A reader contributed this article

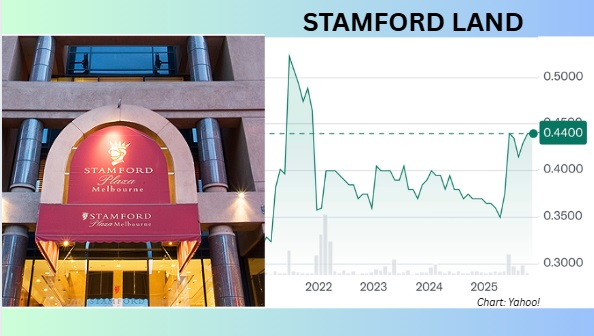

| In the current bullish stock environment, where many stocks have trended up, Stamford Land Corporation Ltd (SGX: H07) remains a remarkable case of undervaluation. Reason: Even after a modest rise after years of treading water, the stock price implies a discount of more than 80% to its true book value. The stock recently traded at S$0.44.  With a robust balance sheet featuring S$507 million in cash (and zero debt), it will not surprise if controlling shareholder Ow Chio Kiat, the executive chairman, might push for privatization to capture this untapped potential. |

Let me paint some background, using public information, on Mr Ow, 81, a veteran in hotel and shipping business circles who won the Businessman of the Year award in 2009 under the Singapore Business Awards by Singapore Press Holdings.

Business aside, he was Singapore's non-resident Ambassador to Argentina (2009-2015) and the current non-resident Ambassador to Italy (from 2015).

Between January and October 2022, he and his immediately family injected S$180 million into Stamford Land through a rights issue, excess rights applications and open market share purchases.

This resulted in his stake increasing from 45.9% to 58.7%.

The rights issue was done to bulk up its balance sheet for the potential redevelopment and renovation of its hotels as well as for opportunistic property investment in Singapore, Australia and the UK in the event of any distress sales.

Interestingly, in June 2023, he voluntarily forfeited S$5 million in bonus payments which was part of the incentive payment contractually due to him. (Page 61 of 2023 Annual Report).

It can be considered a magnanimous act, which underscores his long-term vision, especially as he and parties acting in concert now hold about 64% of the shares.

Recent disclosures reveal ongoing interest changes by Mr Ow, including purchases as late as Sept 15, 2025.

At the heart of Stamford Land's investment merits is its gross undervaluation and large cash pile with no debt.

When compared to its peers which are typically highly leveraged and trading at discounts of between 40% - 60% of RNAV, Stamford Land’s discount to RNAV of more than 80% stands out strikingly.

The company's S$623 million market cap doesn't reflect its asset base, which primarily includes 1,177 freehold and 252 leasehold hotel rooms across 5 hotels in Australia.

Using two alternative valuation methods—beyond the book value of S$0.59 per share reported in its financial statement —we see a clearer picture:

|

Metric |

Method A |

Method B |

|

Hotel Assets Valuation (see explanation below) |

S$710M |

S$560M |

|

Excess over Book Value (PPE: S$175M) |

S$535M |

S$385M |

|

Excess per share |

S$0.36 |

S$0.26 |

|

Revalued Book Value (ie RNAV) |

S$0.95 |

S$0.85 |

|

Less Cash per Share |

S$0.34 |

S$0.34 |

|

Property Assets per Share |

S$0.61 |

S$0.51 |

|

P/B @ S$0.44 (ex-cash) |

0.16 (ie 10/61) |

0.20 (ie 10/51) |

|

Discount to RNAV |

84% |

80% |

Note: As at 31 March 2025, the total number of issued shares (excluding treasury shares) held by the Company is 1,483,610,022.

Using conservative per room key figures, the above table highlights discounts of 80-84% to revalued net asset value (RNAV) ex-cash, offering an unheard of margin of safety.

Well, all this sets it up for a re-rating -- when investors realise the discrepancy between market values and accounting figures.

| Rerating catalysts |

The introduction of the $5b EQDP fund has spurred a search for undervalued companies.

With its superior financial metrics and track record of creating shareholder value, Stamford Land is likely to catch the eyes of some funds.

• In 2023, Stamford Land sold this Sydney luxury hotel for A$210 million. Stamford bought it for A$36 million in 2000. • Hotels are initially recorded at purchase price plus directly attributable costs (e.g., renovations, site preparation). Over time, they're depreciated using the straight-line method over useful lives. Their market values are much higher than their accounting values. |

Regulatory tailwinds are amplifying the pressure.

The relentless push by our regulatory authorities (as exemplified by the quotes below) to drive listed companies to increase shareholder value will have a huge impact on Stamford Land primarily due to its pristine balance sheet.

The Stamford Land Board is likely to be pressured to enhance shareholder value, either by increasing dividends, distributing special dividends or buying back its shares in meaningful quantities.

In a July 31, 2024, Business Times op-ed, SGX RegCo CEO Tan Boon Gin emphasized putting boards at the forefront of enhancing shareholder value, advocating actions like capital returns and strategic reviews.

"The Japanese have taken a much more prescriptive approach and are putting a lot more direct pressure on boards. For example, companies must disclose plans to improve capital efficiency, return on equity, and price-to-book ratios. Those which fail to do so are effectively 'named and shamed'.

"So, should we apply the same pressure and prescriptive approach taken by Japan?

| On Sept 12, 2025, Monetary Authority of Singapore Deputy Chairman Chee Hong Tat, spoke about an upcoming "Value Unlock" package aimed at boosting Singapore's equities market. "Shareholder value must therefore be a priority in order for this journey to continue and to be sustainable. Company management and boards must look for ways to deliver shareholder value – and this includes through business expansion, capital optimisation, and operational transformation, just to name a few examples." |

"There are any number of ways our companies can unlock value: mergers and acquisitions, divestments or asset recycling, or committing to a dividend policy."

A re-rating of Stamford Land may also be driven by a macro-economic tailwind.

The value of its 60%-owned London investment property, marked down S$182 million from FY2022-2024 amid peak Bank of England rates at 5.25%, could see a rebound as rates have dropped to 4%.

Falling interest rates globally will boost Australian hotel valuations and liquidity.

These assets are recognised as "property, plant, and equipment (PPE)" on Stamford Land's financial statement at S$175M. Method A: Per-Room (Key) Valuation Approach ($710M)This method uses a direct capitalization per room based on market comparables. The per-room key figures are conservative.

Citeable Basis:

Method B: Income Capitalization Approach ($560M)This method capitalizes normalized earnings from hotel operations using a discount (capitalization) rate to estimate market value.

Citeable Basis:

In contrast to Method A, a weakness of the EBITA method is it doesn't accord a premium to freehold assets (which Stamford Land holds). |

| More on Dividends, Buybacks |

Stamford Land has an enviable track record of being profitable and it has distributed dividends every single year since its IPO in 1989.

It spun-off Singapore Shipping Corporation (SSC) in year 2000 and sold off the bulk of its vessels by 2008.

The value created amounted to at least $400m and most of it was distributed to SSC shareholders. This included total dividends of $187m over FY2006 to FY2008.

Stamford Land distributed 3 -4 cents ($26M - $34.5m) of dividends per year from FY2006 to FY2015, except for the two years during the Great Financial Crisis (FY2009-FY2010) when it was lowered to 1-2 cents. ($8.6M -$17.2M).

The dividends were substantially reduced from FY2016 onwards, to the great disappointment of shareholders.

However, the bulk of the savings from the reduced dividends were utilized to buyback 81m shares between Aug 2018 and April 2020 after which the share buyback was stopped during the Covid-19 pandemic.

In total, the Company spent $40m on the share buybacks (SBB), as detailed in this table:

|

SBB Mandate Effective Date |

Purchase Date |

Total Qty |

% |

Notes |

|

27 July 2018 |

1 Aug 2018 – 11 July 2019 |

44.35m |

5.133 |

|

|

26 July 2019 |

1 Aug 2019 – 1 Apr 2020 |

36.77m |

4.486 |

81.12 m shares cancelled on 15 May 2020, valued at S$39.64m |

|

28 July 2020 |

26 Feb 2021 – 23 Mar 2021 |

1.03m |

0.132 |

| Privatization Candidate - and Possible Payouts |

A closer look at recent company developments will help investors to determine its likelihood of privatization.

Controlling Shareholder Substantially Increased Stake

From Nov 2018 to Mar 2021, the Company bought back 82m shares (10% of its outstanding shares).

This enhanced shareholder value and simultaneously allowed Mr Ow to boost his effective stake from 41.5% to 45.9%, a rise of 10%.

In the rights issue in 2022, Mr Ow and his immediate family injected $180m into Stamford Land to further boost his stake from 45.9% to 58.7%, a huge increase of 28%.

The Company resumed buying back its shares in Jan 2024 but stopped within 3 months, in Mar 2024 after purchasing 9m shares.

Interestingly and perhaps tellingly, Mr Ow then started buying shares in his personal capacity from May 2024 to mid Sept 2025.

In total he bought 6.82m shares bringing his immediate family stake to 59.5%. Other shareholders deemed to be acting in concert controls another 4.5%.

Re-rating Catalyst (mentioned above) Will Serve As A Prime Motivator

The US Federal Reserve has cut interest rates by 1.25% since Sept 2024 and other central banks have followed suit. However, the Company’s balance sheet and stock price have not reflected this.

For example, the 60% owned London property was marked down by a total of $182m from FY2022 to FY2024 when rates peaked at 5.25%. There has yet to be any revaluation despite rates having dropped to 4%.

Similarly, the Reserve Bank of Australia has reduced interest rates by 0.75% since Feb 2025. It typically takes up to 12 months for rate cuts to filter into the physical economy and recent hotel transactions and prices suggest that things are perking up.

Worldwide, further interest rate reductions are expected and this will exacerbate the current deep undervaluation of the stock.

All said, there are certainly strong motivations and benefits for Mr Ow to privatize the Company, especially when the share price remains deeply undervalued.

Further delays will make it more expensive for him if he has any intentions to privatize the Company.

If The Company Is Privatized, What Can Investors Expect ?

A) Under a conservatively ‘low-ball’ scenario where its property assets ($0.61) are valued at only 50% of its RNAV, investors may expect to receive $0.645.

ie ($0.61 X 50%) + ($0.34 cash) = $0.645.

Total cost to buyout minority shareholders = 533m shares X $0.645 = $344m

|

Scenario |

Property Assets Valn |

Discount to RNAV |

Investor Payout per Share |

Total Cost to Buyout Minority Shareholders |

|

A (Low-Ball) |

$0.61 × 50% = $0.305 |

50% |

$0.305 + $0.34 (cash) = $0.645 |

533m shares × $0.645 = $344m |

|

B (Fair) |

$0.61 × 75% = $0.4575 |

25% |

$0.4575 + $0.34 (cash) = $0.80 |

533m shares × $0.80 = $426m |

B) Under a ‘fair’ scenario where its property assets are value at 75% of its RNAV, investors may expect to receive $0.80.

ie ($0.61 X 75%) + ($0.34 cash) = $0.80

*DBS Bank, acting as financial advisor to Thai Beverage in its Share Swap of Frasers Property Ltd (FPL) shares for F&N shares had used a 20-25% discount to RNAV to value FPL, which it says is in line with previous privatization of SGX – listed real estate companies by controlling shareholders.

Total cost to buyout minority shareholders = 533m shares X $0.80 = $426m

In either of the above two scenarios, the cost is sufficiently fundable by the Company’s cash reserves of $507m through a Selective Capital Reduction exercise, similar to that used by Best World International in 2024.