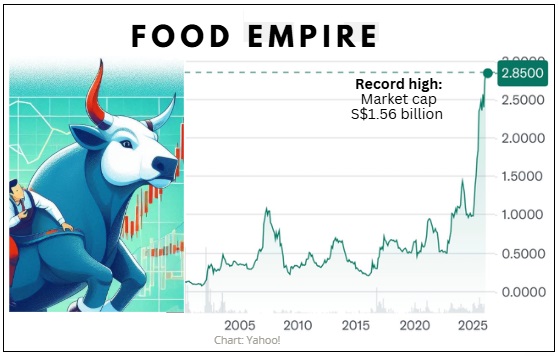

• While DBS is late to the table—joining several other brokerage houses that have covered Food Empire for a few years—its arrival brings a distinct, high-conviction perspective that looks beyond historical operating metrics. • DBS is initiating coverage with a BUY rating and a target price of SGD3.40, offering a 26% upside, predicated on the view that Food Empire is a strategic takeout target. • It argues that the clock is ticking toward a sale. With no family succession plan in place and the maturity of investor Ikhlas Capital's convertible bonds set for November 2029, interests are aligned for a buyout.  • DBS has even identified Tata Consumer as the most logical acquirer. It says Tata offers the necessary operational synergies, a valuation rich enough to fund an earnings-accretive acquisition, and benefits from India’s pragmatic geopolitical stance toward Russian assets. Read excerpts below ... |

Excerpts from DBS Group Research report

Analysts: Zheng Feng CHEE & Andy SIM, CFA

• Initiate with BUY, TP SGD3.40 with key catalyst being potential acquisition by FCMG with likelihood and valuation improving if war end

• Strong 15% top-line 3-year CAGR and 31% bottom-line CAGR (FY25-FY27F) supported by growth and margin expansion in its core East Europe business • Alignment of interest between management and Ikhlas to support eventual end goal of acquisition by 2029 • Screen flags Tata Consumer as ideal potential acquirer given business synergies |

|||||

Food Empire won “Company of the Year” award at The Edge Billion Dollar Club Awards 2025.

Food Empire won “Company of the Year” award at The Edge Billion Dollar Club Awards 2025.

L-R: Chin Tze Ting (Executive Personal Assistant to Chairman) | Tan Guek Ming (Non-Executive Director) | Tan Wang Cheow (Executive Chairman) | Sudeep Nair (CEO) | Tan Cher Liang (Independent Director)

| Investment Thesis |

Fast growing instant‑coffee‑mix and ingredient player in emerging Eurasia. Food Empire Holdings (FEH) dominates the 3‑in‑1 coffee segment in Russia, Ukraine, Kazakhstan and other CIS markets (East Europe), commanding a significant majority market share at >60%. CafePho is Food Empire's best-seller in Vietnam.In recent years, it has also made significant inroads into growing its branded coffee business in Vietnam and expanding its coffee ingredient business in South Asia with new plants planned in India and Vietnam.

CafePho is Food Empire's best-seller in Vietnam.In recent years, it has also made significant inroads into growing its branded coffee business in Vietnam and expanding its coffee ingredient business in South Asia with new plants planned in India and Vietnam.

Double digit top and bottom-line growth driven by its dominant Russia, Ukraine, Kazakhstan & CIS business. We forecast 15% top-line CAGR (24A-27F) supported by combination of price increases and volume growth largely led by East Europe markets where the company has a strong presence.

On earnings, we forecast 31% earnings CAGR (24A27F) driven by gross margin expansion as company pass on higher coffee bean prices and increased operational leverage.

Series of corporate actions to unlock value with acquisition as end goal. Based on the terms of the Ikhlas investment and no succession plan in place, we believe Ikhlas and management are actively working towards a buyout of the company by Nov 2029, when the Ikhlas’ convertible bond investment matures.

Tata Consumer jump out as best fit given

(i) operational synergies with existing coffee business,

(ii) rich valuation to support equity raise to fund earnings accretive acquisition and

(iii) India and Russia’s neutral and pragmatic stance towards each other.

| Initiate at BUY with TP of SGD3.40. Our valuation is based on the average of sum-of-the-parts valuation of bear and bull case scenarios with TP of SGD2.45 and SGD4.35 respectively. We believe downside is supported by meaningful buyback capacity of c. SGD37mn. Key Risks Green coffee prices increase significantly outpace price increases, supply chain disruption and potential volatile FX swings due to ongoing conflict. |

See the DBS report here.