A long-time shareholder of China Sunsine contributed this article.

| Singapore-listed China Sunsine has addressed shareholder questions ahead of its Annual General Meeting (AGM) scheduled for 29 April 2025. Several issues, particularly the authenticity and management of its substantial RMB 2,074 million cash balance, have been at the forefront of some shareholder attention.  |

| Cash Audit and Dividend Track Record |

A shareholder queried the verification of Sunsine’s cash holdings (Question 10). The company’s reply via a SGX filing was reassuring, detailing the audit procedures used to confirm cash balances.

| Response from Auditor, CLA Global TS Public Accounting Corporation (“CLA”): We adopted the following measures: * Obtained listing of bank balances and agreed the amounts to original bank statements and/or internet bank portal, bank confirmations and accounting ledger. * Obtained confirmation for all bank balances directly from the banks which include information of the facilities obtained by the Group. The bank confirmations are either obtained electronically through the banks’ centralised digital platforms or via direct mail sent to the regional/central processing department of the banks. * Reviewed the year end bank reconciliation and tested the subsequent clearance of material reconciling items, if any. * Verified on sampling basis, receipts from customers and payments to suppliers to relevant supporting documents. * Using data analytics, to identify any unusual transactions and/or significant bank transactions and verified the nature of the transactions to relevant supporting documents. SGX does not have any specific guidelines on cash audit, but auditors perform its audit under Singapore Standards on Auditing (“SSA”). |

Sunsine also highlighted its strong dividend record.

In response to a lengthy multi-part Question 2, the company stated that, including dividends to be paid post-AGM, it would have distributed more than RMB 1 billion since its 2007 IPO, which raised RMB 264 million.

This significant return for shareholders had been stated in its FY2024 results presentation — though this message was somewhat buried in the latter slides of the presentation.

Below is its payouts in the past 6 years:

|

YEAR |

'19 |

'20 |

'21 |

'22 |

'23 |

'24 |

|

Dividend /share |

1 |

1 |

2 |

3 |

2.5 |

3 |

| Financial and Operational Performance |

Sunsine elaborated on its financial health and operational achievements, which have given cause for optimism among investors.

• Productivity Gains

The company addressed the sustainability of its productivity improvements, which rose from 46 tonnes per capita in 2013 to 100 tonnes in 2024.

Sunsine attributed this to ongoing investments in research and development, automation, and continuous production processes.

The company affirmed its commitment to further enhancements, expecting continued gains in efficiency and output:

|

“Certainly. In recent years, we have been increasing our investment in research and development and technological improvements, adopting automation and continuous production processes to reduce production costs and enhance efficiency. We are pleased to see that these efforts have yielded positive results. At the same time, we will continue to make improvements and upgrades, and we look forward to further enhancing productivity.” |

• Working Capital Management: Receivables and Payables

A concern raised by a shareholder is the mismatch between revenue collection and supplier payments.

The company’s trade receivables turnover days have increased from 59 in 2020 to 74 in 2024, while trade payables turnover days have declined from 13 to 6 over the same period.

This means Sunsine pays suppliers much faster than it collects payments from customers and often pays suppliers in advance.

|

Days |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Trade receivables turnover |

59 |

56 |

70 |

75 |

74 |

|

Trade payables turnover |

13 |

9 |

10 |

7 |

6 |

Sunsine explained that this strategy leverages its strong financial position to secure better raw material pricing, ensure supply stability, and foster long-term supplier relationships:

| “The Group adopts advance payment methods in its transactions with most of its raw material suppliers, resulting in a significant amount of prepayments each year. With our strong financial position, the Company is able to arrange advance or prompt payments to suppliers. This allows us to benefit from more favorable raw material pricing, ensure supply stability, and maintain strong, long-term partnerships with our suppliers.” |

• Capacity Expansion Plans

On future growth, Sunsine confirmed that new rubber accelerator capacity expansion is underway, with further announcements to be made in due course.

| Debate Over Cash Holdings |

A significant portion of the shareholder discussion centers on whether Sunsine should set a ceiling on its cash holdings

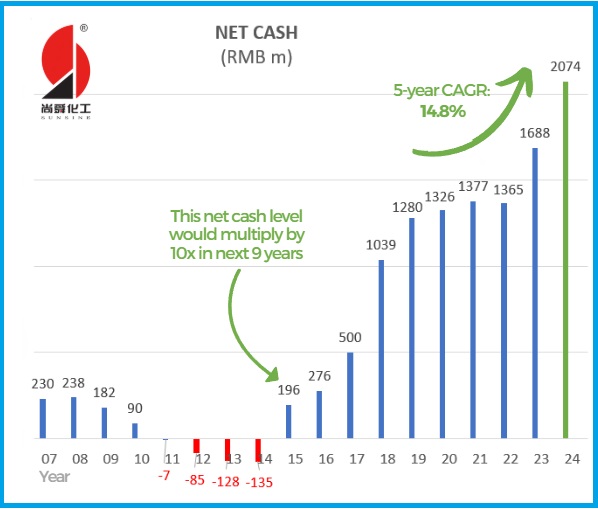

The end-2024 cash pile stood at a record RMB 2,074 million.

This sum was remarkable as it was after Sunsine had spent RMB 2,097 million for inventory purchases in 2024 and RMB 322 million in overheads.

The company’s reply did not directly address these comparisons.

Particularly in the last couple of years, Sunsine’s cash generation has accelerated, as the chart shows:

Cash Accumulation Trends over Past 5 Years

- Cash increased from RMB 1,280 million in 2019 to RMB 2,074 million in 2024, a rise of RMB 794 million.

- This growth occurred even after allocating RMB 1,491 million for capital growth (table below), RMB 467 million for dividends, and RMB 45 million for share buybacks.

- Shareholder funds rose from RMB 2,562 million to RMB 4,209 million.

|

2019 |

2024 |

Change |

|

|

PPE |

1,425 |

2,170 |

745 |

|

Land use rights |

53 |

226 |

173 |

|

Working capital |

617 |

1,190 |

573 |

|

Sum |

2,095 |

3,586 |

1,491 |

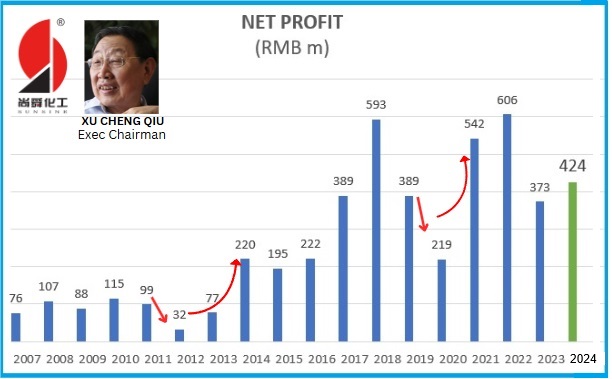

Profit Trends

While Sunsine’s profits have fluctuated, the overall trend is upward, with rebounds typically following declines—except in 2012 and 2020.

Notably, Sunsine posted RMB 219 million in profit during 2020, despite the widespread impact of COVID-19.

Sunsine’s responses ahead of its AGM provide transparency on its financial practices, dividend policy, operational efficiency, and growth plans. |

The full shareholder-Sunsine Q&A content can be found here.