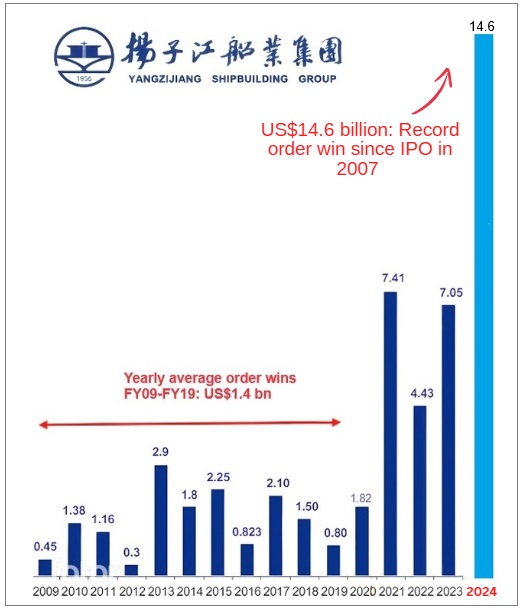

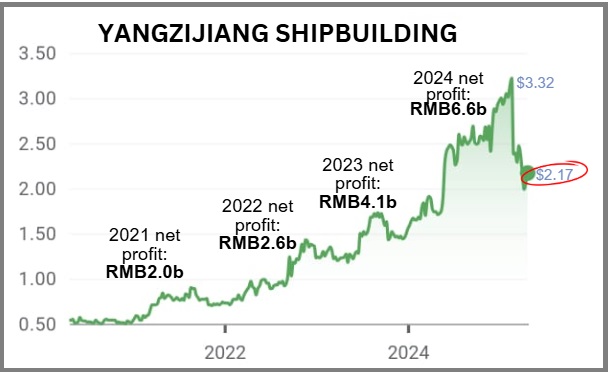

• Go by the hard numbers, not speculation or sentiment. That may well be part of the underlying message from yet another analyst covering Yangzijiang Shipbuilding. • In his report this week, Adrian Loh of UOB Kay Hian said: "...its yard is full until end-27, investors should focus on earnings and ship deliveries." And Yangzijiang has a massive US$23.2b orderbook with ship deliveries into 2030. • Still, the stock is down since Feb 2025 on news of a US plan to slap huge fees on Chinese-built vessels calling at its ports. A subsequent US announcement in April outlined watered-down fees. • The US moves have greatly impacted Yangzijiang's order wins for vessels in 1Q2025 following which analysts from two houses —CGS International and DBS Bank—offered contrasting takes to the news. • CGS trimmed its forecasts and cautioned on near-term risks, while DBS saw an attractive buying opportunity given the company’s strong backlog and balance sheet. (see: YANGZIJIANG SHIPBUILDING’s Q1 Order Slump Sparks Caution for CGS -- But DBS Thinks Stock’s a Steal) Read more below what UOB KH says .... |

Excerpts from UOB Kay Hian report

Analyst: Adrian Loh

Yangzijiang Shipbuilding (Holdings) (YZJSGD SP)

Big Backlog – But New Order Wins Needed In The Medium Term

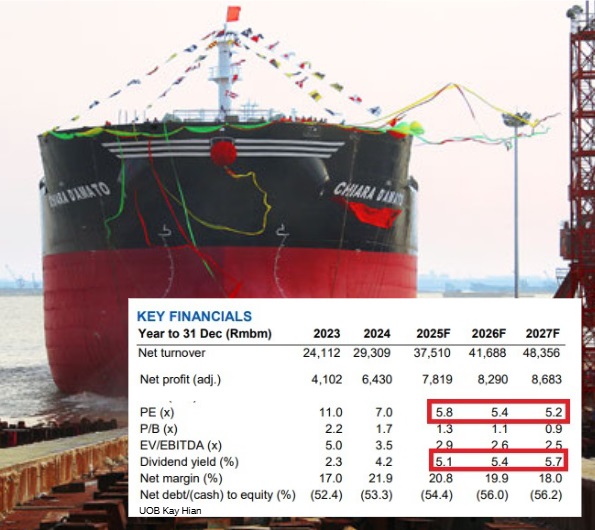

| VALUATION/RECOMMENDATION Maintain BUY with a slightly lower PE-based target price of S$3.29 (previously S$3.50). Our target price has dipped slightly given that the company’s past five-year average PE has declined due to recent market volatility, thus lowering our target PE multiple to 9.1x vs 9.6x previously. The target multiple is 1SD above the company’s 10-year average of 6.6x which we believe is justified given the company’s earnings visibility into 2028 as well as its strong track record of safe and efficient shipbuilding for its international customer base. Using its past 10-year average PE of 6.6x results in a fair value of S$3.29.  |

|

YANGZIJIANG |

|

|

Share price: |

Target: |

What would happen if new order wins do not eventuate in 2025? In our view this has been negative for sentiment on the stock with ytd share price having fallen over 31%.

We would only start worrying if YZJ failed to win new orders in 2025 and 2026 thus potentially negatively affecting 2028 earnings.

As pointed out earlier, the company has long-term earnings visibility into 2028 and thus patient investors will be rewarded.

YZJ remains very inexpensive trading at 2025F PE and EV/EBITDA of 5.8x and 2.9x respectively, while delivering nearly 25% ROE and a 5.1% yield.

• YZJ’s current orderbook comprises 230 vessels worth US$23.2b as at 22 May 25. We note that clean energy vessels account for c.74% of its orderbook value.

Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened in Feb 2025 high port fees for Chinese-built ships.

Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened in Feb 2025 high port fees for Chinese-built ships.

• A more consistent implementation of its share buyback programme |

Full report here.