Dutech Holdings is a global manufacturer of high security products. The principal activity is investment holding and general wholesale of high security products. The Company's products include automatic teller machine (ATM) safes, banking safes, commercial safes and cash handling systems. It also designs and manufactures intelligent terminals and provides other business solutions to its customers. At a previous AGM: Dr Johnny Liu (red tie), Chairman and CEO of Dutech Holdings, with shareholders, including Robert Stone (back to camera) who holds 23.254 million shares of Dutech (source: FY18 annual report).

At a previous AGM: Dr Johnny Liu (red tie), Chairman and CEO of Dutech Holdings, with shareholders, including Robert Stone (back to camera) who holds 23.254 million shares of Dutech (source: FY18 annual report).

NextInsight file photo

As an initiative to raise the quality of AGMs, The Securities Investors Association of Singapore has engaged a team of analysts to research listed companies' annual reports and come up with questions that should be raised during their AGMs. The questions for Dutech Holdings include the following:

Following the strategic acquisitions, the group has transformed into a global leading manufacturer with two core businesses: High Security Segment and Business Solutions Segment. The chairman highlighted the group’s investments in R&D and innovative products, coupled with the group’s operational efficiency achieved through quality improvement and resource optimisation.

The group has targeted a shift up the value chain and expansion of its market presence and customer base.

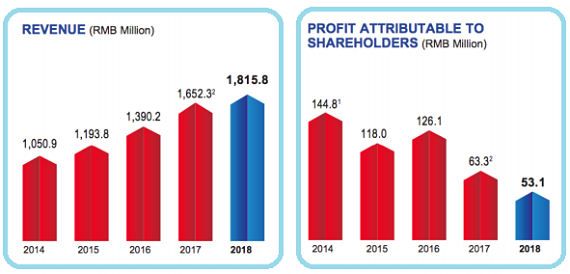

As shown on page 5 of the annual report (Financial highlights), the group has increased its revenue by 73% from 2014 to 2018 but profit attributable has been on a downward trend dropping from RMB144.8 million (or RMB88.9 million if the effect of one-off bargain purchase was excluded) to RMB53.1 million in 2018. 1. Excluding the one-off bargain purchase of RMB55.9 million in FY2014 arising from the acquisition of DTMT, the profit attributable to shareholders was RMB88.9 million in FY2014.

1. Excluding the one-off bargain purchase of RMB55.9 million in FY2014 arising from the acquisition of DTMT, the profit attributable to shareholders was RMB88.9 million in FY2014.

2. Restated due to the adoption of SFRS(I) 15.

|

Stock price |

22.5 c |

|

52-week range |

20.5 – 33 c |

|

Market cap |

S$80 m |

|

PE (ttm) |

9.4x |

|

Dividend yield |

4.35% |

|

Year-to-date |

-11% |

|

Shares outstanding |

356.5 m |

|

Source: Yahoo! |

|

(i) Would the board help shareholders better understand its business model and identify the key value drivers for the group?

(ii) Have the acquired companies been fully integrated into the group?

(iii) What synergies are there? Has the group been able to optimise the resources to streamline its processes on a global basis?

(iv) What are the challenges as the group moves from a hardware-based manufacturer to a software-heavy manufacturer?

(v) The decline in profits seems to suggest that competition is eroding the group’s margin. Can management elaborate further how the new products can capture better margins? How does the group prevent low-cost manufacturers from copying their concepts, designs and implementation?

| Dividend: The group has cash and bank balances of RMB335 million as at 31 December 2018, against total borrowings of RMB180.6 million. Cash generated from operations has also increased to RMB153.8 million compared to RMB32.7 million in the previous year. The company gave out an interim dividend of 1 cent per share in July 2018.

Has the board evaluated the optimal capital structure? Has the board deliberated on a higher dividend pay-out given the strong financial position of the group coupled with the strong cash flow from operations? The interim dividend of 1 cent per share translates to approximately RMB17.8 million. |

|||||||||||||||||||||

For the full list of questions, visit the SIAS website.

Also, read ThumbTackInvestor's 2018 article: @ DUTECH's AGM: "I'm accumulating the depressed shares"