AmFraser Securities starts coverage of MTQ with $2.55 target

Analyst: Royston Tan

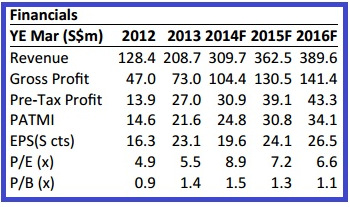

AmFraser forecasts that MTQ would record a profit after tax of S$24.8 m. Photos: Company

AmFraser forecasts that MTQ would record a profit after tax of S$24.8 m. Photos: CompanyMTQ Corporation (“MTQ”) is an oilfield equipment service specialist in the Oil & Gas industry.

Kuah Boon Wee, CEO of MTQ.

Kuah Boon Wee, CEO of MTQ. NextInsight file photoIt has 3 distinct segments, namely 1) Oilfield Engineering Services which provides oilfield equipment repairs and rental operations,

2) Subsea Services through its 86.8% owned Neptune Marine Services and

3) Engine Systems Distribution which is the largest supplier of turbochargers and fuel injection engines in Australia.

High rig utilization and supply. According to IHS Petrodata, utilization rates for marketed rigs are currently at a robust 95%.

Strong rates are further accompanied by growth in key regions like Middle East and Southeast Asia, the two largest Jack-up rig markets in the world.

MTQ's exposure to this sturdy industry through its established facilities in Singapore and Bahrain sets the company in good stead to capitalize on rising demand for rig equipment servicing in the years ahead.

Bahrain the potential wildcard. We forecast MTQ’s operation in Bahrain to achieve P&L breakeven for FY15, reversing 3 years of consecutive losses for this new start-up.

With a common pool of international clients and market potential twice as large as its Singapore operations, Bahrain might well be the key to provide the next leg of sustainable growth for MTQ.

With a common pool of international clients and market potential twice as large as its Singapore operations, Bahrain might well be the key to provide the next leg of sustainable growth for MTQ. Value-accretive acquisitions. In a short span of 3 years, MTQ has made 3 value-accretive acquisitions in the form of Premier, Neptune and Binder.

Neptune alone has the potential to contribute 3X its current earnings in a short span of 3-4 years.

The Group is also cash-flow generative and possess the financial might to acquire one new business every year to nicely complement its organic growth.

Initiate with BUY and TP of S$2.55. Based on our SOTP valuation, MTQ is still significantly undervalued despite share price having appreciated 70% in the past one year.

Our TP of S$2.55 values the company at approximately 10.5X FY15 P/E, in-line with peers valuation and on an attractive 0.44X FY15 PEG ratio.

This provides an upside potential of 50%, inclusive of a 3% forecasted yield based on last closing price of S$1.735.

Recent story: MTQ: Neptune contribution doubles 9MFY2014 earnings for group

Daiwa lowers target for Sheng Siong to 67 cents

Analysts: Jame Osman & Ramakrishna Maruvada

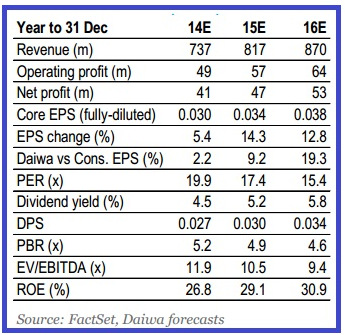

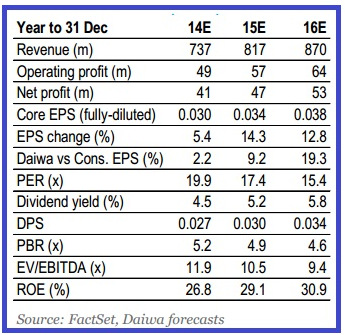

Revisions to our forecasts. We reduce our revenue forecasts for 2014-15 by 6-8%, mainly as a result of downward revisions to our gross floor area (GFA) forecasts – to reflect the delay in new store openings.

We raise our capex forecasts to incorporate progress payments of the Yishun (Junction 9) outlet (due for completion in 2017).

We raise our capex forecasts to incorporate progress payments of the Yishun (Junction 9) outlet (due for completion in 2017).

As a result, we reduce our 2014-15 EPS forecasts by 14%. We introduce our 2016 forecasts, with 13% YoY EPS growth for that year.

What we recommend:

We lower our DCF-based 6-month target price to SGD0.67 (from SGD0.73), reflecting the above-mentioned changes to our forecasts.

We reaffirm our Outperform (2) rating on Sheng Siong. Its share price decline over the past 6 months (down 7% vs. a 2% increase in the STI Index) appears to have adequately discounted investor concerns about the lack of new store openings.

Further, given the company's much smaller store base (compared to bigger rivals NTUC and Giant), each new store opening brings a significant and immediate contribution to its earnings.

Also, we continue to like Sheng Siong stock for its exposure to a defensive business within the Singapore consumer sector, supported by a strong balance sheet and reasonable-looking 2014E dividend yield of 4.5%. Further delays in opening new stores would be a key risk to our view.

What we recommend:

We lower our DCF-based 6-month target price to SGD0.67 (from SGD0.73), reflecting the above-mentioned changes to our forecasts.

We reaffirm our Outperform (2) rating on Sheng Siong. Its share price decline over the past 6 months (down 7% vs. a 2% increase in the STI Index) appears to have adequately discounted investor concerns about the lack of new store openings.

Further, given the company's much smaller store base (compared to bigger rivals NTUC and Giant), each new store opening brings a significant and immediate contribution to its earnings.

Also, we continue to like Sheng Siong stock for its exposure to a defensive business within the Singapore consumer sector, supported by a strong balance sheet and reasonable-looking 2014E dividend yield of 4.5%. Further delays in opening new stores would be a key risk to our view.

Today MTQ - 40c, SS - $1.05