• Yangzijiang Shipbuilding is sailing away from the woes created by news of US port fees for Chinese-built and/or owned ships. The stock recently recovered to the pre-US news $3.30 level, recovering from the sub-$2 low it crashed to at the height of the sell-off early this year. • As ship owners considered adjustments to their fleet sailings, new ship orders have materialised for Chinese yards, including Yangzijiang Shipbuilding. • Chinese yards remain competititve and resilient, offering cost advantages and labor reliability (with virtually no strike risk), which makes them more attractive than many regional counterparts. • In August 2025, after it had bagged only US$0.74 billion order wins so far this year, Yangzijiang said it has secured US$2 billion worth of Letters of Intent, signalling a pipeline of serious deals being hammered out.  • In the latest development, Yangzijiang said it had won some orders -- and initiated the cancellation of a few (more on this below). In response, DBS Research this week said that trading at 8x PE and 2x PB, Yangzijiang remains undervalued relatively to regional peers 18x PE and ~3x PB, despite YZJ’s earnings with >25% ROE, 5% dividend yield and 10-15% earnings growth. Reiterate BUY and TP SGD3.80 (2.5x PB). • What does CGS International say? Read excerpts below .... |

Excerpts from CGS report

Analysts: Lim Siew Khee & Meghana Kande

Yangzijiang Shipbuilding

| Wins and losses ■ YZJSB has secured US$440m of contracts of four containerships and four bulk carriers for delivery in 2027-2029, bringing YTD order to US$1.9bn. ■ However, it also terminated contracts of four oil tankers (US$180m) that it believes was related to a scheme to circumvent US sanctions law. ■ For the cancelled contracts, no revenue nor profit was recognised up to 30 June 2025 with 20% of payment collected. Work had started for one vessel. ■ We believe its share price could react to the cancellations, although it was YZJSB that initiated the action. Maintain Add and TP of S$3.90. |

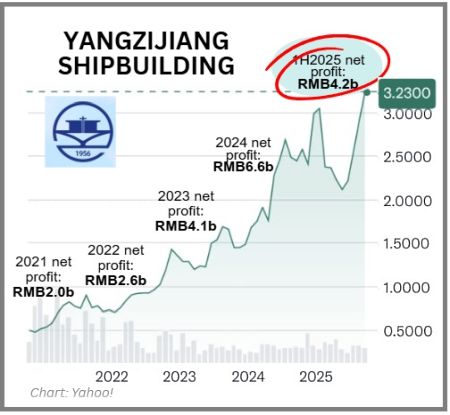

Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened, in Feb 2025, high port fees for Chinese-built ships. The stock recovered in recent months.

Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened, in Feb 2025, high port fees for Chinese-built ships. The stock recovered in recent months.

| YTD order win of US$1.90bn; order book at c.US$25bn |

● YZJSB has secured shipbuilding contracts for eight vessels amounting to US$440m.

The contracts comprise four units of containerships ranging from 1,100 TEU to 11,800 TEU as well as four units of 71,000 DWT bulk carriers.

|

YANGZIJIANG |

|

|

Share price: |

Target: |

The 11,800 TEU containerships are from YZJSB’s long-term customer, Seaspan Corporation (not listed).

● This brings YTD order wins to US$1.90bn and we estimate order book to reach c.US$25bn currently.

We keep our US$3.7bn target win for FY25F for now. Initiated cancellation of orders; no EPS impact

● YZJSB also terminated contracts for four 50,000 DWT Medium Range (MR) oil tankers worth about US$180m, originally scheduled for delivery in 2026–2027.

The decision to terminate followed newly disclosed critical information alleging that the buyer’s sole shareholder was involved in a scheme to circumvent US sanctions.

From YZJSB’s legal standpoint, the contracts were deemed either anticipatorily repudiated or frustrated due to supervening illegality associated with the buyer’s payment obligations.

● Deposits of US$22.48m (10% initial plus 10% for one vessel) had already been collected, with no revenue or profit recognised as of 30 June 2025.

Construction had begun on only one vessel.

EPS is not affected by the cancellations.

| Share price may weaken temporarily, providing buying opportunity |

● News of cancellations often negatively affect share prices for companies driven by order books.

We believe YZJSB’s share price could be slightly affected by the cancellation news although it was initiated by the yard.

We also believe the contract is with an oil trader with operating offices in Geneva and Singapore that was clinched in 2023.

● We understand construction of the first vessel has reached 20%.

We believe YZJSB is likely to complete the construction and resell/transfer to another customer.

The company’s last major cancellations were in 2016 where YZJSB saw cancellations of contracts for bulk carriers and containerships due to a challenging market.

Some of the vessels were subsequently resold.

● Maintain Add on the back of its strong order book and potential for margin expansion. |

→ Full CGS report here. → Full CGS report here.→ See also: YANGZIJIANG SHIPBUILDING: Goldman Sachs Initiates ‘Buy’ And $4 Target On Earnings Boom Amid Industry Upcycle |