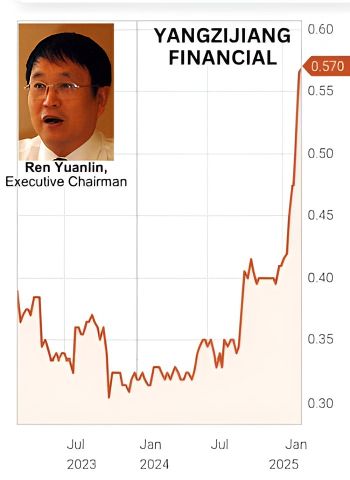

• Yangzijiang Financial Holding (YZJFH) was ignored by the market for the better part of the past 2 years, until 4Q2024. It has since risen from ~40 cents to close to 60 cents -- justifiably. Its 2H2024 profit was a big surge, confirming earlier market readings on how undervalued it was given its net cash equalled its market cap, etc. (See: YANGZIJIANG FINANCIAL: Can It Mirror Yangzijiang Shipbuilding's Rise?)  • Its investment focus is shifting. YZJFH is putting more money into maritime assets and private credit funds in Southeast Asia. • In China's real estate, YZJFH has reduced its debt investments. If China's real estate improves, YZJFH could benefit. • Positive outlook. CGS, in a report, expects YZJFH to do well, with a target price of S$0.66 for its stock. • Read more in excerpts from the report below ... |

CGS analyst: Andrea Choong

| A promising dividend-paying growth stock |

■ 2H24 net profit of S$198m beat our expectations due to strong cash mgmt. and maritime income, impairment reversals, and larger tax rebates.

YZJFH will continue deploying more AUM into its maritime funds in a cautious manner. ■ Reiterate Add with a higher TP of S$0.66. YZJFH guides that the impairments for its debt portfolio are largely completed; we look forward to writebacks. |

||||

| YZJFH’s 2H24 net profit ahead of our expectations |

Yangzijiang Financial Holdings (YZJFH) reported 2H24 net profit of S$198m (+76% hoh, +392% yoy), beating our S$61m estimate.

In tandem, FY24 net profit of S$310m was ahead of our S$173m forecast.

The beat was due to a combination of

| i) stronger non-II (non-investment income) on the back of increased contributions from cash management activities and (maritime) fund investments, ii) unrealised fair value gains from Singapore fund investments, iii) writeback in allowances for debt investments fully repaid during the year, and iv) higher tax rebates in China. |

YZJFH declared a final DPS of 3.45Scts for FY24 (FY23: 2.25Scts).

| Impairments for its debt portfolio largely provided for |

YZJFH had reduced its debt investment portfolio in China to c.29% of its total asset under management (AUM), or c.S$1.2bn, as at end-2H24, ahead of its medium-term (c.3-5 years) c.30% target.

| "Our TP (based on blended P/BV and P/E valuations) rises to S$0.66 as we factor in stronger cash mgmt. and maritime fund income, and mild impairment writebacks, and roll over to FY26F. -- Andrea Choong, analyst |

This resulted in c.S$46m in impairment reversals in 2H24 – a marked departure from hefty allowances in previous periods as operating conditions in China turned challenging.

Notably, YZJFH has been steadfast in reducing these exposures over the past 2 years (c.S$1.5bn cumulatively) while limiting new debt investments (c.S$355m cumulatively).

It guides that the necessary impairments have been taken for its weaker exposures.

While the pace of further recoveries could be lumpy, we are optimistic of lower impairments ahead given the minimal addition of new investments.

| Executing its longer-term target of US$900m in maritime assets |

YZJFH’s longer term investment strategy is to reallocate a portion of its cash management fund (2H24: c.S$1.8bn, 43% of AUM) towards maritime-related investments and private credit funds in SEA.

Towards this end, it targets c.US$900m in maritime-related AUM in the medium term (c.3-5 years; 2H24: US$450m) and deployment will be done cautiously given its investment return threshold of c.8-10%.

|

Full CGS report here.