| • The Singapore construction industry isn't exactly where one can find many compelling stocks given its stiff competition that leads to non-sexy profit margins. • There may exists at least one value play, according to Lim & Tan Securities, citing Tiong Woon Corp (S$118 million market cap) in a new note to investors. • Tiong Woon is enjoying steady customer demand for its Heavy Lift and Haulage solutions, particularly in the petrochemical and construction sectors, as well as in key regional markets such as India, Saudi Arabia, and Thailand. • Read about Lim & Tan Securities' take on the stock below: |

By Lim & Tan Securities:

We highlight 3 key investment thesis for Tiong Woon Corp / TWC ($0.505, up 0.5 cents):

|

TIONG WOON |

|

|

Share price: |

Target: |

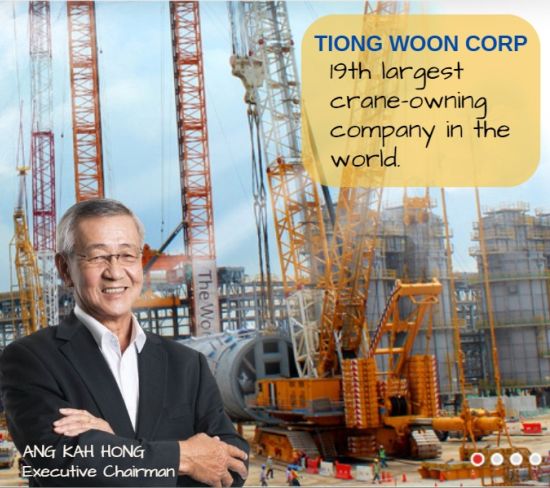

1. TWC is a regional heavyweight in the heavy lift industry, currently trading at a significantly undervalued level. TWC is a lifting powerhouse that has competed successfully against the likes of international competitors such as Mammoet and Sarens by winning contracts against them.

However, the market has failed to recognize TWC and has unfairly punished TWC’s share price.

| "... as No.19 (previously No.22) in the world (according to InternationalCranes June 2023 article), TWC has the capabilities to compete effectively against world No.1 Mammoet and No.2 Sarens." |

2. There exists a notable gap between the market’s perception and reality regarding TWC’s capabilities, which are on par with international industry giants, yet remain relatively unknown.

This presents a strong potential for a re-rating. The perception is that crane companies are unpopular and unexciting, which often results in investors not paying heed to the likes of TWC, resulting in an unfavoured company with extremely cheap valuations.

However, as No.19 (previously No.22) in the world (according to InternationalCranes June 2023 article), TWC has the capabilities to compete effectively against world No.1 Mammoet and No.2 Sarens.

TWC’s moat lies not just in its ability to provide large-capacity cranes to suit the local market’s needs, but also in providing a range of solutions that are safe and timely to their prospective clients.

TWC’s heavy lifting and construction services, as well as their best-in-class capabilities, has allowed them to compete shoulder-to-shoulder in the international arena.

We think this is an excellent achievement as Mammoet and Sarens are titans of the industry with long-standing histories. With their latest released AR2023, TWC is now trying to bridge that perception by listing out additions to its existing fleet and CapEx plans.

With this in mind, we think it is only a matter of time before TWC and its perception gap are noticed by investors and thus, a re-rating lies on the horizon.

3. TWC stands out as one of the few publicly listed companies maintaining a positive outlook, driven by the upswing in the petrochemical and construction sectors within the region.

For the first time, TWC has mentioned that it “maintains a positive outlook” vs being “cautiously optimistic” 6 months ago. The reason for this positivity is due to “steady customer demand for its Heavy Lift and Haulage solutions, particularly in the petrochemical and construction sectors, as well as in key regional markets such as India, Saudi Arabia, and Thailand”.

Explanation: The regions that TWC operates in are facing tailwinds from the higher construction demand post-COVID, higher oil prices and Final Investment Decisions (FID) that were not present since 2014.

The worst is over for TWC since the 2014’s oil price crash and TWC is now operating in a much better macro environment with better business prospects.

TWC’s market cap stands at S$117mln and now trades at 0.4x PB, 6.2x FY24 PE and 2.5x FY24 EV/EBITDA and ROE has improved to 5.4% despite a strengthening balance sheet, signalling that TWC remains undiscovered by investors despite the considerable improvement in its latest results.

Mgmt. has doubled dividends to a record high of 1.0 S cts and has been posting gradually positive outlooks with each passing result.

Also, the construction sector is doing well as evidenced by the share buybacks, statement outlook, profits, and positive share price movements of the entire construction value chain such as the other SGX-listed construction plays amongst others.

Despite profits at a record high since its last downturn in FY17, TWC is far from the cycle peak and trading at distressed valuations.

We think that this is the appropriate method to value TWC given its consistent cash flows. A 40% discount is ascribed due to TWC’s small market cap and low trading liquidity. We believe the time for a sector rerating is imminent and Tiong Woon remains the cheapest and the biggest laggard in the construction industry, which should translate into supernormal gains for investors in time to come. |