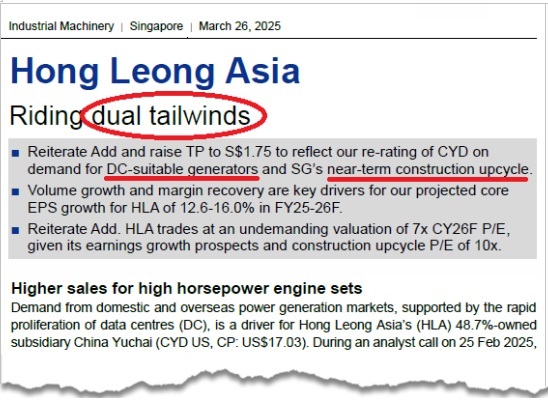

• Our recent article Underground and Overground: Booming Construction Sector Will Benefit Many Players. Here's one example ... highlighted that Hong Leong Asia is riding a boom in the construction industry in Singapore and Malaysia. • Hong Leong Asia (market cap: S$912 million) has another core business -- the Powertrain Solutions (see graphic above) -- via its 48.7% stake in China Yuchai, which is listed on the New York Stock Exchange. It manufactures diesel engines for various applications, including trucks and industrial and marine. • Now, a CGS International report has shone a spotlight on a part of China Yuchai that is particularly promising -- making power generation equipment for data centres.  CGS analysts: Lim Siew Khee & Natalie Ong CGS analysts: Lim Siew Khee & Natalie OngWe summarise below what CGS' 16-page report says about the data centre opportunity .... |

Listed on the New York Stock Exchange and headquartered in Singapore, China Yuchai manufactures high horsepower engine sets for use in data centres.

These engines are crucial for providing backup power to these energy-intensive facilities.

GYMCL (Guangxi Yuchai Machinery Company Limited), which is China Yuchai's subsidiary, manufactures engine sets.

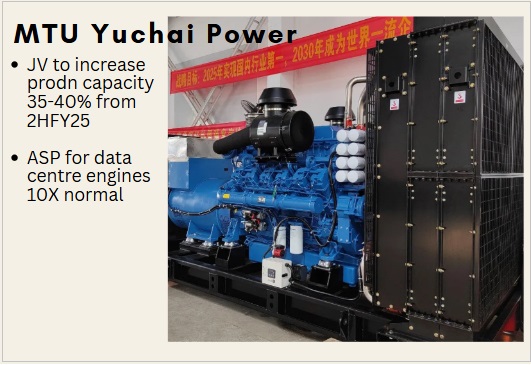

Over and above that, it is in a 50/50 joint venture with Rolls-Royce Power Systems known as MTU Yuchai Power (MTU).

|

HONG LEONG ASIA |

|

|

Share price: |

Target: |

This JV focuses on the production of high horsepower engines, including those specifically designed for data centre applications.

To capitalise on the growing demand, MTU is undertaking a phase 2 expansion of its manufacturing capacity, which is expected to increase production of these data centre-suited engines by 35-40% in 2026.

That will sharply boost what is currently an unquantified nascent business.

In FY24, China Yuchai, including its JV, sold less than 1,500 high horsepower units that were suitable for both the data centre and oil & gas industries.

Notably, these specialised engines command significantly higher average selling prices (ASPs), potentially 10X greater than China Yuchai’s normal blended engines. China Yuchai said order books for 2025 are already full for both the MTU joint venture and China Yuchai's own generator business. The company is having to turn away orders due to capacity constraints.

China Yuchai said order books for 2025 are already full for both the MTU joint venture and China Yuchai's own generator business. The company is having to turn away orders due to capacity constraints.

The growth potential of supplying to data centres is substantial.

This demand is evident in both domestic Chinese and overseas markets:

| • It is estimated that the China market alone may require at least 1,500-2,000 data centre generator engines to meet the projected capacity by 2030F. The demand is for large-capacity engines like MTU’s mtu 4000 Series. • There's a whole market opening up in places like Asia-Pacific and Latin America for smaller, edge data centers and on-premise data centres. These need less powerful generators This presents an opportunity for MTU’s smaller capacity engines, such as the mtu 2000 Series and the Yuchai-branded VC series of diesel engines. |

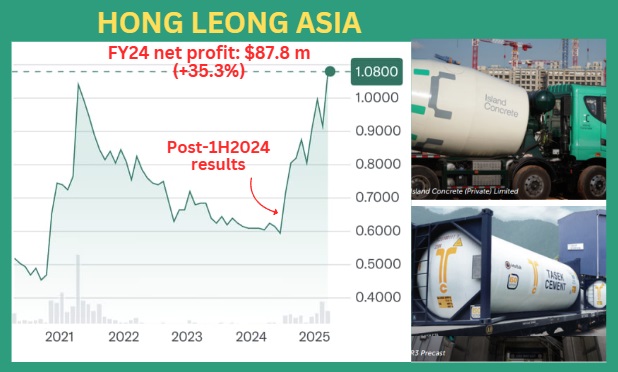

What a difference 2 days make. Above is a Hong Leong stock chart showing $1.08. The stock closed at $1.21 yesterday for a rise of 33% year-to-date.

What a difference 2 days make. Above is a Hong Leong stock chart showing $1.08. The stock closed at $1.21 yesterday for a rise of 33% year-to-date.

| In summary, Hong Leong Asia, through its subsidiary China Yuchai and the MTU joint venture, has a high-growth business in supplying high-value, high horsepower engine sets to the growing data centre market. The ongoing expansion of MTU's production capacity, and the demand from emerging markets for smaller capacity generators, suggests a strong growth trajectory. The much higher ASPs associated with these engines will further contribute to the future increased revenue and profitability for Hong Leong Asia. |

China Yuchai's FY24 investor webcast is here.