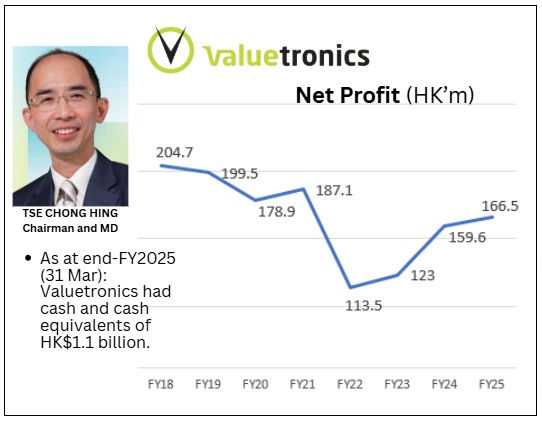

• Why Valuetronics Stands Out: It is sitting on over HK$1 billion, or about S$180 million, cash, has zero debt, and keeps rewarding shareholders.

• For more, read excerpts of the UOB KH report below .... |

Excerpts from UOB KH report

Analyst: John Cheong

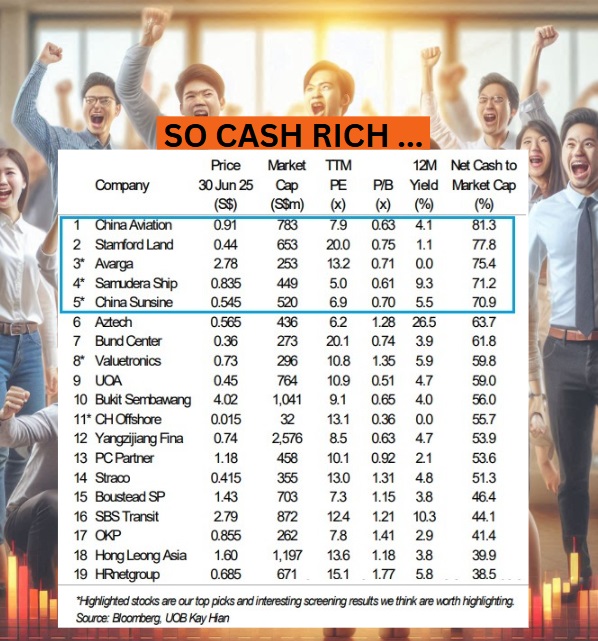

| The number of privatisation offers remains elevated, at 15 companies ytd vs 18 in 2024. We did a screening of companies with high net cash as a % of market cap to identify potential privatisation targets and deep value stocks. Stocks we like under our coverage are China Sunsine (1.7x 2025F ex-cash PE, 5.3% yield) and Valuetronics (3.7x 2025F excash PE, 6.3% yield). Screening results we like to highlight: Avarga (75% net cash to market cap), Samudera Shipping (71%) and CH offshore (56%). |

| WHAT’S NEW |

• Number of privatisation offers remains elevated in 2025.

We believe this is largely due to:

a) lacklustre valuation;

b) lack of funding requirements; and

c) backing from new partners.

These have led to major shareholders privatising their companies from SGX.

The highest premium offered in 2024 and 2025 were 174% and 78% vs the last closing price for Isetan and Singapore Paincare.  John Cheong, analyst• Majority of stocks that receive privatisation offers are trading at or below book value. Based on historical data, we note that around 80% of the companies that receive privatisation offers in 2024 and 2025 were trading either near or below their book value.

John Cheong, analyst• Majority of stocks that receive privatisation offers are trading at or below book value. Based on historical data, we note that around 80% of the companies that receive privatisation offers in 2024 and 2025 were trading either near or below their book value.

This indicates that attractive valuation is the main driver for offerors to launch the takeover offers.

• Identifying deep value stocks through screening of companies with high net cash as a % of market cap. Through this screening exercise, we have identified a list of 19 companies (please see table overleaf) which have net cash as a % of market cap of 35% and above.

We believe deep value names with high margin of safety have room for further rerating, especially in the current environment where privatisation offers remain elevated and potential re-rating due to improving market liquidity from The Monetary Authority of Singapore (MAS) S$5 billion Equity Market Development Programme (EQDP).

In addition, companies with high cash reserves and dividend yields can weather any downturn better.

... include China Sunsine and Valuetronics. Their valuations are highly attractive, and investors could receive generous dividend yield while waiting for positive catalysts, including takeovers and potential rerating: |

• Other stocks we think are worth highlighting from the screening results include:

a) Avarga – Net cash forms 75% of its market cap and trading at 29% discount to book value. A major shareholder launched a takeover offer in 2024.

Concerted parties failed to secure 90% acceptance rate but managed to raise their stake from 53% to 87%.

b) Samudera Shipping – Net cash forms 71% of its market cap and trading at 39% discount to book value.

It is also trading at an attractive 5x 2024 PE and 9.3% yield.

c) CH Offshore – Net cash forms 56% of its market cap and trading at 64% discount to book value.

The company completed a highly dilutive 2-for-1 rights issue at deep discount in Jun 25.

Currently, the company sits on a net cash of S$17m vs its market cap of S$32m. Also, its parent company, Baker Technology sits on a net cash of S$95m.

| VALUATION/RECOMMENDATION |

|

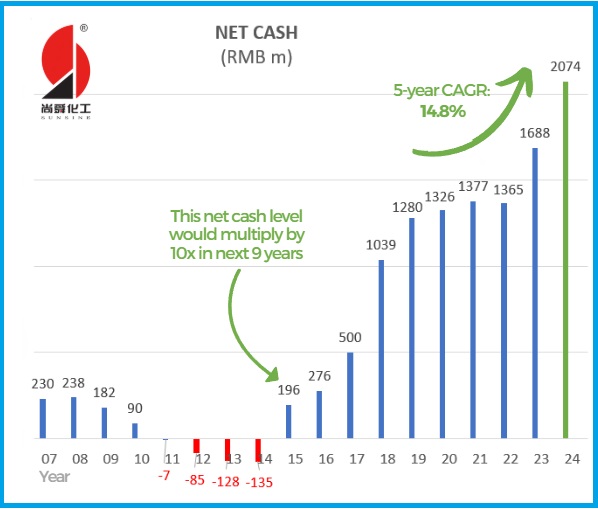

CHINA SUNSINE |

|

|

Share price: |

Target: |

• China Sunsine. Maintain BUY and target price of S$0.63, pegged to a PE multiple of 7.5x 2025F earnings, or 1SD above the mean PE.

• Valuetronics. Maintain BUY and target price of S$0.83, based on 11x PE for FY26 pegged to 1SD above its historical mean.

|

VALUETRONICS |

|

|

Share price: |

Target: |

SHARE PRICE CATALYST

• Higher-than-expected earnings or dividends.

• Takeover offer.

Full report here.