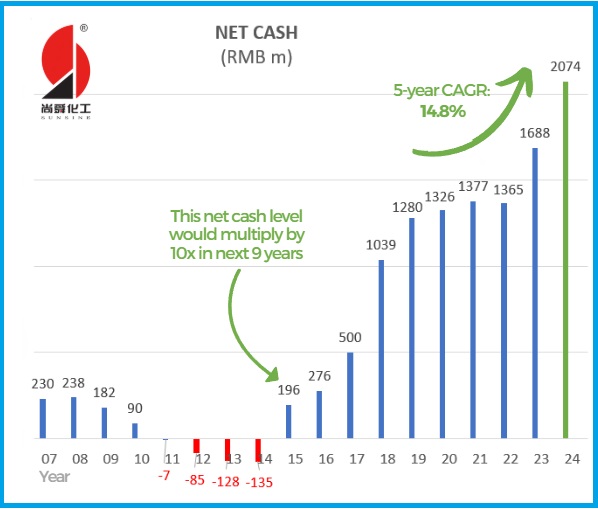

| In his article below, a long-time shareholder of China Sunsine Chemical analyses the growth of the company since its listing on the Singapore Exchange in 2007. The longevity itself of this business is remarkable, given that many China companies which listed on the Singapore Exchange, also known as S-chips, have fallen by the wayside for a number of reasons. China Sunsine instead has demonstrated an enduring vigour. If there's one metric that reflects that, it is its cashpile which has risen steeply (chart below).  At RMB 2 billion and climbing, it accounts for 84% of its market cap (S$457.6 million). Its cash equates to 40 SGD cents, so at a stock price of 48 cents, the PE ratio is 1 ex-cash. No typo there: it's 1X PE ex-cash. Read more below .... |

China Sunsine Chemical Holdings has crafted an extraordinary growth story, transforming RMB 264 million in net IPO proceeds into a financial powerhouse with RMB 2,074 million in cash reserves by 2024.

Sunsine's remarkable organic growth since its 2007 IPO is shown in slide 23 of its 2024 results presentation:

This cashpile comes after paying off all bank loans by 2016 and distributing RMB 936 million in dividends.  Another RMB 154 million in dividends is set for payout in May 2025.

Another RMB 154 million in dividends is set for payout in May 2025.

Sunsine’s ability to thrive through market cycles and crises, while maintaining profitability and expanding operations, underscores its position as a leader in the rubber chemical industry.

Rubber accelerators and MBT

Rubber accelerators (RAs), Sunsine’s mainstay, are crucial additives that speed up the vulcanization (hardening) of rubber, making the production process more efficient.

MBT is a key feedstock in the production of many RAs.

When utilisation of its 117,000-tonne RA capacity reached 85% in 2023, Sunsine announced on 23 April 2024 a preliminary study to explore the potential for further capacity expansion. Utilisation was 92% last year.

Several years ago, the Shandong provincial government requested Sunsine to devise a cleaner MBT production process to produce tyres. With R&D and a RMB 24m government grant, the "continuous" method was developed.

This method not only reduces pollution but also lowers production costs for Sunsine.

Sunsine's ultimate MBT capacity is 105,000 tonnes -- 60,000 tonnes from the "continuous" method and 45,000 tonnes from the old one.

As Sunsine needs around 65,000 tonnes of MBT to produce RAs, 40,000 tonnes are for sale. The running costs of the new method are lower.

Long-term sustainable growth

According to slide 29 of the results presentation, long-term sustainable growth relies on two drivers:

|

(a) Enhancing efficiency through operation improvement, waste reduction, and cash flow management. (b) Expanding capacity to meet growing demand for our products. |

Automation and improved production methods have achieved higher sales with an almost unchanged headcount.

|

Year |

Headcount |

Rubber chemical sales (tonnes) |

Per-capita (tonnes) |

|

2013 |

2,134 |

98,345 |

46.1 |

|

2014 |

2,186 |

108,973 |

49.9 |

|

2015 |

2,084 |

114,572 |

55.0 |

|

2021 |

2,249 |

195,405 |

86.8 |

|

2022 |

2,193 |

186,153 |

84.9 |

|

2023 |

2,116 |

206,996 |

97.8 |

On 23 April 2024, Sunsine indicated that productivity growth would continue.

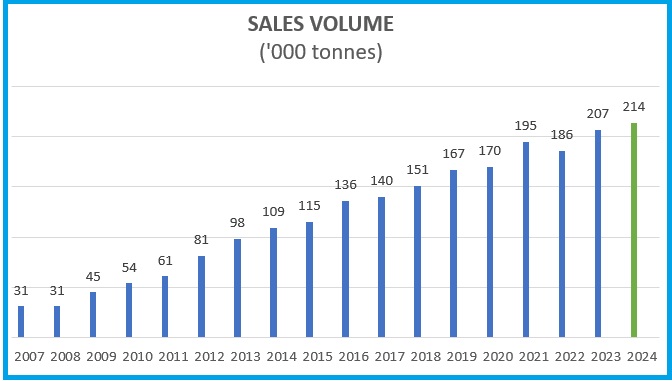

Sunsine's track record of rising sales volume is shown below:

Sunsine operates a cost-plus pricing model, meaning they add a margin to their production costs to determine the selling price.

This leads to profit fluctuations in line with raw material prices.

When sales volume rises, raw material prices rebound after bottoming, and more efficient production processes are executed, profit trends up over time.

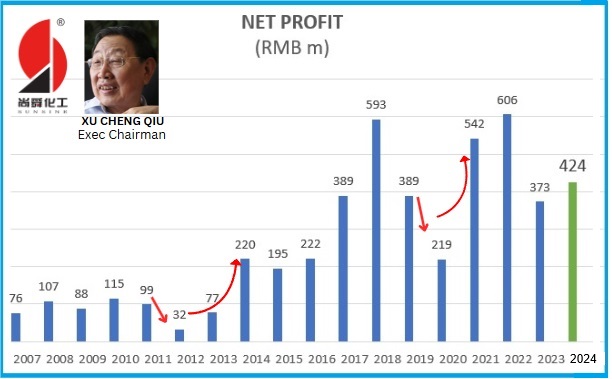

In the past 17 years, Sunsine has been profitable through various crises and market cycles.

Low profits have been short-lived, typically not lasting longer than a year except for the consecutive declines in 2011 and 2012, and 2019 and 2020.

The onset of COVID-19 in 2020 pushed many companies into the red, but Sunsine still managed to achieve a profit of RMB 219m.

Back to cash

At past AGMs, a hot topic was how much cash would provide business security to Sunsine.

Strong cash generation has led to cash accumulation despite the company handing out dividends (RMB 1,090m by May 2025) with RMB 264m seed money.

Its cashpile will exceed RMB 2,074m because of the following:

|

• Sunsine will receive RMB 71m from the Shanxian county government for giving up certain non-core assets for redevelopment by the government.

|

In perspective, the end-2024 RMB 2,074m cash is enough for five years of overheads (RMB 408m in 2024).

It is also enough to cover the cost of a one-year raw material supply (RMB 2,040m in 2023), providing a substantial buffer against price fluctuations or supply chain disruptions.

During the 2023 AGM, Independent Director Benny Lim said, "The Executive Chairman, Mr Xu Chengqiu, has gone through the Cultural Revolution and knows and appreciates how quickly things can change, and wants to ensure that there are sufficient funds to meet any challenges."

When Mr Lim made his point, the cash level in 2022 was much lower at RMB 1,365m.

It grew to RMB 2,074m two years later, and will continue to grow without hefty capital expenditures.

Although capacity expansions slow cash accumulation, the ensuing higher sales generate more cash flows, bringing cash to yet another record level.

Under Chairman Xu's leadership, Sunsine, which ventured into the rubber chemical business in 1994, has built up a solid foundation.

Instead of mainly relying on supplier credits like many do, it has been prompt in payments, with trade payables turnover ranging from 7 to 13 days between 2014 and 2023, demonstrating its financial strength.

At the same time, Sunsine could offer tyre makers longer credit terms, as it did to Zhongce. (Trade receivables turnover was between 55 and 75 days during the same period.)

| Conclusion Shareholders are positive about Sunsine's commendable financial strength and expect it to continue its consistent profitability. The company has demonstrated its ability to navigate crises and market fluctuations while amassing substantial reserves. Shareholders, especially the long-term ones, desire higher dividend payouts which the company can comfortably hand out. Hopefully, the company will indeed distribute a larger portion of its earnings as dividends to not only reward loyal shareholders but also enhance investor confidence and attract new stakeholders. |