MTQ Corporation is facing headwinds because of depressed demand for oilfield engineering services in Singapore, but its subsea segment remains resilient. Photos: Company

MTQ Corporation is facing headwinds because of depressed demand for oilfield engineering services in Singapore, but its subsea segment remains resilient. Photos: Company

Time & date: 10 am, 31 July 2015

Time & date: 10 am, 31 July 2015

Venue: Carlton Hotel

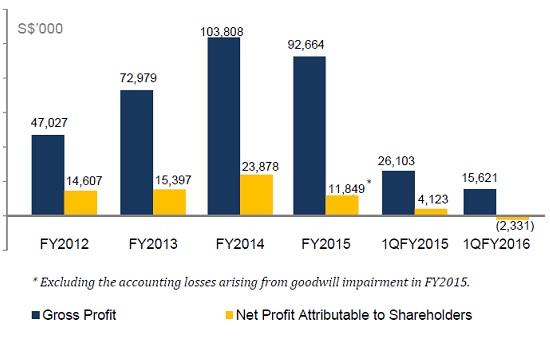

MTQ profit fy2012 -- 1q2016

MTQ profit fy2012 -- 1q2016

AT MTQ Corporation's AGM, the management shed light on how it was coping with headwinds in the oil & gas sector.

Below is a summary of questions raised by shareholders and the replies provided by the management.

Q: How much capex do you need to maintain your asset base?

Kuah Boon Wee (CEO): The gentleman is referring to the depreciation of S$12.6 million in the FY2015 statement of cash flow. We are keeping capex to the minimal, especially in Singapore. Capex will be slightly higher in Bahrain because the activity load there is still reasonable.

We had a capex of S$3.3 million in 1QFY2016. There was some discretionary capex in 1QFY2016 because of ROVs and new premises for Neptune. All that will be reflected in the depreciation expense starting from the second quarter.

I will be looking at maintenance capex of S$2 million to S$2.5 million per quarter. Hopefully, we can do better than that. We have a facility in Bahrain that is into its 6th year and that needs infrastructural maintenance. The numbers are quite small in the overall scheme of things.

Q: What is your outlook of revenue from Bahrain?

Kuah Boon Wee: Revenue continues to grow. We are not immune to yield pressures affecting the whole industry. I expect steady growth and hope to improve profitability for the whole year.

Q: Why was there a severe drop in segment profit from oilfield engineering from S$30 million in FY2014 to S$10 million for FY2015?

Kuah Boon Wee: Oilfield engineering covers a few businesses: Singapore and Bahrain. In FY2015, this segment also included Binder, which has a production facility in Indonesia. It was a tough year for the oilfield engineering business and we had losses from Binder. That pulled down the overall segment result.

Bahrain fared better but its overall contribution was still quite small. Demand from Singapore was weak during the first two quarters of this year, compared to the previous quarters.

The new segment was incurring losses. The existing segment had weaker revenues, and lower contribution. Also, there was significant squeeze on profit margin.

Q: What was the impairment on goodwill of S$6.8 million?

Kuah Kok Kim: 80% of the goodwill impairment was related to the acquisition of Binder. A very small amount was related to engine systems.

Overseas business expansion

|

Q: Is this downturn a structural change that will result in write-downs of the subsidiaries that you acquired (such as Neptune Marine Services and Binder)? Kuah Kok Kim (Chairman): The market will recover and our services will be continually required. But I can be honest with you that we do not see any sign of recovery at the moment. In today’s news, we have Shell sheding headcount because it expects the downturn in oil prices to continue for several years.

There will be those who retire. As with any other organization, we will let go of the less productive people. However, we are mindful that we need to upgrade the skills of our core people. Q: National oil companies are still maintaining their budget, especially in the Middle East. Why are you not expanding your activities there? Kuah Kok Kim: The dominant player in the Middle East is Saudi Arabia. They have not cut back. But, we must bear in mind that there is severe price cutting pressure. What we did for a dollar 2 years ago, the customer is only prepared to pay 70 cents now (July 2015). We need to structure ourselves to be able to cope with these new margins. Q: What about North Africa? Kuah Kok Kim: Countries like Libya, Algeria and Egypt are too far away from us. Our business requires hard assets like machinery near our markets. We are tapping on our contacts in Bahrain to develop business in the Middle East. Kuah Boon Wee: A colleague who was in Nigeria recently discovered that the ROV business has worked in North Africa. You are right to say there are activities in some of those places, where the national oil companies are involved. But as a Group, we have to realize our limitations. A lot of the things that we do require being near to the underlying activity. In this environment, it is not realistic to spend capital expenditure in new markets. We are not at the right stage of the industry cycle. Q: You expanded tremendously in Australia. The Australia economy is not doing well. How has the weakening of the Australian dollar impacted you? Kuah Boon Wee: The Australian business that we bought focused a lot on the offshore LNG development. Much of the subsea services that we provide are in inspection, repair and maintenance. Those activities will remain. One cannot stop maintaining long term assets in this area. Some LNG projects will be put on hold. But there is sufficient activity going on in the sector for us to carry on this work. As the Chairman has said, yield pressure is something that everybody is facing. Kuah Kok Kim: Over the recent years, Australia has embarked on a quite a few offshore projects. Some of these have a capital expenditure budget in the billions. Some of these projects are in the process of being built, projects that cannot be simply kick started or halted and we will have a role to play in these. Projects that have not been started will obviously be put on hold. |

Group CEO Kuah Boon Wee.

Group CEO Kuah Boon Wee.

NextInsight file photoQ: I understand that there is still demand for subsea services in shallow waters, but not in deep waters. Which area are you focused on?

Kuah Boon Wee: I don’t think you can generalize on that.

Because of our focus in Southeast Asia, Australia and the Middle East, we are more into the shallow water activity. We do not have a physical presence in regions with deep water activity such as Brazil, North Sea, Gulf of Mexico and Norway.

Q: Today’s oil prices are US$40 to US$50 a barrel. Is the pessimism as bad as the times when oil price was at US$10?

Kuah Kok Kim: In 1998, oil price was less than US$10 and we were profitable. The market condition that we experienced in 1998 was nowhere as bad as what we are seeing now. I have never seen such a bad market in all my years in the industry.

In recent years, an enormous amount of capital expenditure has been put into new equipment. The market has become saturated for us now.