• The FY24 dividend amounts to about S$29 million, or 36% of its FY24 earnings. • China Sunsine's stock has recently risen to 52 cents. |

Excerpts from UOB Kay Hian report

Analysts: Heidi Mo & John Cheong

China Sunsine Chemical (CSSC SP)

Sunsine’s sales volumes are expected to maintain an upward trend, driven by China’s stimulus measures and rising tyre exports. |

Singapore analysts visited China Sunsine last year. Picture: Control room which monitors operational and production system. The large display shows detailed layouts and data related to the facility's production. China Sunsine integrates safety monitoring, management, decision-making, and response into a unified digital platform. Photo: Company

Singapore analysts visited China Sunsine last year. Picture: Control room which monitors operational and production system. The large display shows detailed layouts and data related to the facility's production. China Sunsine integrates safety monitoring, management, decision-making, and response into a unified digital platform. Photo: Company

WHAT’S NEW

• Expect volumes to maintain an upward trajectory. In 2024, China Sunsine Chemical (Sunsine) achieved a record sales volume of 214,094 tonnes (+3% yoy), driven by an 11% yoy increase in international sales volume on robust demand from Southeast Asia-based tyre manufacturers.

|

CHINA SUNSINE |

|

|

Share price: |

Target: |

However, domestic sales volume saw a slight 1% yoy decline.

Looking ahead, we expect domestic sales to improve, supported by China’s targeted stimulus measures to aid consumption recovery.

Note that China’s automobile sales grew 5% yoy to 31.4m units, demonstrating strong domestic demand.

• Chinese tyre makers continue to offshore production for better access to natural rubber, cost savings, and trade advantages.

As the world’s largest tyre producer accounting for >40% of global output, China’s rubber tyre exports grew 3.3% yoy to 1.38m tonnes in Jan-Feb 25 according to China’s tire industry data service provider Tireworld, suggesting continued growth in international sales volume for Sunsine.

In addition, increased adoption of electric vehicles could boost new vehicle sales.

"With the largest rubber accelerator capacity of 117,000 tonnes, Sunsine is well-positioned to expand its customer base of over 1,000 clients across >40 countries, including more than 75% of the top 75 global tyre makers such as Bridgestone, Goodyear and Michelin." - UOB KH |

• Stable gross margins despite ASP and raw material price decline. Per Sublime China Information (SCI), average rubber accelerator ASPs in Jan-Mar 25 were slightly lower than in 4Q24, while average aniline prices dropped by around 6%.

We expect gross margin to remain stable yoy at around 25% in 1H25, supported by cost savings from the ramp-up of new Mercaptobenzothiazole (MBT) production in 4Q24, which may partially offset the intensified market competition.

Notably, Phase 1 (20,000 tonnes) of its 60,000-tonne MBT project began commercial production in 4Q24, while Phase 2 (40,000 tonnes) has yet to be announced.

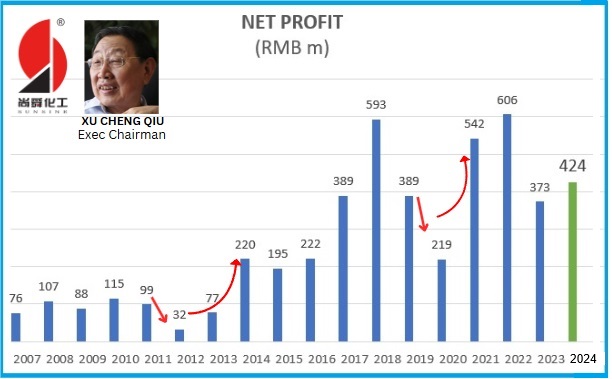

• 2024 review. Sunsine reported 2024 earnings of Rmb424m (+14% yoy), beating our/consensus forecast by 12%/14% respectively.

The beat was due to lower-than-expected R&D expenses, which fell 28% yoy or Rmb33m due to the completion of R&D activities, and foreign currency gains of Rmb28m (vs Rmb17m in 2023).

Revenue of Rmb3.5b (+1% yoy) matched our forecast, driven by record-high sales volume (+3% yoy), offset by a 2% yoy decline in ASPs.

Gross margin expanded to 24.2% (+1.3ppt yoy).

STOCK IMPACT

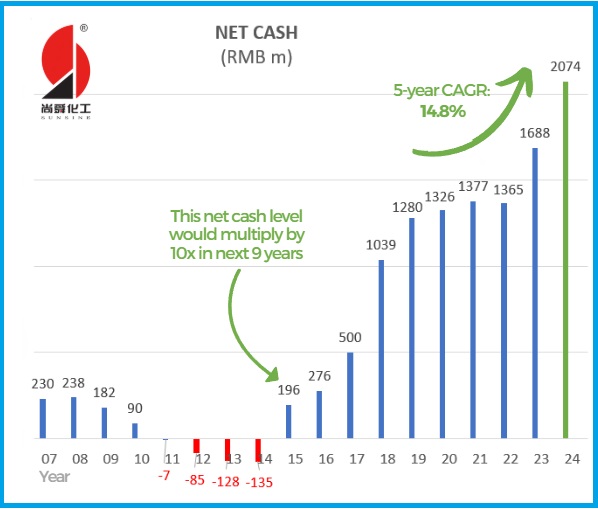

• Attractive dividend yield of around 6% backed by strong balance sheet. Sunsine provided an attractive yield of around 6%, supported by its strong cash position of Rmb2,074m (+23% yoy) as of end-24.

This translates to Rmb2.18/share (S$0.40/share) or around 77% of its market cap.

This provides ample room for Sunsine to potentially raise its dividend and continue to perform share buybacks.

• Maintaining market leadership. Management highlighted that Sunsine maintained its position as the world’s largest accelerator producer, with a stable market share of 23% in 2024.

In China, it also upheld its leadership with 35% market share.

• Projects in the pipeline to boost production and cost savings. Phase 2 (30,000 tonnes) of a 60,000-tonne capacity insoluble sulphur project is set to begin trial runs in 1H25, adding to its production to meet the rising market demand.

Additionally, Phase 2 (40,000 tonnes) of the 60,000-tonne MBT project is in the pipeline.

As MBT is a key intermediary product to produce about 80% of all types of rubber accelerators, this will enhance cost savings and reduce reliance on external suppliers.

EARNINGS REVISION/RISK

We have raised our 2025/26 earnings estimates by 9%/6% respectively, after factoring in better-than-expected gross margins from its MBT capacity expansion, which improves self-sufficiency as MBT is the main feedstock for most types of rubber accelerators.

Net margins are also raised 1-2ppt on lower R&D expenses.

VALUATION/RECOMMENDATION Heidi Mo, analyst• Maintain BUY with a 9% higher target price of S$0.63 (S$0.58 previously), as a result of our raised earnings forecasts. Heidi Mo, analyst• Maintain BUY with a 9% higher target price of S$0.63 (S$0.58 previously), as a result of our raised earnings forecasts. This is pegged to an unchanged PE multiple of 7.5x 2025F earnings, or 1SD above the mean PE. The stock trades at an attractive valuation of 1.4x ex-cash 2025F PE. SHARE PRICE CATALYSTS • New manufacturing capacities commencing production. • Higher ASPs for rubber chemicals. • Higher-than-expected utilisation rates. |

Full report here.