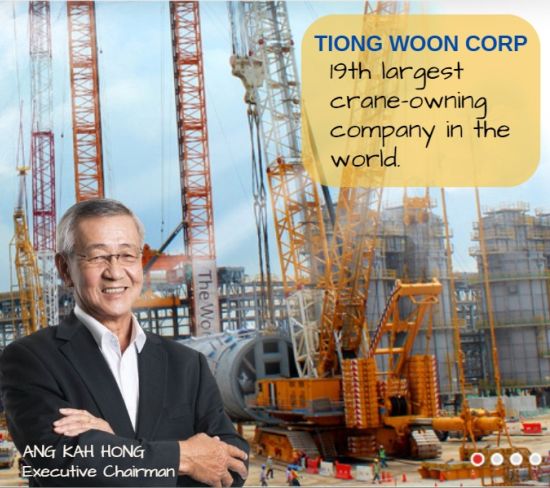

| • Next year (2024) will be the 25th anniversary of the listing of Tiong Woon Corporation, a rare longevity for a listco on the Singapore Exchange. It's particularly notable for a construction-related company as the stiff competition and generally lower profit margins within the industry make the survival odds relatively low. • But Tiong Woon is not entirely dependent on the construction industry --- it also serves oil & gas and petrochemical clients. All in, Tiong Woon has been around for more than 45 years, providing services relating to Heavy Lift and Haulage, Marine Transportation and Inland Transportation. • It's a business with high barriers to entry given the requirements such as a robust safety and operating track record, and high levels of engineering know-how. • In a notable move, Tiong Woon has just announced a strategic tie-up with a global peer whose origin traces back over 200 years. Read Lim & Tan Securities' note to clients on this below .... |

By Lim & Tan Securities

Tiong Woon Corporation / TWC ($0.455, unchanged) has announced that it will form a strategic alliance with Mammoet Asia Holding B.V. to expand its footprint in Thailand, enhance the Group’s ability to cater to the evolving needs of existing customers in the region, and significantly broaden its service offerings to existing as well as new customers, particularly within the heavy lift and haulage market in Thailand.

The collaboration will also place both the Group and Mammoet in a stronger position to offer, tender, negotiate, and provide best-in-class solutions in projects in Thailand involving both the Group and Mammoet’s respective capabilities.

In a significant move aimed at fortifying its position in the transportation and heavy haulage industry in Thailand, the Group announced the acquisition of various assets from Mammoet, including transportation, heavy haulage, and heavy lifting equipment.

This strategic investment marks a pivotal moment in the Company’s growth trajectory, empowering the Group to expand and enhance our services throughout Thailand.

The acquired equipment will position and enable the Group to undertake new, larger, and more complex projects for existing and new customers, further solidifying the Group’s reputation as a go-to partner for high-value, complex and challenging heavy lift and haulage solutions in Thailand and the region.

Mr Ang Guan Hwa, Executive Director, and Chief Executive Officer, said: “We are excited about the opportunities this strategic alliance and asset acquisition with Mammoet in Thailand brings to our organisation and our customers. This is yet another chapter in the Group’s growth story in the right direction. We will be positioned to deliver a wider suite of exceptional services to our customers.

"The investment also underscores our commitment to meeting the evolving needs of our customers and partners, and our vision for the Group as the market leader in high-value, large, complex heavy lift and haulage solutions in Thailand and the broader region. We believe that this broadening of our strategic partnership with Mammoet in the Asia Pacific region augurs well for further growth in the region.”

TWC’s market cap stands at $105.7mln and currently trades at 5.6x forward PE and 0.4x PB, with a dividend yield of 2.2%.

We think this is a great achievement as it shows once again that TWC can and has successfully competed head to head with the titans of the heavy lift industry. We continue to be positive on TWC given the continued upswing in the petrochemical and construction sectors within the region but yet still trading at significantly undervalued levels. We continue to maintain a BUY on TWC with a target price is $0.88, representing 93.4% upside to current share price. |

||||