• When markets are hit by uncertainty, bargain stocks start popping up. No less a believer, CGS -International retained its target price of $3.62. Read more below .... |

Excerpts from UOB Kay Hian report

Analyst: Adrian Loh

Offshore Marine – Singapore

| Tariff Tantrum: Winners, Losers & Deepwater Plays In Apr 25, Trump’s steep tariffs triggered a drop in oil prices amid worries about oil demand and excess OPEC supply. Shipping has also been impacted; however, this may be somewhat limited as US-China trade forms just 5% of global container volumes, offset by rapidly growing intra-Asia trade. In the drilling market, deepwater rigs are still the most resilient segment. Maintain OVERWEIGHT on the sector. |

ACTION

• Maintain sector view at OVERWEIGHT.

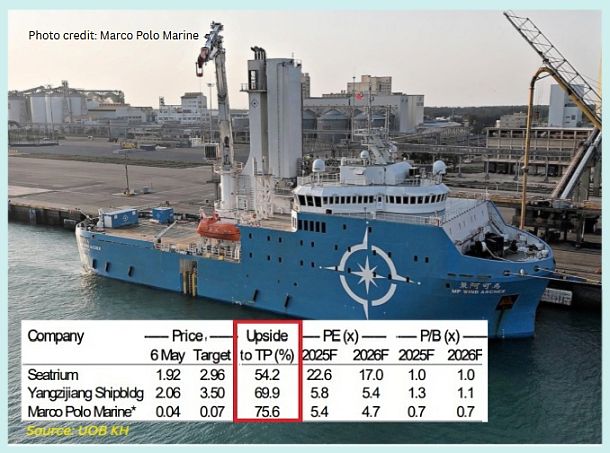

Top picks are STM and MPM with YZJ appearing to have very favourable risk/reward at present.

We like Seatrium (STM SP/BUY/Target: S$2.80) as we believe that the company will benefit from resilient demand for oil and gas production assets as well as demand for offshore vessels and structures related to the renewables industry.

We also like Marco Polo Marine (MPM SP/BUY/Target: S$0.072) as its vessels are exposed to potential upside in charter rates in 2025 and beyond.

Trading ex S$0.12 dividend as of 5 May, Yangzijiang Shipbuilding (YZJ) appears extremely inexpensive with its 2025F PE and P/B of 5.8x and 1.3x respectively while delivering a forecast yield of 5.1% and ROE of 24.9%.  Adrian Loh, analystIts share price has fallen 38% since its peak in Feb 25, and thus YZJ’s risk/reward ratio appears very attractive in our view. Adrian Loh, analystIts share price has fallen 38% since its peak in Feb 25, and thus YZJ’s risk/reward ratio appears very attractive in our view. Downside risk: order cancellations for container vessels which make up 69% of the company’s orderbook of US$24.4b as at end-24. |

RISKS TO OUR THESIS

• Risks include:

a) Delays in project sanctioning due to supply chain issues;

b) lack of financing for fossil fuel-related industries; and

c) a global recession leading to lower oil prices and lower capex spending.

Full report here.