| Sinarmas Land's controlling shareholder, the Widjaja family, has offered to buy out minority shareholders at 31 cents/share. This is a steep 73.9% discount to Sinarmas Land’s net asset value (NAV) as at Jun 30, 2024, of S$1.19 per share. The discount is glaring, of course. Business Times columnist Ben Paul didn’t hold back in his article published on 31 March (screenshot below). He pointed out how unfair this deal feels, especially after a similar acquisition was done at a premium just months ago by a Widjaja entity.  |

Sinarmas Land is actively involved in developing integrated townships, residential areas, commercial properties, retail spaces, hospitality, and industrial estates. BSD City, one of its flagship projects, is a massive development covering thousands of hectares in Tangerang, Indonesia, designed as a self-sustaining city with residential, commercial, and industrial zones.

Stock trading prices at discounts to NAV are common among public listed property-related companies, and BT cited the cases of Widjaja-related companies.

Sinarmas Land owns stakes in two Jakarta-listed property companies Bumi Serpong Damai and Puradelta Lestari.

The BT article pointed out that these two are currently trading at discounts of 58.3 per cent and 9.1 per cent to their NAVs, respectively.

(Note that the 9.1% discount is pretty tiny).

Now, a third property developer -- Duta Pertiwi -- which is held under Bumi Serpong Damai is trading 42.2 per cent below its NAV.

Certainly in all these cases, there are indeed discounts but they certainly are not as steep as the privatisation offer for Sinarmas Land.

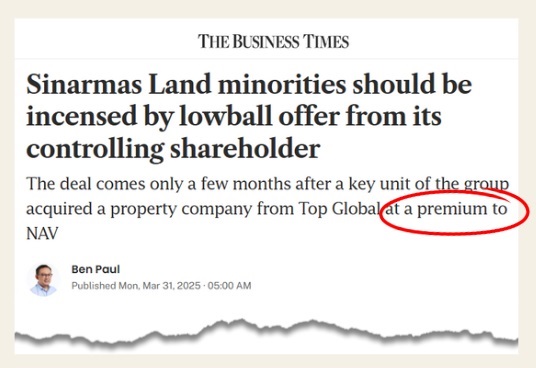

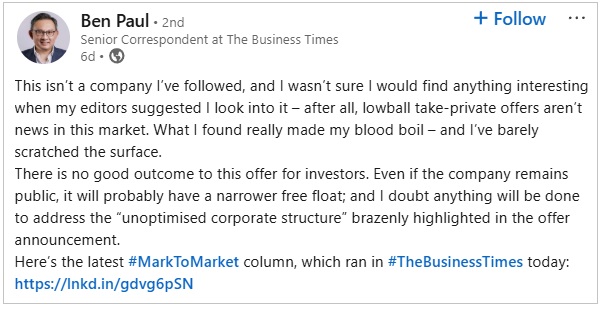

Hence, BT's headline: "Sinarmas Land minorities should be incensed by lowball offer from its controlling shareholder".

The article had a subheadline referring to Bumi Serpong Damai which "acquired a property company from Top Global at a premium to NAV".

That's quite intriguing. Let's break it down:

|

• Bumi Serpong Damai is ~66% owned by Sinarmas Land.

|

Sure, minority shareholders of Sinarmas Land and market watchers are in various degrees of angst at the lowball offer.

If history repeats itself, the offer will be raised.

The Widjajas have made two previous privatisation deals involving SGX-listed companies whose initial offers were upped subsequently:

| • Top Global: The cash offer was 33 cents per share in March 2017. A fresh offer was tabled in August 2021 at 39 cents per share, leading to the privatisation. • Golden Energy and Resources: Initially, in November 2022, the all-cash offer for this coal miner was set at 84.6 cents per share. This was revised in March 2023 to 97.3 cents per share. |

Again, whether a higher offer for Sinarmas Land will come is entirely speculative. There are lots going on in the near term that the market will look out for: the Independent Financial Adviser's opinion on the offer, an EGM to vote on the offer (the Sinarmas Land controlling shareholder can't vote), and even the trading price of the stock.

There are lots going on in the near term that the market will look out for: the Independent Financial Adviser's opinion on the offer, an EGM to vote on the offer (the Sinarmas Land controlling shareholder can't vote), and even the trading price of the stock.

On that last point, the stock traded between 32 and 34 cents on very high volume (11.9 million shares) the first day post-offer (28 March).

If this higher-than-31-cent trading continues, it suggests some shareholders speculate that a higher offer will materialise.

Or some shareholders aim to secure a larger voting stake to block the delisting resolution, which requires at least 75% approval from shareholders present and voting, while no more than 10% of votes can oppose it. Source: LinkedIn

Source: LinkedIn

| In a note to clients last Friday, Lim & Tan Securities said: "This offer values Sinarmas Land at S$1.3bln and valued at 0.4x PB. In view of the cheap take-over offer and that the offer is not final, we advise shareholders to “HOLD” on to their shares and “NOT ACCEPT” their unconditional offer for Sinarmas Land shares." |