@ Dutech's factory in Nantong: Row after row of semi-assembled ATMs. Inside them are safes made by Dutech. One of the world's largest ATM producer, Wincor Nixdorf, used to buy just the safes but has since also directed parts to Dutech to assemble into partial ATMs.

@ Dutech's factory in Nantong: Row after row of semi-assembled ATMs. Inside them are safes made by Dutech. One of the world's largest ATM producer, Wincor Nixdorf, used to buy just the safes but has since also directed parts to Dutech to assemble into partial ATMs.

NextInsight file photo.

DUTECH HOLDINGS -- which manufactures safes for ATMs, offices and homes, gun safes, and gaming machines -- recorded Q4 revenue of 269m RMB, up 18.8% year-on-year.

Surprisingly, Q4 saw a net loss of 6.4m RMB compared to a net gain of 45.2m RMB in 4Q2013.

The full-year FY2014 result: 1.05bn RMB in revenue and 142.7m RMB in net profit, up 2.3% and 42.2% year-on-year, respectively.

The reasons for the Q4 net loss were largely attributed to Deutsche Mechatronics (DTMT), a German company which Dutech acquired in 2H2014.

Consolidation of DTMT into Dutech's P&L, a one-off downward revaluation of DTMT, and currency fluctuations contributed to the Q4 net loss.

Stripping them out, Dutech's core operations and cashflow remain as decent as before.

4Q sales in the High Security segment decreased 20.1% to 170.3m RMB y-o-y due to weaker demand for gun safes in the US.

2013 was a good year for Dutech's exports of gun safes to the US, and demand has since normalized in 2014. However, there are signs that the gun market is picking up in 2015.  @ Dutech's factory in Nantong in Jan 2015: Gun safes ready for shipping to the US.

@ Dutech's factory in Nantong in Jan 2015: Gun safes ready for shipping to the US.

NextInsight file photo.

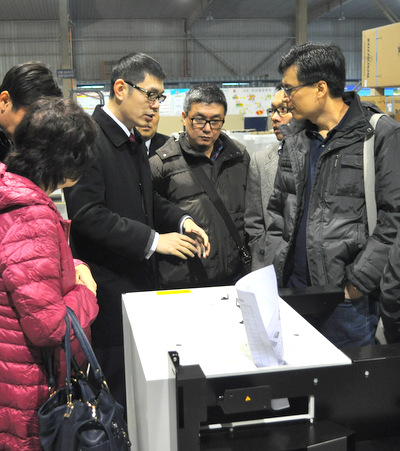

CFO Walter Cao explains the making of ATM safes to Singapore investors. NextInsight file photo.Revenue from DTMT increased from 45.8m RMB to 63.2m RMB between Q3 and Q4.

CFO Walter Cao explains the making of ATM safes to Singapore investors. NextInsight file photo.Revenue from DTMT increased from 45.8m RMB to 63.2m RMB between Q3 and Q4.

However, gross profit decreased from 7.5m RMB to 3.5m RMB.

According to the management, DTMT suffered a loss in Q4 but was profitable in January 2015. They remain confident of turning around DTMT.

It is still too early to draw any conclusions from these figures as the turnaround of Dutech’s previous acquisition, Format, the largest safe manufacturer in Germany, took several years.

A downward revaluation of 18m RMB on the acquisition of DTMT was recorded in Q4.

This pertains to the fair market value of DTMT’s property, plant & equipment (PPE) based on the valuation report by an independent valuer, which was not available at the time of acquisition.

Currency hedges and forward contracts contributed to a loss of 3.6m RMB, a reversal of the 11.5m RMB gain in 2013. This was due to the fluctuation of the USD-CNY forex. Given the recent appreciation of the USD against the CNY, management plans to reduce hedging substantially, thereby benefiting from the strengthening USD.