|

Food Empire Brews Success Amidst Rising Coffee Bean Costs

|

In this article, we report on what CEO Sudeep Nair shared, in response to questions at a results briefing, as an overview of the company’s strategies, performance, and resilience. (In another article next week, we will cover analysts' reports).

Impact of Rising Coffee Prices

The CEO addressed the ongoing challenge of escalating coffee prices, a significant concern given coffee’s status as a major commodity.

|

|

“Coffee is a commodity, and its price fluctuations affect the industry,” he noted, highlighting the universal challenge faced by coffee producers.

However, Food Empire’s strong brand portfolio provides a competitive edge.

“The difference is that we own strong brands in our markets, so the ability to pass on the prices is very high,” he said. "There will always be a time lag... margins will improve."

He emphasized a multifaceted approach comprising periodic pricing changes and cost optimization to mitigate rising raw material costs while maintaining a strong market position.

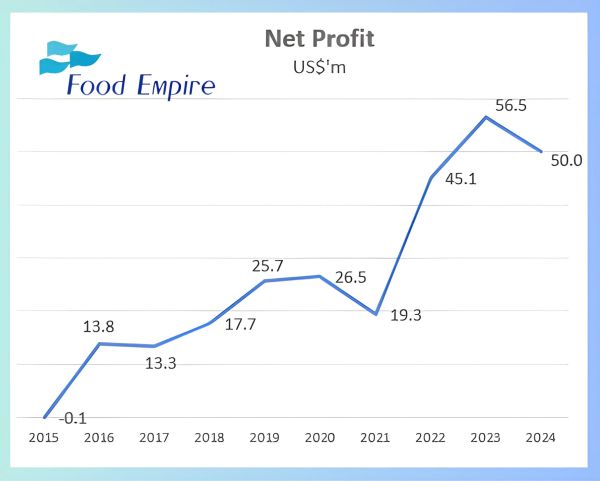

“It’s a matter of multiple things… how much cost goes up and what quantum we pass to consumers and what quantum we manage internally.” These are core earnings numbers and exclude one-off gain from a property sale in 2022 and a fair value gain in 2024 from redeemable exchangeable notes.

These are core earnings numbers and exclude one-off gain from a property sale in 2022 and a fair value gain in 2024 from redeemable exchangeable notes.

Growth Strategy and Performance

Food Empire’s growth trajectory is impressive, underpinned by strategic investments made in Asia.

“We started from scratch building the Asian business around 2010-2011,” Sudeep recalled, a move that transformed the company from a Russia-centric entity to a diversified global player.  This strategy bore significant fruit after many years.

This strategy bore significant fruit after many years.

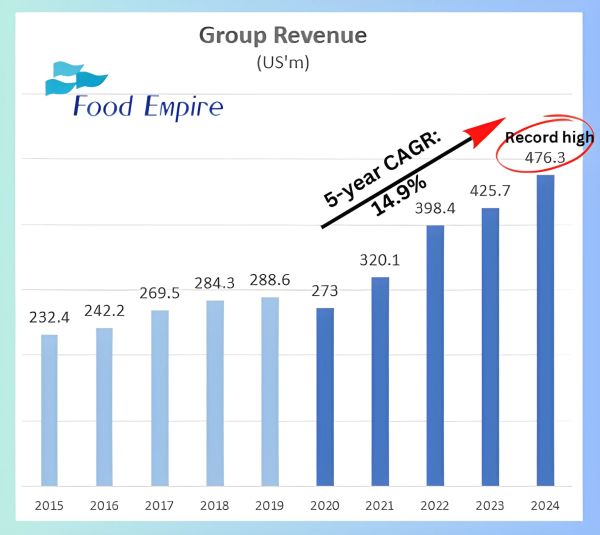

“From 2020 to 2024, our revenue grew from $273 million to $476 million. We are on track to cross the half-billion mark in 2025."

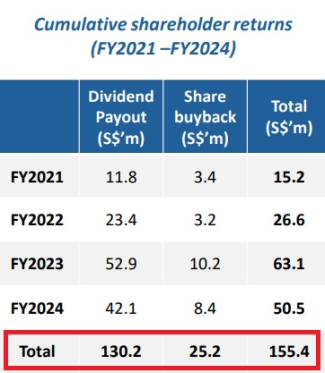

Beyond revenue, creating shareholder value remains a priority, with the company creating S$155 million in value and distributing S$130 million in dividends over the past four years (see table).

Market Strategy and Brand Building

The CEO highlighted how Food Empire found its winning product in Vietnam.

Here, the company capitalized on a demand for iced coffee with milk, a niche overlooked by giants like Nestlé. “We found a gap in the market and created a brand that catered to local tastes,” he said.  Cafe Pho: This is Food Empire's winning 3-in-1 coffee product in Vietnam.This success, built over a decade with significant investments in distribution and sales teams, has secured a 14-15% market share.

Cafe Pho: This is Food Empire's winning 3-in-1 coffee product in Vietnam.This success, built over a decade with significant investments in distribution and sales teams, has secured a 14-15% market share.

"In the last 5, 10, 15 years, no other company has been able to build a brand in the coffee business in Vietnam. Only Food Empire has done that."

Navigating Geopolitical Challenges

Geopolitical tensions, notably in Russia, pose indirect challenges despite no direct sanctions on food and beverage products.

“It’s a stressed environment, but we have managed to navigate these challenges,” the CEO remarked, pointing to complications in logistics and financial transactions.

Food Empire’s diversified model and strong brands have been vital in maintaining stability.

Additionally, a US$30 million investment, including working capital, in a Kazakhstan factory to produce instant coffee -- which currently is shipped from factories in Malaysia and Vietnam -- aims to bolster supply chain resilience and tap into Central Asian growth.

CEO Sudeep Nair with executive chairman Tan Wang Cheow. File photo CEO Sudeep Nair with executive chairman Tan Wang Cheow. File photoOutlook -- Resilient as Always Sudeep outlined a cautious yet optimistic vision. Plans to leverage expertise from India—where two plants produce 10,000 tonnes of soluble coffee annually—into Vietnam underscore a focus on Asia. |

The 2024 presentation deck is here.