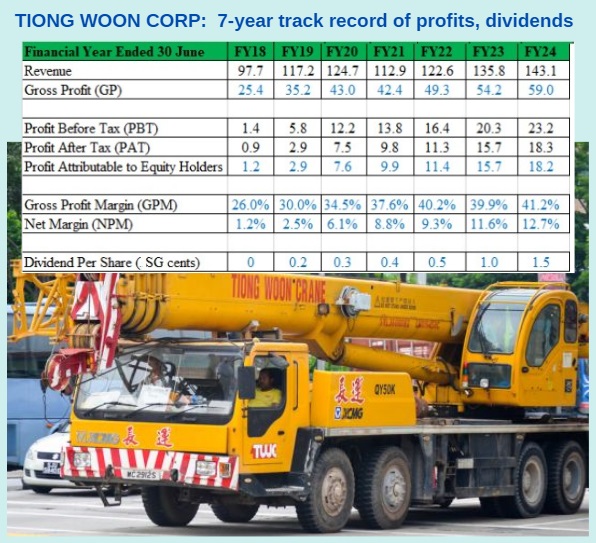

• Changi Airport's Terminal 5 has just started construction and is expected to be operational in the mid-2030s. This mega project is symbolic of the current buoyant era of construction in Singapore. Construction stocks have been hitting the 'buy' list of analysts. One of them, Tiong Woon Corporation, is a laggard and has low liquidity, even when it has delivered 7 consecutive years of profit growth. The Singapore-based company specializes in heavy lifting and transportation services for big construction projects across a range of industries.  • Investor engagement looks to be a challenge for Tiong Woon. As a shareholder cited in the FY2024 AGM minutes lamented: "Moving forward, I suggest you take additional steps to reach out and engage with them (investors) more directly rather than rely solely on the annual report for communication". (See also: TIONG WOON: This company has done well in business. Now SIAS wants it to try harder at investor relations) • Tiong Woon is highlighted in a UOB Kay Hian report today as one of its 3 picks from the construction sector alongside Hong Leong Asia and Pan United Corp.  • The graphic above depicts the 2 key business segments of Hong Leong Asia:

• Read more below .... |

Excerpts from UOB Kay Hian report

Analyst: Heidi Mo

Construction – Singapore

Laying The Groundwork: Infrastructure Upcycle And Margin Tailwinds

| Singapore’s construction sector is entering a new growth phase, underpinned by major infrastructure projects such as Changi T5 (S$5.75b in awarded contracts), Tuas Mega Port, and the Marina Bay Sands expansion. Falling material and labour costs are easing margin pressures, improving the profitability outlook for contractors. Maintain OVERWEIGHT on the sector. |

WHAT’S NEW

• Changi Airport Terminal 5 (T5) contract awards mark key infrastructure milestone. Changi Airport Group recently awarded

-- S$5.75b in contracts for T5 — a S$999m contract to a Penta-Ocean-Koh Brothers JV for underground tunnels housing automated people-mover systems, baggage handling and utilities,

-- a S$3.8b substructure package to a China Communications Construction Company –Obayashi JV for the terminal and ground transport centre, and

-- a S$950m airside infrastructure package to Hwa Seng Builder for remote stands, taxilanes and support facilities.

|

Tiong Woon |

|

|

Share price: |

Target: |

• Construction players poised to benefit from major infrastructure pipeline. The continuous investment in large-scale projects like the T5 expansion (S$4.75b out of total estimated S$12.5b awarded), Tuas Mega Port (S$20b investment), and Marina Bay Sands integrated resort expansion (around S$10.4b investment) provides a steady stream of highvalue projects that Singapore companies can bid for or participate in via JVs.

• Sustainability a key focus. The Singapore government actively fosters innovation, productivity, and sustainability through initiatives like the Green Mark Certification Scheme and the Singapore Green Plan 2030, which includes quadrupling solar energy deployment and issuing up to S$35b in green bonds. Companies aligning with these government priorities can gain a competitive edge and access funding.

• Easing cost pressures. Prices for several key construction materials, such as steel rebar, copper, stainless steel, steel flat, cement and diesel, are forecast to fall 1-13% yoy in 2Q25, driven by oversupply and competitive exports.

Labour inflation also eased to 1.5% in 2024 from 9% in 2023.

These reductions in input costs can improve profit margins for most construction companies.

• Maintain OVERWEIGHT. The construction sector benefits from stronger infrastructure spending, major project rollouts and supportive green policies. The easing cost pressures also support our positive view.  Heidi Mo, analyst• Within our coverage universe, our top picks are Hong Leong Asia (HLA SP) and Tiong Woon Corporation Holdings (TWC SP) with rationale detailed in the table below. Heidi Mo, analyst• Within our coverage universe, our top picks are Hong Leong Asia (HLA SP) and Tiong Woon Corporation Holdings (TWC SP) with rationale detailed in the table below. While BRC Asia (BRC SP) is a key beneficiary of the construction upcycle, we maintain a HOLD call as falling steel prices are expected to pressure margins. We also highlight other stocks across the construction supply chain that we think are well-positioned to ride on the sector’s positive momentum, as outlined below. |

Full report here.