• A couple of construction stocks are hitting the 'buy' list of analysts. Mundane as they may sound, these businesses have done pretty well and some investors recognise the industry upcycle. • Consider some mega projects:

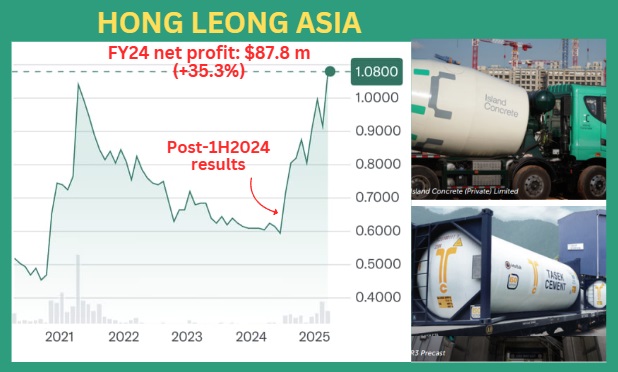

• The Building and Construction Authority projects total construction demand in 2025 at S$47 - S$53b, a sharp increase from S$44.2b in 2024. • This robust demand will benefit the entire construction supply chain. One player -- Hong Leong Asia -- was named in a new report by UOB Kay Hian, which raised its target price for the stock from $1.11 to $1.46.  • The graphic above depicts the 2 key business segments:

• Aside from strong earnings growth, UOB KH is forecasting Hong Leong Asia's FY25 NAV/Share will reach $1.46, and FY25 net cash/share at $0.95. • Read more below .... |

Excerpts from UOB Kay Hian report

Analysts: Llelleythan Tan Yi Rong & Heidi Mo

Hong Leong Asia (HLA SP)

Attractive Valuations Despite Recent Rise In Share Price Performance

| HLA is set to post strong earnings growth for 2025-27, driven by its two main business segments. With a significant market share across its key markets, the building materials segment faces a robust pipeline of mega infrastructure and HDB projects. The diesel engine segment also faces strong volume growth across new markets. In our view, HLA remains undervalued given the positive outlook for its businesses. Maintain BUY with a higher SOTP-based target price of S$1.46. |

• Expect robust earnings growth. Given the strong expected growth for both the BMU segment and China Yuchai, we expect HLA’s PATMI to grow by 23.0% yoy for 2025 and 11.9% yoy for 2026 respectively.

|

Hong Leong Asia |

|

|

Share price: |

Target: |

HLA is also implementing cost efficiency initiatives that would help support and expand margins moving forward.

We forecast 2025-27 PATMI at S$79.4m, S$88.8m and S$102.4m respectively.

EARNINGS REVISION/RISK

• Earnings revision: None.

• Maintain BUY with a higher SOTP-based target price of S$1.46 (S$1.11 previously), valuing the BMU and diesel engine segments at S$854m (6.4x 2025F EV/EBITDA multiple) and S$769m (6.0x 2025F EV/EBITDA multiple) respectively.  Llelleythan Tan, analystThe increase in target price is due to a higher market valuation for its stake in BRC Asia along with a higher EV/EBITDA multiple used for the BMU segment (4.0x 2025F EV/EBITDA multiple previously), given the robust outlook for the construction sector. Llelleythan Tan, analystThe increase in target price is due to a higher market valuation for its stake in BRC Asia along with a higher EV/EBITDA multiple used for the BMU segment (4.0x 2025F EV/EBITDA multiple previously), given the robust outlook for the construction sector.• With HLA’s current market cap at around S$763m, we still think that HLA remains undervalued, specifically its BMU segment which is currently being neglected by the market, in our view. |

SHARE PRICE CATALYST

• Earnings surprise from better-than-expected engine and building materials sales.

• Better-than-expected dividend.

Full report here.