A China Aviation Oil shareholder contributed this article.

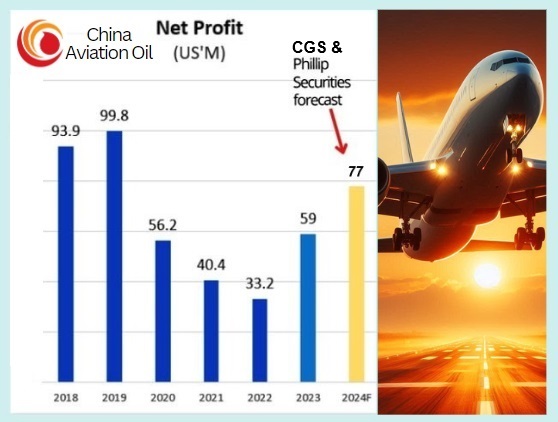

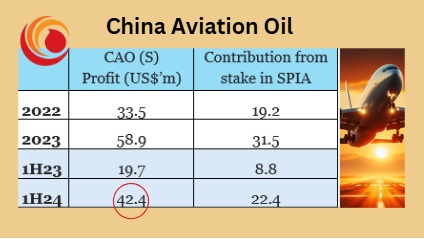

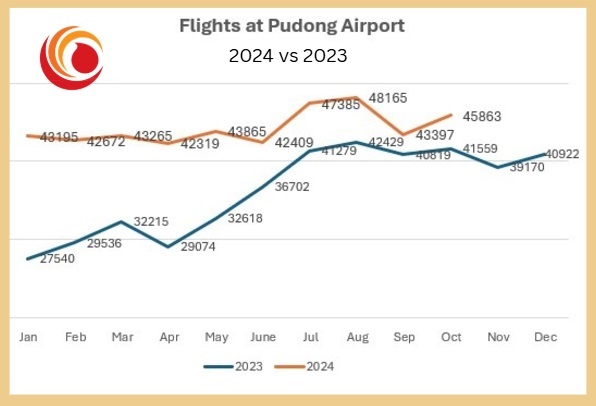

| For investors and analysts keeping an eye on China Aviation Oil (Singapore), there are plenty of reasons to be optimistic. The Singapore-listed company’s solid stake in SPIA gives it direct exposure to one of China’s busiest airports at a time when global travel is bouncing back. With flight volumes in 2024 expected to exceed 2023 and perhaps even pre-COVID levels, and with international travel continuing its upward trajectory, CAO is well-positioned for growth. Keep an eye out for these trends to unfold—especially given that SPIA's profitability directly influences CAO's bottom line. Already, analysts are forecasting US$77 million profit for FY24 (see chart).  Profit attributable to shareholders in 1H2024 = US$42.4 million. Profit attributable to shareholders in 1H2024 = US$42.4 million. |

Positioned for Growth as Aviation Recovers  CAO's primary business revolves around trading and supplying jet fuel to airlines.

CAO's primary business revolves around trading and supplying jet fuel to airlines.

CAO owns 33% of Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA).

SPIA is responsible for refueling all planes departing from Pudong Airport, one of China’s busiest hubs for international travel.

SPIA’s two other shareholders are Sinopec and Shanghai Pudong International Airport Company (SPIAC), which owns and operates Pudong Airport.

Key Profit Driver: SPIA

SPIA has been a significant contributor to CAO's bottom line.

In 2019, before the COVID-19 pandemic disrupted air travel, SPIA contributed USD 58.8 million to CAO’s total profit of USD 99.8 million—or nearly 60% of its earnings.

However, like many companies tied to the aviation sector, CAO faced challenges during the pandemic as flight volumes at Pudong Airport plummeted due to travel restrictions.

Things started looking up when China lifted its zero-COVID policy in early 2023.

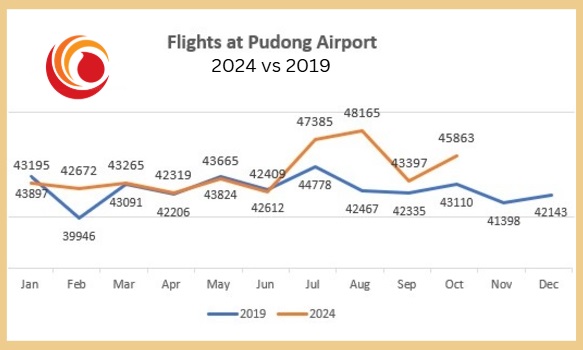

Still, flight activity at Pudong for the whole year 2023 was 15% below pre-pandemic levels (433,863 flights compared to 511,807 in 2019).

Recovery Gaining Momentum in 2024

Flight numbers from January-June 2024 were looking up -- 1% higher than the same period in 2019, according to filings submitted to the Shanghai Stock Exchange (e.g., monthly data from Shanghai International Airport Co., Ltd.).

The pace picked up even more in the July-October 2024 period:

- + 7% compared to the same period in 2019

|

1H |

2H |

Jul – Oct |

|

|

2019 |

255,689 |

256,118 |

172,690 |

|

2024 |

257,724 |

n.a. |

184,810 |

|

Change |

1% |

n.a. |

7% |

If the uptrend continues for the rest of the year, a recovery above the pre-COVID levels is likely (see chart above).

- +11% compared to the same period in 2023.

|

1H |

2H |

Jul – Oct |

|

|

2023 |

187,685 |

246,178 |

166,086 |

|

2024 |

257,724 |

n.a. |

184,810 |

|

Change |

37% |

n.a. |

11% |

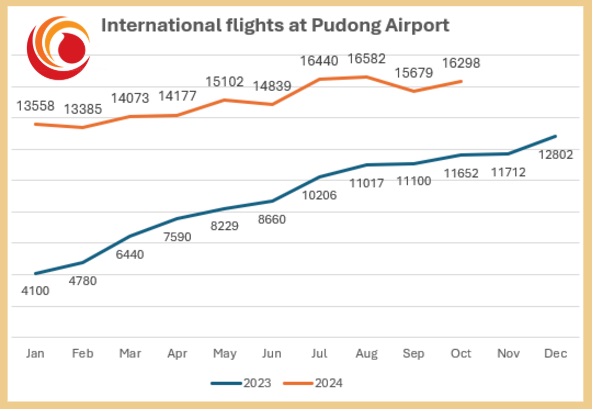

One key factor driving this recovery is the surge in international flights, especially after China relaxed its visa policies.

International flights typically consume more jet fuel than domestic ones, which means SPIA—and therefore CAO—stands to benefit significantly as global travel picks up.

|

Intl. flights |

1H |

2H |

Jul – Oct |

|

2023 |

39,799 |

68,489 |

43,975 |

|

2024 |

85,134 |

n.a. |

64,999 |

|

Change |

114% |

n.a. |

48% |