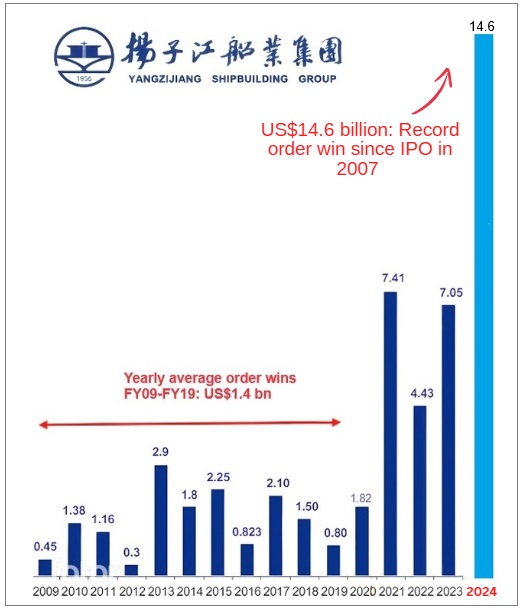

• Yangzijiang Shipbuilding was cruising along, racking up huge orders in recent years and looking unstoppable. • Why all the drama? The US wants to revive its own struggling shipbuilding scene, while China’s been increasingly dominating the global market. |

Excerpts from DBS Research report

Analyst: Ho Pei Hwa

USTR's scaled-back port fees proposal eases concerns

|

| What has happened |

The U.S. Trade Representative (USTR) has significantly scaled back initial proposals on hefty port fees targeting Chinese operators and Chinese built vessels, after industry backlash.

Effective Oct 14, 2025 (after a 180-day waiver), fees will apply once per voyage (not per port call; an Asia-US vessel typically makes three port calls per voyage) and are capped at five charges annually per vessel (a vessel could make 6-8 round trips on Asia-US routes).

In terms of fees structure, vessel operators of Chinese-built ships will be charged USD18/net ton for arriving vessels (increasing to USD33 by Apr 17, 2028) or for containerships at USD120/container discharged (rising to USD250 by 2028).

For Chinese operators, their vessels will be charged at higher fees of USD50/net ton (rising to USD140 by 2028).

(More details in DBS report)

| Our view |

Based on our estimate, the impact on large containerships is expected to be much less severe, with the port fees now projected to represent 5-6% of freight rates (rising above 10% by 2028), compared to the previously estimated 20-30% increase.

|

Yangzijiang |

|

|

Share price: |

Target: |

These more manageable port fees and more room for shipping companies / shipbuilders to manoeuvre should ease concerns about Chinese shipbuilding order cancellations and future ordering.

Korean and Japanese yards are expected to somewhat benefit from a preference for non-Chinese-built vessels and modest price premiums.

We expect the trend to impact tier two yards in China, driving further consolidation of Chinese shipbuilding industry with higher order concentration at top yards.

Ordering for top tier Chinese shipbuilders should be more resilient.

After all, China accounts for half of global shipbuilding capacity.

Shipwoners typically also take other factors such as slot availability, newbuild prices etc into consideration while placing orders, especially that port fees are likely to pass on to consumer.

Furthermore, the success of building cost competitive ships in US remains to be seen.

While Korea yards have already approached US for potential collaboration to accelerate US shipbuilding revival, this is a long-term process that will take 5-10 years to develop, at least.

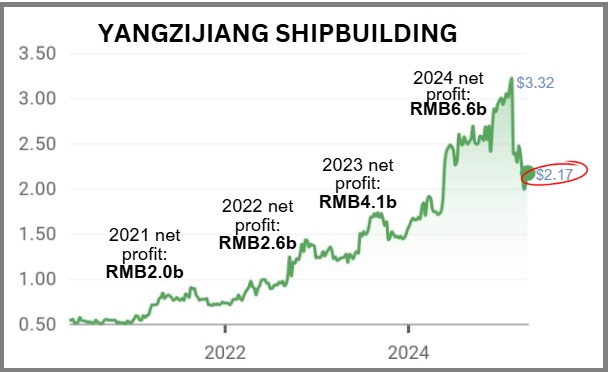

Ho Pei Hwa, analystWhile broad market is volatile with ongoing US-China trade war, we opine that Yangzijiang’s 30% selloff on port fee news is excessive. Ho Pei Hwa, analystWhile broad market is volatile with ongoing US-China trade war, we opine that Yangzijiang’s 30% selloff on port fee news is excessive.As the world 3rd largest shipbuilder by orderbook and amongst the most profitable shipbuilders, Yangzijiang has wide economic moat and strong balance sheet to weather through near-term uncertainties and potential structural shift. Reiterate our BUY call with SGD3.80 TP (2.5x PB; 11x PE). |