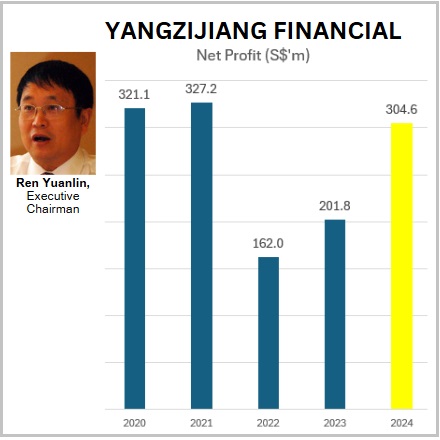

• A star performer so far in 2025 is Yangzijiang Financial (YZJF), which was ignored by the market for the better part of the past 2 years, until 4Q2024. • Born from a strategic spin-off in 2022, the stock has surged an impressive 77% year-to-date in 2025. This was driven by YZJF's strong set of FY2024 results: Net profit grew 51%, reaching S$304.6 million. Earnings per share was 8.66 cents.  • YZJF is a Singapore investment company listed on the Singapore Exchange (SGX). It operates as a fund structure, investing in debt and equity securities, with a focus on capital appreciation and investment income. • Following its FY24 results, CGS International (the only local sellside broker covering the stock) said it continued to hold a positive view on the stock, with a higher target price of S$0.66 for the stock. (See: YANGZIJIANG FINANCIAL: From Under the Radar to Center Stage: A Financial Star Rises) • But a Singaporean fund manager, who was a sellside analyst, estimates that YZJF deserves a higher valuation, and contributed his write-up below ... |

|

The Company YZJF was spun off from Yangzijiang Shipbuilding (YZJS), a leading shipbuilding company in China, in 2022.

It is progressively reducing its weightage in China while increasing investments in maritime-related investments and credit funds in Southeast Asia, particularly Singapore. |

||||

Why does a mispricing of the stock exist?

1. Negative sentiment towards Chinese investments due to economic and geopolitical reasons.

2. Spinoff listings typically suffer from:

| (1) heavy selling by shareholders (especially institutional investors) whose mandate prohibits them from holding a business different from its mother company (2) a lack of understanding of the business. |

Concerns on its China investments are well allayed

CEO/Chairman Ren Yuanlin is not particularly concerned with the Non-Performing Loans as he can sell collaterised assets such as land.

YZJF ensures that its debt investments are well-collateralized with a loan-to-value ratio of approximately 50%. For discussion sake, assume its entire China investments go to zero.

For discussion sake, assume its entire China investments go to zero.

Then, its current liquid NTA of $1.17 would stand at $0.76.

The current share price of $0.725 is still at a discount even at such an extremely and unlikely scenario.

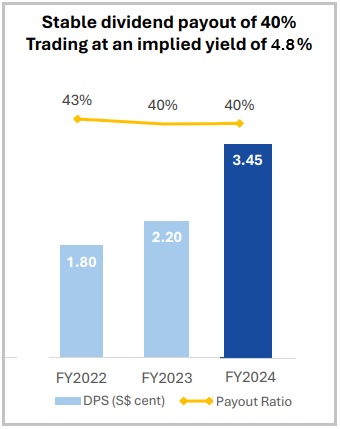

The upcoming 3.45 ct dividend (4.8% yield@$0.725 ) + free optionality on the improving business makes the current price still very attractive.

Positive Share price Catalysts

1. Further improvement on its earnings and dividends driven by reducing its PRC investments and deploying its liquid NTA into higher yielding investments in the 2 segments :

|

• Private Credit - partnering with a unit of Temasek Holdings, Singapore’s state-owned investment company. • More maritime assets - ship chartering, finance leases and loan services. |

The annual cash flow returns for the 2 segments are typically in the range of 10-20%.

In FY24 it only generated ~6.6% operating returns on its NTA as ~45% of its NTA was in lower yielding cash management products.

2. Growing fee income from fund management business managing 3rd party assets.

YZJF is raising a US$600m fund to invest in green vessels.

|

Stock price |

73.5 c |

|

52-week range |

31-74 c |

|

Market cap |

S$2.6 b |

|

PE |

8.2 |

|

Dividend yield |

4.7 |

|

P/B |

0.6 |

|

52-week change |

126% |

Given its entrenched network and deep knowledge in the maritime industry + industry tailwinds, it is highly probable for YZJF to attract investments from institutions who want exposure to this niche sector.

3. Potential Coverage from more sell-side research including bulge bracket ones + More interest from Institutional and retail investors.

The recent surge in price and volume + the positive results + increasing media coverage have generated more interest in the stock.

Currently, there is only 1 active sell-side coverage by CGS International.

Having a relatively large market cap of $2.6 bil and high liquidity will attract a wider range of institutional funds. This makes commercial sense for more sell-side research to initiate coverage.

How to value YZJF?

CEO/ Chairman Ren, who used to helm Yangzijiang Shipbuilding, told the media that YZJF will continue to grow fast and “investors will not be denied the same kind of returns that YZJ Shipping has delivered”.

YZJ Shipbuilding's share price went up by more than 6x from 2020 to 2024. Applying that to YZJF would mean hitting the share price of ~$1.80.

I would approximately value YZJF in the following manner:

|

Basic Valuation

Valuation with Borrowing Now, let's consider what happens if YZJF borrows money to invest:

|

The above calculations don't include the potential value of YZJF's fund management business.

This could add extra value to the share price, based on the fees and performance income it generates.

It is likely to take some time for the NTA to be fully deployed in higher yielding investments and the fund management business to attract 3rd party AUM to generate material fee income.

However, do note that equity pricing is very forward looking + it's common for prices to overshoot on the upside during the bull phase and vice versa.

When the outlook is certain, media+ many analysts singing the consensus tunes, prices would have already priced in a great deal of the positive factors.

The risk-reward ratio by then would be far less attractive.

** My valuation figures are just broad estimates. There are many moving parts in a business + new critical info surfacing + fluctuating market sentiment. However, my valuation approach is pretty mainstream and widely used by sell/buy side analysts. Do your own due diligence.