• Samudera Shipping has been a low-key stock with no regular analyst coverage. It has riding the ups and downs of volatile freight rates and, along the way, has amassed an impressive amount of cash. • The core of its business is to ship containers across Asia.  • As of 1HFY25, it had S$345m of net cash, or 67% of its market cap. • What's more, it was awarded the Silver Award for Best Managed Board at the Singapore Corporate Awards 2025, underscoring its strong reputation and sound corporate governance practices. • For more, read excerpts of UOB Kay Hian's non-rated report below .... |

Excerpts from UOB Kay Hian report

Analyst: Roy Chen, CFA

Samudera Shipping (SAMU SP)

A Leading Regional Container Shipping Feeder Player

• After a strong 1H25, SSL’s 2H25 earnings are likely to slow down, in line with industry dynamics, but remain at healthy levels. |

| Analysis |

• A leading player in regional container shipping feeder market. Samudera Shipping Line (SSL) is a leading regional container shipping feeder service provider, connecting the maritime hub of Singapore with spoke ports across Asia.

Handling over 30% of independent feeder-carried container volume that transits at Singapore, SSL benefits from ASEAN’s economic growth and rising role in the global supply chain.

With a fleet of about 30 container vessels (including both self-owned and leased), SSL ranks 39th globally by capacity.

• Trailing PE excluding net cash : 1.4X • Trailing EV/EBIT : 1.1 • Price/Book: 0.67 (Source: UOB Kay Hian) |

• Inclusion in the new SGX Next 50 Index. SSL has been recently included in the SGX’s iEdge Next 50 Index which was launched last week, with an index weight of 0.4%.

Together with the MAS Equity Market Development Programme, the inclusion in the Next 50 Index may attract market attention and future fund flows into the counter; this may drive re-rating for SSL.

• 1H25 results highlights. SSL’s net profit rose 100.4% yoy in 1H25, driven by higher freight rates (SSL’s container revenue per TEU rose 8.5% yoy), and amplified by the shipping company’s high leverage.

Its net cash position expanded slightly to US$267m (S$344m) at end-1H25 (end-24: US$252m or S$324m), forming 67% of SSL’s current market cap.

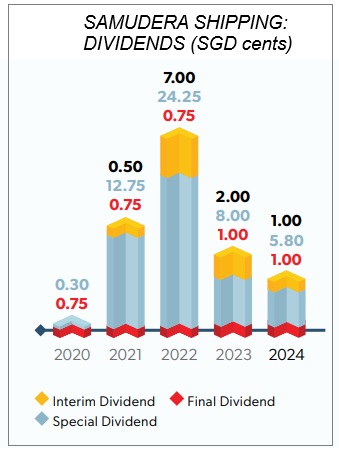

The company increased its interim dividend of 1.5 S cents for 1H25 (1H24: 1 S cent).

• Overall sector outlook slowing down in 2H25, despite a relatively healthy feeder segment. Based on the Drewry World Container Index, global freight rates peaked in Jun 25 and have since stayed in a declining trend, as the previous frontloading effects amid the US tariff war reverse.

Drewry expects supply-demand balance to weaken in the next few quarters, leading spot rates for long-haul routes to decline.

We reckon that the downward pressure is likely to gradually cascade to regional routes and subdue feeder service pricing, though trade dynamics in the regional market have remained healthy (the Singapore port throughput rose 7.2% yoy in Aug 25) and the supply-demand balance for feeder vessels is more favourable than larger vessels, (as reflected by the steady prices of feeder vessels).

• SSL likely to post hoh and yoy lower earnings in 2H25. Given the weakening sector outlook, SSL is likely to post hoh and yoy weaker earnings performance in 2H25 (2H24 was a high base due to the Red Sea disruption), driven by weaker average freight rates.

Based on the current freight rate dynamics, our best guesstimate is that SSL’s 2H25 earnings performance should not be lower than the recent trough levels seen in 1H24 (US$21m).

• Trading at 0.67x trailing P/B. |

→ See full report here. → See full report here.

→ Also, see this vessel owner: DBS Calls It an 'Undervalued OSV Gem' Amid Order Book Surge |