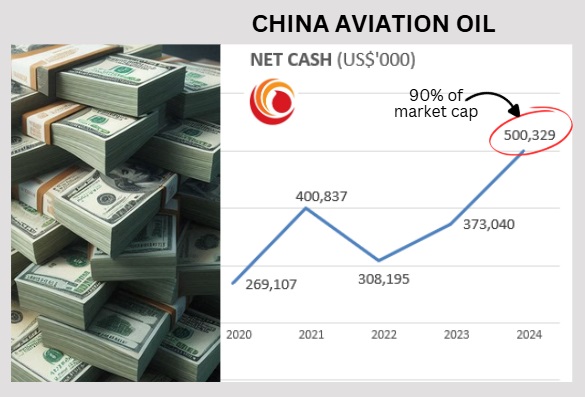

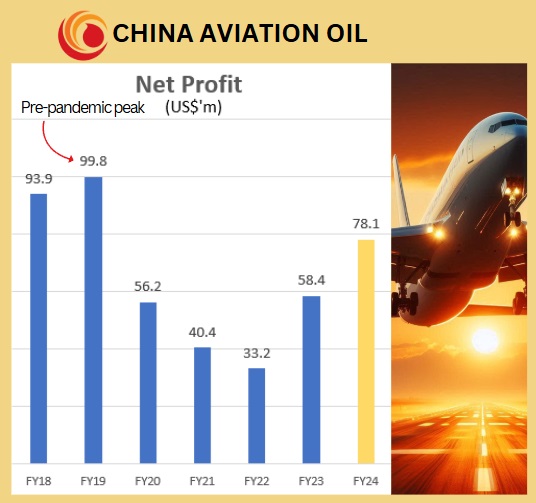

• Singapore-listed China Aviation Oil (CAO) delivered US$78.1 million earnings for 2024 which was 33.8% higher than the year before. It exceeded analysts' forecasts but not significantly. • As jet fuel supply is a core business via its 33% stake in fuel supplier SPIA, CAO has been benefitting from the recovery of domestic and international air travel in China post-pandemic. This is reflected in the 51% jump in share of results from associates to USD45.9 million.  CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou. CAO is the largest purchaser of jet fuel in the Asia Pacific region and accounts for more than 90% of the PRC's jet fuel imports. CAO supplies to the three key Chinese international airports -- in Beijing, Shanghai and Guangzhou.• CAO surprised, however, in amassing a cashpile of US$500 million by end-2024, up from US$373 million a year earlier. Net cash generated from operating activities was US$121.4 million (+55% y-o-y). CAO said this was "mainly attributable to the decrease in inventories and lower utilisation of working capital for trading."  • When you look at the company's current market value of S$740 million (US$555 million, stock price 86 SGD cents) and subtract all that cash, the actual business is valued at only US$55 million. That's low for a company that just made US$78.1 million in profit. That translates into an ex-cash PE of less than 1. • Wait, there's a downside risk to point out -- it has to do with CAO's trading of oil products, a business that is high volume and low margin. CAO reported losses for its 2H24 "other oil products" trading segment. It explains why total 2H gross profit was US$17.68 million, a 27% drop compared to 1H24. That 2H trading loss was also why pre-result speculation for a high 2024 total profit didn't pan out (See: CHINA AVIATION OIL: Fueling Profits: Why This Company Might Beat Analysts’ Forecasts). • Bottomline: SPIA's contribution is on an uptrend with Chinese aviation growth, while oil trading risks pose uncertainty on their impact to CAO. For more, read what OCBC Investment Research says below ... |

Excerpts from OCBC Investment Research report

Analyst: Ada Lim

|

Comfortable growth |

Investment thesis

China Aviation Oil (CAO) is the largest physical jet fuel trader in the Asia Pacific (APAC) region, with Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA) being its crown jewel.

A key supplier of imported jet fuel in the civil aviation industry in the People’s Republic of China (PRC), CAO is a strong proxy to the growing Chinese aviation industry.

|

CHINA AVIATION OIL |

|

|

Share price: |

Fair value: |

Although CAO’s post-pandemic recovery has been gradual due to lacklustre Chinese outbound travel momentum, we think it is well positioned to capture long-term growth in jet fuel demand, given:

| i) its entrenched presence in China and status as a market leader in the region; and (ii) the increasing affluence of the APAC region and burgeoning middle class in China. |

Coupled with a strong net cash position to support the pursuit of inorganic growth opportunities, this makes CAO an attractive multi-year investment story.

• … surpassing our expectations – Altogether, FY24 revenue and net income came in 5% and 6.5% above our full year forecasts, respectively, on higher-than-expected volumes.

The company has proposed an ordinary dividend of 3.72 Singapore cents per share, representing a constant dividend payout ratio of 30%.

Without taking into consideration the special one-off cash dividend of 2.34 Singapore cents, which was paid out in FY23 in commemoration of CAO’s 30th year of establishment in Singapore, FY24 dividend is 37.3% higher year-on-year (YoY), reflecting the company’s improved financial performance.

• CAO maintains a healthy debt-free position and ended FY24 with USD500m worth of cash – We continue to see potential for the company to deploy cash either to acquire new, synergistic oil-related business assets, or to expand its current operations in a manner that will be accretive to the company’s earnings, though we note that progress on this front has been slow in the past two years.

Management has also expressed an interest in opportunities related to sustainable aviation fuel (SAF).

The company seems inclined to maintain a stable dividend payout ratio of 30%, in our view, and there does not appear to be plans to conduct share buybacks.

China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.• Maintain FV estimate of SGD1.10 – Management is “cautiously optimistic” of the company’s FY25 outlook. The International Air Transport Association (IATA) is forecasting total revenues from the global airline industry to surpass USD1t to reach record highs this year, driven by greater passenger traffic and more flights; in particular, China is expected to account for more than 40% of APAC’s aviation traffic. China National Aviation Fuel Group (“CNAF”) is the controlling shareholder of CAO with its 51.31% stake. A state-owned enterprise, CNAF is the largest aviation transportation logistics services provider in the PRC, providing refuelling services at over 200 airports in China. CAO is CNAF's key overseas subsidiary and platform for international aviation fuel trading and procurement to support China's civil aviation industry. Photo: CAO.• Maintain FV estimate of SGD1.10 – Management is “cautiously optimistic” of the company’s FY25 outlook. The International Air Transport Association (IATA) is forecasting total revenues from the global airline industry to surpass USD1t to reach record highs this year, driven by greater passenger traffic and more flights; in particular, China is expected to account for more than 40% of APAC’s aviation traffic. Meanwhile, international flights from China have recovered to 84% of pre-pandemic levels, according to data from the Civil Aviation Administration of China (CAAC), and passenger volumes are expected to further recover to 780m (i.e. 90% of pre-pandemic levels) in 2025. This is expected to improve refuelling volumes at SPIA, though this may be (partially) offset by a more pronounced decline in jet fuel prices. All things considered, we roll forward our valuations, and maintain our FV estimate of SGD1.10. |