• About a week ago, we published This stock is the "cheapest and biggest laggard" in construction industry. The stock is Tiong Woon Corp. • Following that, UOB KH yesterday had an analyst report on the company, which is a large Singapore-listed crane owner-operator. Read excerpts below, including why its potential upside is 70%. • If you read Business Times yesterday, you would have seen Tiong Woon featured too -- "Tiong Woon reaches for regional growth to build on pandemic momentum". • Briefly, Tiong Woon sees strong demand for cranes in the coming years from Singapore's public housing projects and mega infrastructure projects such as the Cross Island Line, Changi Airport T5 and Tuas Mega Port. |

Excerpts from UOB Kay Hian report

Analyst: John Cheong

Tiong Woon Corporation Holding (TWC SP)

Well-positioned To Benefit From Upturn In Construction And Oil & Gas Sectors

|

Tiong Woon is well-positioned to benefit from the construction and oil & gas upcycles. Its outlook has turned positive on the back of a strong project pipeline.

FY23 earnings grew 38% yoy and dividend doubled to 1.0 S cents. |

||||

WHAT’S NEW

| • Well-positioned to benefit from construction and oil & gas industries upcycles. |

With comprehensive ownership of more than 500 cranes, some of which can have a capacity of up to 2,200 tonnes, Tiong Woon Corporation Holding (Tiong Woon) is in a good position to benefit from the strong resumption of activities in Singapore’s construction sector and rising capex in the oil & gas industry.

The construction sector will have strong demand for cranes in the coming years driven by accelerating construction of public housing and new mega infrastructure projects including the Cross Island Line, Changi Airport T5 and Tuas Mega Port.

The Housing & Development Board has launched around 23,000 flats a year in 2022-23, a huge jump from the 48,509 flats launched in 2019-21 (16,170 flats per year).

Construction of more new petrochemical plants could also increase demand for cranes.

| • Positive outlook driven by strong project pipeline. |

In the latest outlook statement, Tiong Woon has highlighted “a positive outlook” vs being “cautiously optimistic” six months ago.

This is due to steady customer demand for its Heavy Lift and Haulage solutions, particularly in the petrochemical and construction sectors, as well as in key regional markets such as India, Saudi Arabia, and Thailand.

| HIGHER UTILISATION RATES |

| "Tiong Woon’s strong earnings growth will be driven by the improved utilisation rates and higher rental rates of its cranes due to demand from contractors. As of FY23, the average utilisation rate of the company’s cranes was only 48%." -- UOB KH |

The regions that Tiong Woon operates in are facing tailwinds from the higher construction demand, higher oil prices and final investment decisions.

In Singapore, the recurring tower crane business continues to be backed by residential launches and public housing projects to meet supply-demand imbalances.

On the heavy lifting side that boasts higher margins, Tiong Woon has secured contracts to assist with constructing Singapore’s Integrated Waste Management Facility, which will start contributing in FY24.

Tiong Woon has also secured two heavy lifting projects in India against international competitors Mammoet and Sarens.

This will meaningfully contribute to earnings in FY24 with its heavy-lifting solutions that generate better margins. In Saudi Arabia, Tiong Woon will be participating in mega infrastructure projects.

| • Expect FY24 to grow 20% yoy after a strong 38% yoy growth in FY23. |

For FY24, we expect Tiong Woon’s earnings to grow 20% yoy after a strong year in FY23, where Heavy Haulage was the star performer as Tiong Woon continues to execute projects, helped by the increased construction activities in Singapore.

| "The Housing & Development Board has launched around 23,000 flats a year in 2022-23, a huge jump from the 48,509 flats launched in 2019-21 (16,170 flats per year). Construction of more new petrochemical plants could also increase demand for cranes." -- UOB KH |

Tiong Woon’s strong earnings growth will be driven by the improved utilisation rates and higher rental rates of its cranes due to demand from contractors.

As of FY23, the average utilisation rate of the company’s cranes was only 48%.

We expect to see a double-digit growth in Tiong Woon’s crane rental rates in FY22 and FY23, which will be the key earnings growth driver.

STOCK IMPACT

| • Second-largest crane operator in Singapore with about 80% revenue derived locally. |

Tiong Woon is a leading heavy lift specialist supporting mainly the construction, oil & gas, infrastructure and petrochemical sectors. It has been listed on the SGX since 1999 and has more than 40 years of track record.

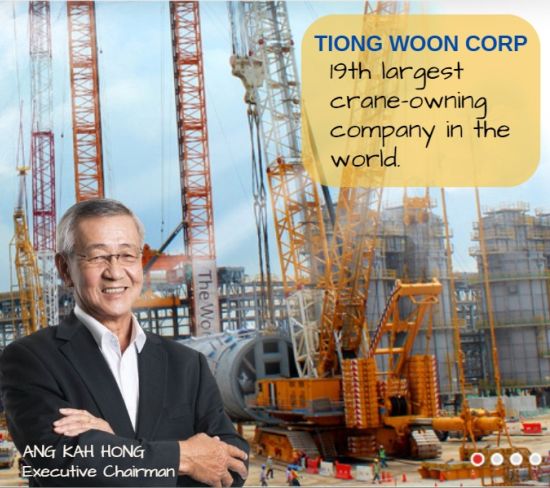

Headquartered in Singapore, the company has a strong regional presence with establishments in 12 other countries. It is ranked 19th globally in the IC Tower Index for 2023 in terms of crane capacity.

We expect a strong construction upturn and resumption of more oil & gas capex to be the key growth drivers.

| • Economic moat from size, track record and unique capabilities. |

Being the 19th largest player globally, Tiong Woon has the capabilities to compete effectively against world No.1 Mammoet and No.2 Sarens.

Tiong Woon’s moat lies not just in its ability to provide large-capacity cranes to suit the local market’s needs, but also in providing a range of solutions that are safe and timely to its clients.

Tiong Woon’s heavy lifting and construction services, as well as its capabilities, has allowed it to compete in the international arena.

With each completed project over the years, Tiong Woon has also been building its reputation and has constantly been ahead of the market by purchasing new and better margined heavier cranes to increase its capabilities, such as the tower cranes for Singapore’s BTO push and the latest 2,200 tonnes crane as set out in its 2023 annual report.

EARNINGS REVISION/RISK

• We maintain our financial estimates.

VALUATION/RECOMMENDATION

|

Full report here.