|

Valuetronics Holdings is successfully transitioning its manufacturing focus from lower-margin Consumer Electronics (CE) to the higher-value Industrial and Commercial Electronics (ICE) sector. That's why the stock, trading at S$0.85, has gained 36% year-to-date (rising from ~S$0.62 at the start of 2025). |

The two reports, one from PhillipCapital (dated 17 Nov 2025) and one from UOB Kay Hian (11 Dec 2025), both take a positive view of Valuetronics, but they seem to differ in their degree of optimism and in the key factors they highlight. Paul Chew, PhillipCapital analystPhillipCapital: Maintains an ACCUMULATE rating.

Paul Chew, PhillipCapital analystPhillipCapital: Maintains an ACCUMULATE rating.

This recommendation means the analyst believes the stock is likely to outperform the market modestly or perform strongly but suggests buying gradually.

- Target Price: S$0.960.

- Share Price: S$0.850.

- Implied Upside: The target price implies a potential price appreciation of approximately 13% (S$0.960 vs S$0.850).

The total expected return, including dividends, is ~18%.

John Cheong, UOB KH analystUOB Kay Hian: Maintains a High Conviction BUY rating, implying strong confidence that the stock will achieve significant returns.

John Cheong, UOB KH analystUOB Kay Hian: Maintains a High Conviction BUY rating, implying strong confidence that the stock will achieve significant returns.

- Target Price: S$1.03.

- Share Price: S$0.85.

- Implied Upside: The target price implies a potential price appreciation of 21%.

Business Fundamentals

|

Category |

PhillipCapital |

UOB Kay Hian |

|

Performance |

• 1HFY26 operating earnings (EBIT) rebounded, rising 16.5%. Revenue was -3% y-o-y. |

• Notes improved order flows supported by external factors. |

|

Margins |

• Highlights a 2-percentage point expansion in gross margins driven by the ICE division and new customers. |

• Also notes the positive shift to more favourable margins from new customers. |

|

Growth Drivers |

• Driven by new customers in network infrastructure and PC cooling solutions; network infrastructure is now the largest category. |

• Driven by new ICE and CE customers (including one supplying a global entertainment conglomerate). |

Valuation

|

Category |

PhillipCapital |

UOB Kay Hian |

|

Valuation |

• Values the stock using a PE ratio of 13x for FY26e, noting this is still a discount to industry peers. |

• States the stock is highly attractive, trading at 12x FY27F PE, representing a 30-35% discount compared to Singapore peers. |

|

Cash Position |

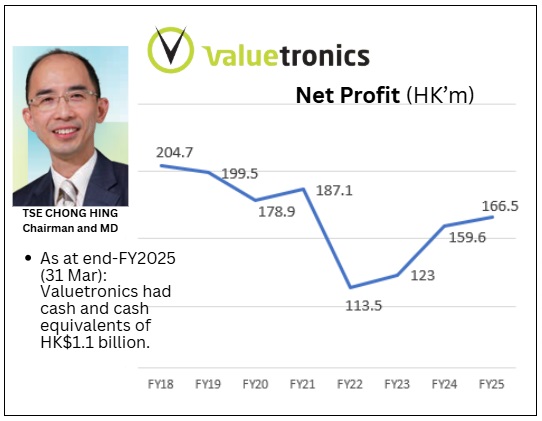

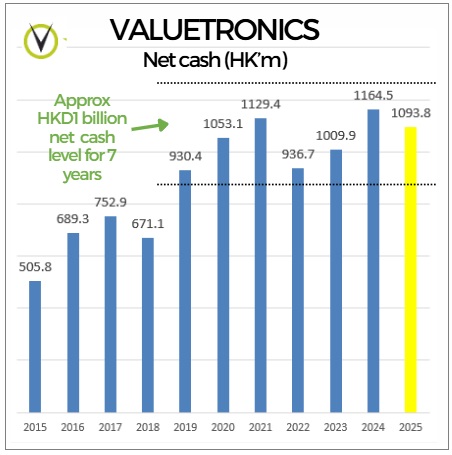

• Emphasises the dividend yield of 5.4%, which is supported by a net cash balance of HK$1.1bn, equivalent to ~50% of the company's market value. |

• Highlights the large net cash position (HK$1.1b) also as ample room to enhance shareholder returns (e.g., through higher dividends or share buybacks). |

Key Risks and Catalysts

|

Category |

PhillipCapital |

UOB Kay Hian |

|

Main Risk |

• TrioAI venture, which is still loss-making and whose losses are widening. |

• Focuses on external tailwinds. |

|

Catalysts |

• Expects TrioAI losses to be contained due to a reduced stake in the company. |

• Easing trade tensions between the US and Vietnam, making Vietnam more competitive. |

| Differences Between the Two Reports |

The primary difference lies in the level of growth assumed and the primary focus of risk/reward analysis.

UOB KH appears more conservative regarding immediate revenue and profit growth compared to PhillipCapital, despite assigning a higher target price:

- Revenue Growth: PhillipCapital forecasts revenue of HK$1,785mn for FY26e (ending March 2026) and HK$1,926mn for FY27e.

UOB KH forecasts lower revenue for the same years: HK$1,650mn for FY26F and HK$1,726mn for FY27F. - Net Profit Forecasts: PhillipCapital forecasts HK$181.9mn for FY26e and HK$207.3mn for FY27e.

UOB KH forecast net profits are lower than Phillip's: HK$176mn for FY26F and HK$185mn for FY27F.

Key Catalysts

Differences in Time Horizon and Scenario Assumptions

|