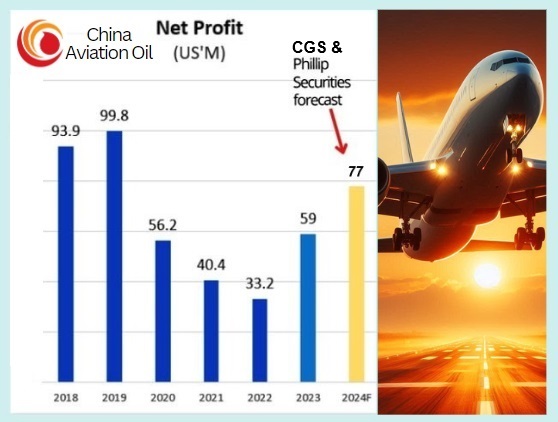

• There are 2 Cs that are coming back: China and construction. Well, actually they are not related -- Chinese people are travelling more and the construction industry in Singapore and Malaysia are in an upcycle.  There are 2 stocks related to the 2Cs which look under-appreciated but each has upside of ~30%, according to CGS-International in a recent report. There are 2 stocks related to the 2Cs which look under-appreciated but each has upside of ~30%, according to CGS-International in a recent report. Interestingly, the report delved into industry efforts to "make the Singapore market great again" as well as pointed to a bunch of value stocks. • First was China Aviation Oil, which is experiencing tailwinds in the form of higher Chinese travel. It has a cash-rich balance sheet that can translate into higher dividends. Moreover, there's a push from the Chinese government for its listed state-owned enterprises to return excess capital to shareholders through higher dividend payouts. • CAO staged a recovery in profit in 2023 and is set to extend the trend in 2024, according to analysts (see chart).  CAO stock currently trades at 4X PE after excluding its large cash balance. CAO stock currently trades at 4X PE after excluding its large cash balance.• The second stock highlighted by CGS was Hong Leong Asia. As part of the Hong Leong Group, HLA has 2 core businesses: Powertrains and Building Materials. • Read more what CGS says below.... |

|

• CAO also markets jet fuel to airports outside China, and engages in international trading of jet fuel and other oil products, as well as carbon credits. |

Excerpts from CGS International's report

We think CAO is set for a healthy earnings recovery trajectory over the coming quarters, backed by further outbound traffic recovery in China and increasing focus on higher-margin jet fuel transactions.

We like CAO as an undervalued play on China’s outbound traffic recovery, and lacklustre YTD share price performance has yet to price this in, resulting in undemanding valuations (7x CY25F P/E) which do not sufficiently reflect the group’s earnings recovery story ahead, we think. |

|||||

In addition to earnings, we believe dividends could remain elevated in FY24-25F.

CAO has historically maintained a dividend payout ratio of c.30%, in line with its official dividend policy; we believe CAO could potentially announce special dividends in FY24F (similar to FY23) in view of its solid earnings growth, which translates into an elevated payout ratio of c.40%.

In its latest results, CAO’s 1H24 core PATMI was a beat at US$42m (+61% hoh, +115% yoy), driven by elevated GPM (+0.15% pts yoy) from higher-margin jet fuel transactions and strong trading volume recovery.

International outbound flights from China have recovered to c.85% of pre-Covid19 levels as at end-Sep 2024 (vs. c.77% at start of Jan 2024).

| "Net cash also remains solid at US$353m as at August 2024 (c.55% of current market cap)." |

We expect further recovery in outbound China flight traffic to directly drive gross profit (core jet fuel business) and associate profit growth (via 33%-owned refueling associate based at Shanghai Pudong International Airport).

Our TP of S$1.20 is based on 9.5x CY25F P/E (2010-19 average).

Re-rating catalysts include a strong recovery in outbound China flight volumes, strong and sustained GPM improvement, and favourable government policies spurring travel demand.

Key downside risks include a global economic slowdown impacting China outbound flight volumes, and gross profit margin weakness from inability to source and execute higher-margin transactions.

| Hong Leong Asia (HLA SP, Add, TP: S$1.20) We believe Hong Leong Asia is an underappreciated proxy for the Singapore and Malaysia construction industry upcycle. Excluding listed subsidiaries/associates, HLA’s building materials unit segment (c.60% of 1H24 PATMI before corporate costs) has an implied valuation of S$172m (2x 12M-trailing P/E), based on latest market cap.  We also note a slew of corporate actions by Hong Leong Asia to improve shareholder value YTD, including

We see potential for MGP to pursue an IPO in the next 5 years. An independent valuation by Zhongming Valuer as at Dec 2023 estimated MGP’s fair value at c.Rmb2bn. As at end-FY23, MGP had a net asset value of Rmb1.3bn, vs. CYD’s Rmb12bn. For its latest results, Hong Leong Asia beat expectations by delivering 1H24 PATMI of S$50m (+61% yoy), which formed 66% of our FY24F forecasts. Both HLA’s core segments performed strongly in 1H24, with yoy PAT growth of 29% at its powertrain solutions segment and 35% at building materials segment. Reiterate Add on HLA as we expect strong PATMI growth in FY24F as HLA fires on all cylinders, benefiting from stronger construction activity levels and volume recovery of its diesel engine unit, with an SOP-based TP of S$1.20. |

Full report here.