MTQ Corporation is facing headwinds because of depressed demand for oilfield engineering services in Singapore, but its subsea segment remains resilient. Photos: Company

MTQ Corporation is facing headwinds because of depressed demand for oilfield engineering services in Singapore, but its subsea segment remains resilient. Photos: Company

Time & date: 10 am, 31 July 2015

Time & date: 10 am, 31 July 2015

Venue: Carlton Hotel

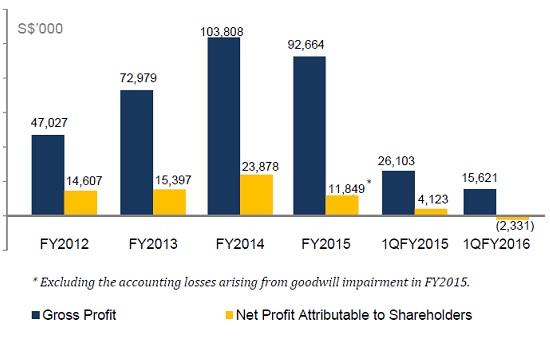

MTQ profit fy2012 -- 1q2016

MTQ profit fy2012 -- 1q2016

AT MTQ Corporation's AGM, the management shed light on how it was coping with headwinds in the oil & gas sector.

Below is a summary of questions raised by shareholders and the replies provided by the management.

Q: How much capex do you need to maintain your asset base?

Kuah Boon Wee (CEO): The gentleman is referring to the depreciation of S$12.6 million in the FY2015 statement of cash flow. We are keeping capex to the minimal, especially in Singapore. Capex will be slightly higher in Bahrain because the activity load there is still reasonable.

We had a capex of S$3.3 million in 1QFY2016. There was some discretionary capex in 1QFY2016 because of ROVs and new premises for Neptune. All that will be reflected in the depreciation expense starting from the second quarter.

I will be looking at maintenance capex of S$2 million to S$2.5 million per quarter. Hopefully, we can do better than that. We have a facility in Bahrain that is into its 6th year and that needs infrastructural maintenance. The numbers are quite small in the overall scheme of things.

Q: What is your outlook of revenue from Bahrain?

Kuah Boon Wee: Revenue continues to grow. We are not immune to yield pressures affecting the whole industry. I expect steady growth and hope to improve profitability for the whole year.

Q: Why was there a severe drop in segment profit from oilfield engineering from S$30 million in FY2014 to S$10 million for FY2015?

Kuah Boon Wee: Oilfield engineering covers a few businesses: Singapore and Bahrain. In FY2015, this segment also included Binder, which has a production facility in Indonesia. It was a tough year for the oilfield engineering business and we had losses from Binder. That pulled down the overall segment result.

Bahrain fared better but its overall contribution was still quite small. Demand from Singapore was weak during the first two quarters of this year, compared to the previous quarters.

The new segment was incurring losses. The existing segment had weaker revenues, and lower contribution. Also, there was significant squeeze on profit margin.

Q: What was the impairment on goodwill of S$6.8 million?

Kuah Kok Kim: 80% of the goodwill impairment was related to the acquisition of Binder. A very small amount was related to engine systems.

You may also be interested in:

|

MTQ: Potential 24% Yield, 72% Upside In 12 Months? |

|

MTQ: Scraps 1HFY2016 interim dividend to conserve cash |

|

MTQ: 1QFY2016 hit by oil & gas slowdown, AUD depreciation |

|

MTQ: High cash flow and yield for long-term investors |

|

MTQ: Dividend yield is 5% but FY2015 earnings hit by impairment |

|

MTQ: Navigating a bearish environment as oil prices fall |