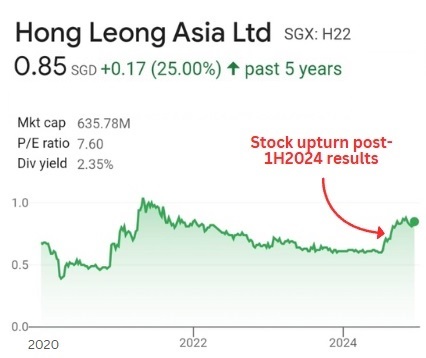

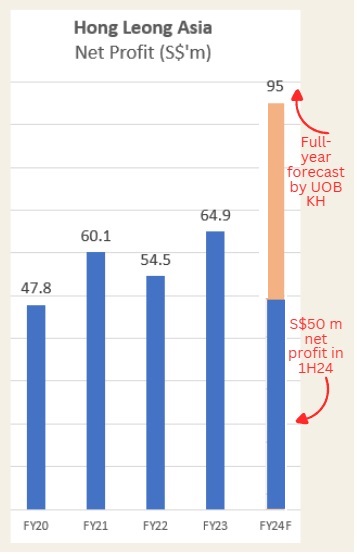

• Hong Leong Asia hasn't been covered widely by analysts. Maybe its business needs some introduction (see below). Still, its stock price has done well post-1H2024 results, rising from 60 cents to 85 cents. This was likely catalysed by a +61% jump in net profit to S$50 million.  From the chart, you can see 2021 was its best year. That year, its key China business, China Yuchai, sold more diesel engines for various applications, including trucks and industrial and marine. The secondary core segment, the building materials unit (BMU), also did well with a rise in demand for its concrete and related products in Singapore. The graphic below depicts the 2 key business segments:  • Hong Leong Asia had cash of S$1.3 billion as of end-1H2024 but S$983. 6 million in short- and long-term borrowings. • We recently excerpted CGS International's report, see "CHINA AVIATION OIL, HONG LEONG ASIA: Broker highlights 2 under-appreciated stocks with +30% upside" Last Friday, UOB Kay Hian put out a report focusing on Hong Leong Asia. Read excerpts below .... |

Excerpts from UOB Kay Hian report

Analysts: Llelleythan Tan & John Cheong

Hong Leong Asia (HLA SP)

| Undervalued Gem Backed By A Strong Positive Outlook |

HLA is set to post strong earnings growth for 2024-26, driven by its two main segments.

|

||||

WHATS’S NEW

• Robust growth and demand. The Building and Construction Authority (BCA) reports that total construction demand is expected to reach S$31b-38b by end-24.

This upward trend is primarily driven by the public sector, with anticipated HDB projects and upcoming infrastructure projects such as the development of Changi Airport Terminal 5, Tuas Port developments, contracts for phase two of the Cross Island Line and expansions to the Integrated Resorts in Marina Bay Sands.

Also, in Malaysia, mega infrastructure projects such as the Penang LRT, Pan Borneo Sabah Phase 1, large-scale flood mitigation projects and Sabah-Sarawak Link Road are expected to help drive market sentiment.

| "As a recap, HLA’s 48%-owned subsidiary, China Yuchai International Limited (China Yuchai, CYD US, non-rated) is one of the top diesel engine manufacturers in China, mainly producing heavy-duty/medium-duty/light-duty diesel engines used across various industries." -- UOB KH |

With significant market share in both key markets, a strong pipeline of both public and private sector projects would benefit Hong Leong Asia’s (HLA) building materials unit (BMU) segment, serving as a strong proxy for the construction sector, in our view.

• Diversified and innovative portfolio.

China Yuchai has consistently committed to invest in research and development to develop and improve its existing portfolio in response to new emission standards such as the upcoming China 7 standards and ongoing secular trends such as new energy vehicles (NEV).

Some new energy solutions include electric-continuously variable transmission power-split hybrid powertrain, integrated electric drive axle powertrain and hydrogen fuel cell systems.

Moving forward, we expect new product designs and growing segments like NEV to help drive engine sales.

• Favourable regulatory tailwinds. In Jul 24, in a bid to boost domestic consumption and spur economic recovery, China’s National Development and Reform Commission announced a Rmb300b stimulus programme to encourage businesses and consumers to scrap old vehicles and equipment and replace them for newer versions.

Subsidies for purchasing new commercial diesel trucks could reach up to Rmb80,000, which forms the main bulk of China Yuchai’s diesel engine portfolio.

With the stricter China 7 emission standards also expected to be published in the medium term, we expect China Yuchai to benefit from these tailwinds which would drive engine sales in 2025 and beyond.

STOCK IMPACT

• Expect robust earnings growth as construction activities recover. With a strong pipeline of projects, we expect the BMU segment to outperform moving forward, in tandem with the sector recovery.  HLA’s wholly-owned subsidiary in Malaysia, Tasek, specifically outperformed in 2023 and 1H24, driven by higher sales volumes and ASPs.

HLA’s wholly-owned subsidiary in Malaysia, Tasek, specifically outperformed in 2023 and 1H24, driven by higher sales volumes and ASPs.

Its Singapore operations are also expected to benefit from higher HDB sales and mega infrastructure public projects starting in 2025.

Based on our estimates, we expect the building materials segment to clock in revenue and EBITDA CAGR growths of 6.0% yoy and 13.2% yoy for 2024-26 respectively.

• Earnings recovery. Based on our estimates, we expect China Yuchai’s earnings to grow in 2024-26 on the back of the favourable regulatory policy coupled with new segments such as NEV driving growth.

Coming off a COVID-19 low in 2023, we estimate that unit sales in 2024- 26 would grow by around 5-8% yoy.

As a result, we expect 2024-26 segmental revenue and EBITDA to grow at CAGRs of 4.9% yoy and 12.6% yoy respectively.

EARNINGS REVISION/RISK

• Expect robust earnings growth in 2024. Given the strong expected growth for both the BMU segment and China Yuchai, we expect HLA’s PATMI to grow by 46.5% yoy for 2024 and 14.9% yoy for 2025 respectively.

HLA is also implementing costs efficiency initiatives that would help support and expand margins.

We now forecast 2024-26 PATMI at S$95.0m, S$109.2m and S$122.2m respectively.

• Risks include:

| a) labour crunch in the construction industry; b) slower-than-expected recovery in demand for building materials; and c) economic slowdown which could result in lower demand for diesel engines. |

|

Full report here