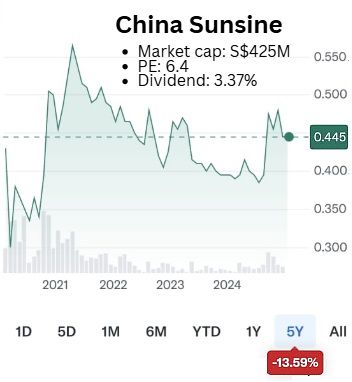

• At the start of every month, UOB Kay Hian rolls out its updated alpha picks portfolio, putting its reputation on the line. And it has delivered the goods. "On a price-weighted basis, we outperformed the STI by 0.7ppt for Dec 24 and an even punchier 14.4ppt for 2024." Talk about consistency: "Our Alpha Picks portfolio has now outperformed the STI in 12 out of the past 15 months," UOB KH triumphantly says in its latest note. •In its portfolio is a relatively new addition: China Sunsine. China Sunsine was added to the portfolio from 1 Oct 2024 when it was at 45.5 cents. It is currently at 44.5 cents.  • Few investors will disagree that China Sunsine stock is undervalued. Among other things, it trades at only 2X ex-cash PE (as UOB KH has also highlighted).  But for its own reasons, the stock continues to test the patience of long-time shareholders over recent few years (see chart). But for its own reasons, the stock continues to test the patience of long-time shareholders over recent few years (see chart). Will it be a drag on the UOB alpha picks portfolio? Or will the stock prove to be as good a pick as the others? Read more about China Sunsine below .... |

Excerpts from UOB KH report

• Strong broad-based performance. Our top performers were Seatrium (+7.3% mom), Sembcorp Industries (+5.7% mom) and Marco Polo Marine (+3.8% mom).

In our view, the strength of the industrials sector in Dec 24 could be attributable to dependable earnings growth in 2025.

CSE Global (-10.8% mom) and Singapore Post (-8.6%) both underperformed as they were impacted by legal and governance issues while China Sunsine (-7.3% mom) was dragged lower by China macro worries.

• Adding SATS and Yangzijiang Shipbuilding, removing SingPost. We add SATS and Yangzijiang Shipbuilding to our portfolio as we expect both to be beneficiaries of positive earnings newsflow in the next three months.

We remove SingPost due to overhang from the untimely departure of its management.

Our current portfolio consists of CSSC, CVL, CSE, CENT, GENS, LREIT, MINT, MPM, OCBC, SATS, STM, SCI, VMS and YZJSGD.

| China Sunsine Chemical - Buy |

| Analysts: Heidi Mo & John Cheong • Potential improvement in demand and ASPs from stronger Chinese economy. China’s latest stimulus measures have improved investor sentiment and may boost consumer confidence.

In turn, Sunsine’s demand and ASPs could see an uptick in the coming months. In Jul-Sep 24, we observe that ASPs have been flattish, accompanied by moderating raw material prices. |

||||

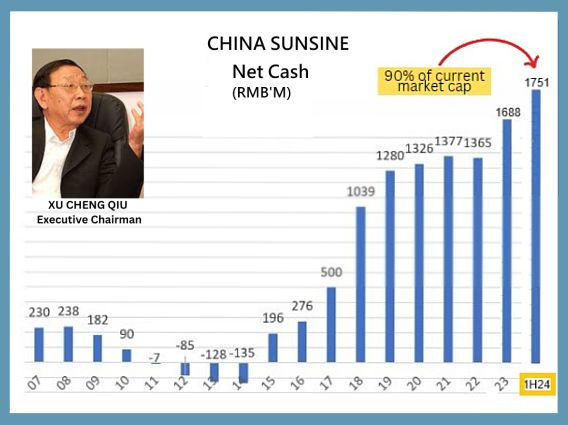

Cashpile has been growing in recent years. It stood at 90% of market cap as at 1H24 when the stock was 40 cents.

Cashpile has been growing in recent years. It stood at 90% of market cap as at 1H24 when the stock was 40 cents.

• Good dividend yield of around 5% backed by strong balance sheet. Sunsine provides an attractive yield of around 5%, supported by its robust cash balance of Rmb1,751m (+4% hoh) as of 1H24.

This translates to Rmb1.82/share (S$0.34/share) or around 70% of its market cap.

This provides ample room for Sunsine to potentially raise its dividend and continue to perform share buybacks.

Sunsine has bought back 3.8m shares for 2024 since the start of its 2024 share buyback plan on 26 Apr 24.

Heidi Mo, analyst• Expect steady volume growth from strong demand. Sunsine achieved stronger rubber chemical sales volume (+6% yoy) in 1H24.

Heidi Mo, analyst• Expect steady volume growth from strong demand. Sunsine achieved stronger rubber chemical sales volume (+6% yoy) in 1H24.

This was backed by better capacity utilisation rates for tyre manufacturers based in Southeast Asia, partially offset by lower domestic demand.

As more Chinese tyre manufacturers look to Southeast Asia to set up factories or beef up production, we expect international sales volume to grow further.

Moreover, automakers reported 6% yoy higher auto sales in China, while New Energy Vehicles saw a 32% yoy surge in 1H24.

We therefore expect sales volume growth to remain steady moving forward.

| • Maintain BUY. Our target price of S$0.58 is pegged to 7.5x 2025F PE or +1SD above historical mean PE. Sunsine is trading at an undemanding 2x CY24F ex-cash PE, and we expect Sunsine to capture the potential demand recovery in 2025. SHARE PRICE CATALYSTS • Events:

• Timeline: 3-6 months. |

Full report here