Tiong Woon: A Potential Undiscovered Gem

| Tiong Woon has been on my watchlist for several months. It often reminds me of Civmec, despite not being directly comparable. They share several similarities, such as chart breakouts, positive analyst commentary, management's optimistic outlook, a strong operating track record, and increasing dividends. Civmec, which I discussed on September 10, 2023, rose 28% from $0.805 on September 8, 2023, to $1.03 on October 18, 2024. Since then, it has distributed a total of AUD0.09 per share, resulting in a solid total potential return of 38%. Will Tiong Woon experience similar growth in the next 12-13 months?  I had the privilege of meeting Mr. Michael Ang (CEO), Mr. William Tan (CFO), and Mr. Aaron Sin (IR Specialist) for a one-on-one meeting on April 11, 2024. Last week, I caught up with William again over coffee. Let's delve deeper into Tiong Woon. |

Description of Tiong Woon

Listed on the SGX Mainboard since 1999, Tiong Woon is a one-stop integrated heavy lift specialist and service provider, mainly supporting the oil and gas, petrochemical, infrastructure, and construction sectors with over 45 years of experience.

The Group manages turnkey projects for engineering, procurement, and construction contractors and project owners from planning and designing heavy lift and haulage requirements to execution. The heavy equipment is transported, lifted, and installed at customers' facilities.The Group also purchases and operates its own heavy lift and haulage equipment, tugboats, and barges.

This flexibility allows them to provide efficient integrated services to their customers.Headquartered in Singapore, the Group has a strong regional presence in 13 countries and is ranked 15th in the IC100 2024 survey.

| Why is Tiong Woon Interesting? |

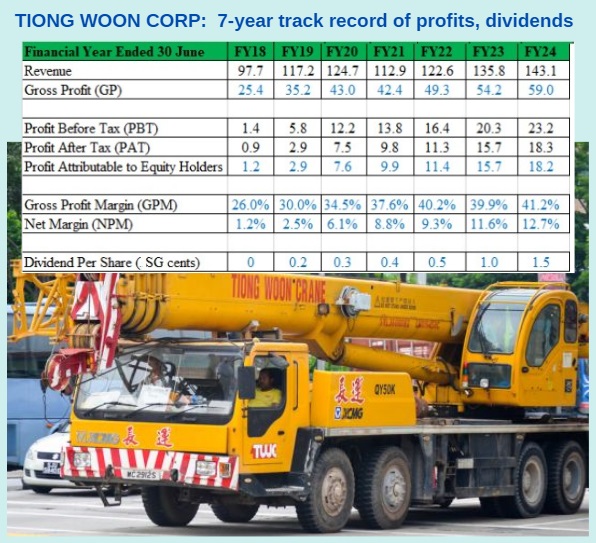

a) Excellent Seven-Year Track Record

Tiong Woon has shown a stellar seven-year track record of growing its gross profit, net profit after tax, and dividends per share every year since FY18, despite disruptions during COVID-19.

b) Management's Positive Outlook

Tiong Woon's revenue and net profit for the second half of FY24 (ended June 2024) were lower compared to the first half due to project delays into FY25F.

However, management remains optimistic about future prospects with numerous ongoing projects both locally and internationally.

Tiong Woon’s 2024 annual report cited numerous projects such as cross-island MRT and road enhancement, semiconductor plant expansion, Changi Terminal expansion etc in Singapore.

Overseas projects include Indian Oil Corporation Limited in Baroda and Panipat, Numaligarh Refinery Limited in Assam, and Jindal Steel and Power Limited in Angul, expansion of the GIGA gas field and high-profile developments such as NEOM and the Red Sea initiative etc.

Despite project delays, FY24 still showed commendable growth in both top and bottom lines with a dividend per share increase of 50% to S$0.015.

At a closing price of $0.530 on October 21, this results in a 2.8% dividend yield.

Tiong Woon will hold its AGM on 30 Oct 24. Its stock will trade ex-dividend on 4 Nov.

c) Prudent Balance Sheet Management

Despite being in a capital-intensive industry, Tiong Woon has significantly improved its net debt to equity ratio from 47.3% in FY16 to 3.8% in FY24.

It held a record cash position of S$81.1 million as of FY24.

According to management, maintaining a strong balance sheet is not only a prudent defensive move, but one of strategic importance, and a source of competitive moat, that helps Tiong Woon move fast to tap growth opportunities.

d) Potential Margin Improvements

Tiong Woon's business model involves high operating leverage due to fixed costs like staff expenses and depreciation.

With growing revenue streams and improved fleet utilization rates above 50%, margins are likely to improve in FY25.

e) Significant Capital Expenditure

In the past five years, capital expenditure hovered at S$30-40m, which was around the depreciation level.

In FY24, Tiong Woon spent S$63 million on capital expenditure—higher than usual—indicating management's optimism about future growth opportunities.

f) Rising ICI100 Ranking

Tiong Woon climbed four spots to rank #15 in the ICI100 survey of world's largest crane-owning companies, just behind Singapore-peer Tat Hong.

g) Under-researched with High Potential Returns

UOB Kayhian is the only broker with an active coverage of this stock.

UOBKH has shaved its forecast FY25/26F revenue by around 11%. FY25/26F net profit estimates were reduced by 5% and 7% respectively.

The broker cited the possibility that project delays may persist.

It has a buy call on Tiong Woon with a slightly reduced target price of $0.870 (from $0.900). It forecasts a total potential return of approximately 68% for Tiong Woon, inclusive of dividends of $0.0185 / share.

h) Positive Chart Breakout

Tiong Woon's stock recently breached $0.510 with increased volume and positive technical indicators suggesting upward momentum.

i) Attractive Valuations

Trading at about 6.3x FY25F P/E and 0.38x FY25F P/BV with an estimated dividend yield of around 3.6%, Tiong Woon appears attractively valued.

According to Shareinvestor, Tiong Woon’s NAV / share stands at S$1.33.

Risks

- Business Risks: Cost escalations, project delays, labor shortages, macroeconomic slowdowns, forex volatility.

Tiong Woon has been in the business for more than 45 years. It has an enviable track record of growing its net margin, return on equity and dividend per share since 2019 which is a testament of management’s capability. - Lack of Analyst Coverage: Limited information may hinder investment decisions but also offers potential for price discovery.

- Illiquidity: Thin trading volumes may affect chart interpretations and ease of transactions. As of 18 Oct, average 30-day volume traded is only 205K shares per day.

- Potential Value Trap: Persistent low valuations despite efforts to engage the investment community.

Bloomberg data shows that the stock's average 10-year P/E and P/BV are 15.3x and 0.3x respectively. Average 5-year P/E and P/BV are 14.6x and 0.4x respectively.

Conclusion

While there are risks such as illiquidity and insufficient information, Tiong Woon’s strong track record in profitability growth and dividends suggests it may be worth closer examination for investors seeking opportunities in this sector. Ernest Lim, CFA, CA (Singapore)For more information or specific advice tailored to your situation, consult a financial advisor or banker.

Ernest Lim, CFA, CA (Singapore)For more information or specific advice tailored to your situation, consult a financial advisor or banker.

For a more complete picture, refer to Tiong Woon’s analyst reports; SGX website and Tiong Woon’s corporate website.

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information.

Readers who wish to be notified of my write-ups and / or informative emails, you can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, I can be reached at

P.S: I am vested in Tiong Woon.

Please refer to the disclaimer.