AT MTQ'S 3QFY2015 results telecon with analysts last Friday, Group CEO Kuah Boon Wee explained how the oil & gas solutions player is managing the sudden plunge in oil prices.

"We will focus on maintaining the credit quality of our customers," said Group CEO Kuah Boon Wee.

"We will focus on maintaining the credit quality of our customers," said Group CEO Kuah Boon Wee.

NextInsight file photo"Oil majors have become very cautious over capital expenditure for exploration. Queries for orders have decreased, and the general sentiment has been bearish," said the CEO.

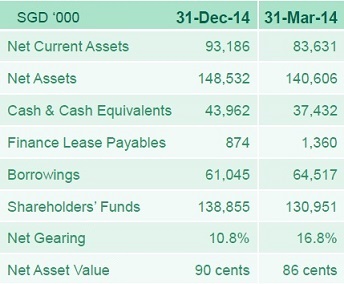

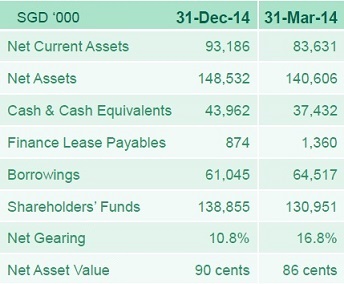

Despite the challenges, MTQ has maintained a strong financial position with higher cash balances and lower net gearing as at 31 December compared to a year ago.

Cash balances increased by 17% to S$44 million, while net gearing declined by 10 percentage points to 10.8%.

MTQ posted revenue of S$74.9 million for 3QFY2015, comparable to 3QFY2014.

Gross profit, however, declined by 14% quarter-on-quarter to S$21.9 million, mainly due to lower gross profit and margins in its Oilfield Engineering business in Singapore and the inclusion of losses from its pipe solutions unit Binder.

Its oilfield services unit, MTQ Bahrain, and subsea services unit, Neptune Marine Services, recorded higher revenues and gross profits.

Lower sales activities were recorded in all the Singapore businesses reflecting the impact of weaker market conditions.

Group profit attributable to equity holders was S$2.2 million, a 66% decline from 3QFY2014.

|

Below is a summary of questions raised at the telecon and answers provided by Mr Kuah and CFO Dominic Siu.

Q: How much profit comes from Singapore?

Improved balance sheetMost of our oilfield engineering revenue comes from Singapore. Historically, Singapore has been a significant part of our business. Improved balance sheetMost of our oilfield engineering revenue comes from Singapore. Historically, Singapore has been a significant part of our business.

Q: Does the oilfield business generate higher margin?

Group margins have been in the low thirties for the first 9 months of FY2015. The engine systems division, being a distribution business, generates margins between 20% and 25%. There is not much difference in margins generated between our oilfield or subsea businesses. It's really about execution and competitive pressures.

We've always been a high-margin business. But when revenue is reduced, fixed cost becomes a higher component.

Q: Have your customers been asking for lower pricing?

Yes, we have received plenty of letters from big and small companies saying that BP has been writing to contractors to ask for lower pricing. So, they would like to see prices come down.

Q: What magnitude of price decrease are they looking at?

CFO Dominic Siu. CFO Dominic Siu.

NextInsight file photoLetters always set up to ask for more. I've seen letters asking for a 25% price reduction. The oil price has dropped more than that. These are immediate responses when the market goes through a phase like what we're facing. The bigger challenge is revenue, not prices. It is the magnitude of the exploration expenditure that I am concerned about.

It's really an environment where I need to think about how I can get my cost down when my selling price has dropped.

Q: What are the areas where you can rationalize your cost?

Our contract workforce can be laid off. There's always been a fair amount of overtime performed by our contract workforce, and that's where we had the most productivity. In this sort of environment, nobody is working any significant amount of overtime at all. We have a significant number of foreign workers in our system. Now, we look carefully at renewals and we can reduce the number of foreign workers immediately if we don't need them.

Our overall labor force has a variable cost component such as bonuses. This sort of thing helps, because we can pare down our cost structure quite quickly.

Neptune Marine Services is rationalizing its property utilization. We will put everybody in one location over the next couple of months. We might have some initial set-up cost, but we want to lower our long term cost.

Q: You have a currency exchange gain. Was it from USD appreciation?

It is from a combination of USD and Aussie dollar appreciation. These are the two currencies the Group has exposure to due to the areas where we have our investments.

|

"We will focus on maintaining the credit quality of our customers," said Group CEO Kuah Boon Wee.

"We will focus on maintaining the credit quality of our customers," said Group CEO Kuah Boon Wee.