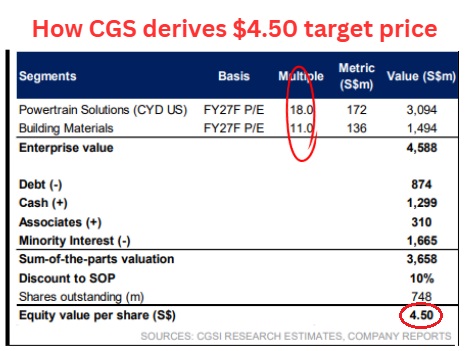

• Hong Leong Asia ($3.50) has been on a tear — up about 260% over the past year — thanks to excitement around the Singapore construction theme. The stock might not be done yet. Another analyst just raised her target price, highlighting the growing value of China Yuchai, Hong Leong Asia’s subsidiary known for its powertrain solutions. Interestingly, China Yuchai plans to IPO an indirect subsidiary that’s tapping into the data centre trend — another hot area for investors. • CGS International has lifted its target price for Hong Leong Asia (market cap: S$2.6 billion) to $4.50, topping UOB Kay Hian’s new estimate of $4.20. Both brokers are using a Sum-of-the-Parts (SOTP) valuation, which basically means they’re valuing each business unit separately, then adding them up to get the total value of the company Here are CGS' numbers:  • Previously, the CGS analyst valued this segment at 15x PE but now it's 18X "in line with regional DC (data centre) engine makers and DC component providers/DC-related plays." Read more below .... |

Excerpts from CGS report

Analyst: Natalie Ong

■ We see stronger yoy 2H25F PATMI growth driven by robust engine sales and Singapore building materials (BM) revenue growth and margin expansion.

■ We see multiple drivers for HLA: multi-year Singapore construction upcycle, secular demand for data centres, higher China domestic engine sales/export. |

|||||

| 2H25F preview: Firing on all cylinders |

Hong Leong Asia (HLA) will announce its 2H25F/FY25F results on 25 Feb after market close.

We estimate 2H25F revenue was S$2.63bn (+31.8% yoy), driven by strong growth in the building materials (BM) segment (+30.0% yoy) and powertrains segment (+32.3% yoy), while core PATMI was S$52m (+53.1% yoy, +3.7% hoh), underpinned by higher sales of high horsepower (HHP) engines, lifting blended ASPs (+3% yoy), with BM margin of 15.5% (from 14.6% in 2H24) on better volume and ASPs.

This should bring FY25F revenue and core PATMI to S$5.46bn (+28.5% yoy) and S$114.2m (+36% yoy), respectively.

| Pegging China Yuchai (CYD) to higher P/E multiple |

HHP engines used in data centres (DCs) and marine applications are sold through CYD’s 71.41%-indirectly-owned subsidiary, Guangxi Yuchai Marine and Genset Power (MGP).

Based on our estimates, MGP accounted for a significant 29%/33% of CYD’s gross profit in FY23/24.

We previously valued CYD at FY26F P/E of 15x, a c.50% premium over its vehicle engine manufacturer peers’ average of 10x, given CYD’s

1) c.20-30% share in China’s HHP/DC generator engine market, and

2) above-industry sales volume growth, supported by indirect exports.

However, as MGP is the largest power generator engine provider and second largest marine engine provider in China (2024 sales revenue) and HHP engines account for 38-42% of CYD’s FY25F-27F PAT, we roll forward our estimates and now peg CYD to 18x FY27F P/E, in line with regional DC engine makers and DC component providers/DC-related plays, raising our TP to US$65.

| Singapore construction pipeline lifts FY26/27F BM topline |

We believe HLA's BM FY26/27F PAT of S$120m/S$136m will remain robust against the backdrop of Singapore’s extended construction upcycle.

We think earnings for ready-mix concrete (RMC) players will likely peak in FY27-28F, uplifted by multiple mega projects in the pipeline, namely Changi T5 and Marina Bay Sands (MBS) Integrated Resort 2, as well as a robust public housing pipeline (more than 35,000 new units in 2026 and 2027).

We retain our Add rating on HLA and raise our SOP-based TP to S$4.50 as we roll forward to higher FY27F EPS, with the powertrain segment now pegged to 18x P/E (previously 15x), in line with regional DC plays, and the BM segment still pegged to 11x P/E (10-year average).  Natalie Ong, analystRe-rating catalysts: stronger CYD sales volumes. Natalie Ong, analystRe-rating catalysts: stronger CYD sales volumes. Downside risks: slower economic recovery in China dampening CYD’s volume growth, and delays in the award of key infrastructure projects in Malaysia. |

→ See the CGS report here.

→ See the CGS report here.

→ See also: HONG LEONG ASIA: Beyond Construction, How Data Centres Are Fueling Its Growth Engine