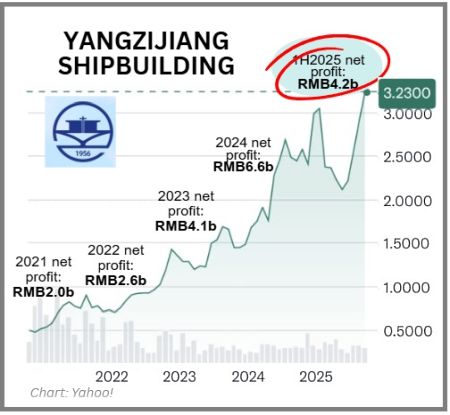

• Think back to Feb 2025 when investors panicked and sold Yangzijiang Shipbuilding's stock from above $3 to below $2 within 2 months. The trigger was the US proposing to impose huge fees on Chinese ships calling at its ports. Never mind that Yangzijiang builds ships and does not own nor operate ships -- let alone those that transport goods to and from the US. • It took time but investors subsequently learnt that ship owners could mitigate the impact by reallocating their fleets. In the end, the US watered down its fees anyway. • As the situation calmed down, ship owners resumed their orders with Chinese yards, including Yangzijiang. • Fast forward to today, Yangzijiang's stock has surpassed its pre-Feb 2025 high.  • At the recent Asian Gems Conference showcasing promising listed companies in Asia -- an event hosted by UOB Kay Hian -- Yangzijiang attracted more than its share of institutional attendees. • Read excerpts of UOB K H's report below .... |

Excerpts from UOB KH report

Analyst: Adrian Loh

Yangzijiang Shipbuilding -- Sailing Past Choppy Waters

| Highlights • Shipbuilding margins are likely to remain elevated in 2026 • Incremental new order wins should be positive for sentiment • Upgraded PE-based target price to S$3.90 (previously S$3.60). Maintain BUY. |

Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened, in Feb 2025, high port fees for Chinese-built ships. The stock recovered in recent months.

Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened, in Feb 2025, high port fees for Chinese-built ships. The stock recovered in recent months.

| Analysis |

• High investor interest. Based on the number of participants at its meetings, Yangzijiang Shipbuilding (YZJ) had a very high level of investor interest with the key items of interest being the sustainability of its shipbuilding margins, prospects for new order wins and impact of the US-China trade war.

|

YANGZIJIANG |

|

|

Share price: |

Target: |

• Shipbuilding margins to remain at historical highs in 2026. Recall that 1H25 shipbuilding margins hit 35.2% (+9.3ppt yoy) due to lower steel costs, a lower CNY/USD exchange rate, successful execution of secured contracts with improved pricing, and the smooth delivery of 23 vessels.

During the conference, the company guided that such shipbuilding margins are sustainable in 2026 with the key swing factor likely to be the CNY/USD exchange rate.

YZJ has currently factored in a slight increase in steel prices.

• Incremental new order wins but nothing major. Given that YZJ’s shipbuilding slots are currently full until at least 2029, especially for large vessels, the company played down its ability to garner more of the seriesbuild, multi-billion-dollar orders that we witnessed in 2024.

That said, we note industry news about YZJ being in the running for up to 12 x 18,000 TEU dualfuel containerships with recent prices at around US$200m-210m per vessel.

• Relatively nonplussed about the US-China trade war. Although orders for China-built vessels dried up in 1H25 in the wake of US port fees targeted at such vessels, management stated that newbuilding enquiries had returned in 2H25 to date.

This was evident in YZJ’s new order wins of US$1.36b in 2H25 which were more than 2.7x higher than 1H25.

The company remains hopeful that the US-China trade war will not escalate and that it can continue to win smaller sized vessel orders from Southeast Asian clients.

• Skewed smaller. During the conference, YZJ stated that order wins for large containerships (ie >15,000TEU) would be difficult given that its yard slots for such vessels are full until 2028.

Thus, it pointed to its order wins this year which comprise of small to medium sized vessels, eg the large majority of its containership orders are sub-5,000 TEU.

This is borne out by industry data with Clarksons stating that while global newbuild ordering activity remains firm in the containership sector, the resurgence in orders has been for smaller sized sub-5,000 TEU feeder containerships.

● Maintain UY with a higher PE-based target price of S$3.90. |

→ Full UOB KH report here.

→ Full UOB KH report here.

→ See also: YANGZIJIANG SHIPBUILDING: Goldman Sachs Initiates ‘Buy’ And $4 Target On Earnings Boom Amid Industry Upcycle