MTQ’S oilfield engineering business registered healthy incremental organic growth across various geographical locations, offset slightly by lower revenue from engine systems business largely due to depreciation in the Aussie Dollar.

MTQ’S oilfield engineering business registered healthy incremental organic growth across various geographical locations, offset slightly by lower revenue from engine systems business largely due to depreciation in the Aussie Dollar.MTQ CORPORATION posted stellar 9MFY2014 results on Monday, thanks to contribution from ASX-listed Neptune Marine Services which became its subsidiary in late December 2012.

Highlights of MTQ’S 9MFY2014 results include:

>> Revenue surged by 104% year-on-year to S$234.4 million

>> Net profit attributable to shareholders surged by 110% year-on-year to S$18.4 million

>> Cash reserves increased by 13% over the past 9 months to reach S$46.2 million as at 31 December 2013

>> Net gearing was reduced by 9.6 percentage points over the past 9 months to reach 11.7% as at 31 December 2013

“I am prepared to trade some profit margin for a higher revenue base,” said MTQ Group CEO Kuah Boon Wee. NextInsight file photo

“I am prepared to trade some profit margin for a higher revenue base,” said MTQ Group CEO Kuah Boon Wee. NextInsight file photoNeptune Marine Services contributed lower margins, pulling 3QFY2014 gross profit margin down to 33.8% for the Group, compared to 38.5% for 3QFY2013.

Other than Neptune Marine Services, the Group inked 2 other M&A deals after Mr Kuah Boon Wee became its Group CEO on 1 July 2010. They are:

(1) Premier Group, an oilfield equipment service company acquired in 2011

(2) Binder Group, one of Southeast Asia’s leading designers and manufacturers of pipe support and pipe suspension solutions for the oil & gas sector.

The deal with Binder Group was announced last month, prompting OSK-DMG analyst Lee Yue Jer to raise his target price for MTQ to S$2.67.

Mr Lee's target price translates into potential upside of 70% for MTQ based on its close price of S$1.575 on Tuesday.

“The acquisition will allow MTQ to expand its oilfield engineering business with a larger customer base, while Binder’s 50% stake in an Indonesian manufacturing facility will give MTQ a foothold in the growing Indonesian market.

“We also see shareholder value creation via this attractively-priced purchase, with a direct boost to EPS growth in the near term," according to Mr Lee.

“We continue to like MTQ’s high cash generation, strong earnings growth, low valuations, healthy yields, strong industry backdrop, and low gearing.

MTQ remains one of OSK-DMG's top picks in the oil & gas sector.

“Acquisition-related growth will taper off from the next quarter. Binder’s contribution is likely to be meaningful only in the next financial year,” said MTQ Group CEO Kuah.

MTQ shares made significant gains in 2012 and 2013. At $1.58, they currently trade at a trailing PE of 8.5 and a market cap of S$198 million. Data and chart: FT.com

MTQ shares made significant gains in 2012 and 2013. At $1.58, they currently trade at a trailing PE of 8.5 and a market cap of S$198 million. Data and chart: FT.com |

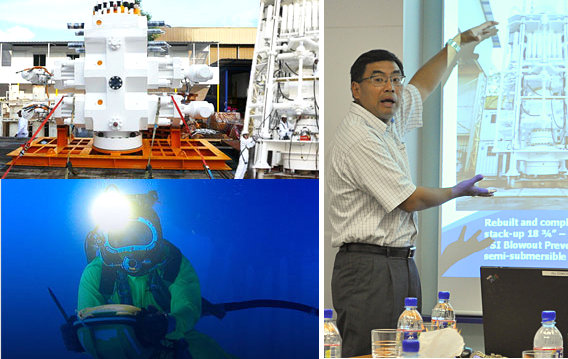

Mr Kuah, MTQ Group CFO Dominic Siu and the CEO of Neptune Marine Services, Robin King, were at MTQ’s results briefing on Monday. Below is a summary of questions raised at the meeting and answers provided by the management. BINDER Q: How did the Binder M&A come about? An accounting firm approached us with the M&A proposal. Binder was owned by private individuals in their sixties seeking to exit. We bought out the 2 non-management shareholders. The shareholder who ran the business remains on board. We plan to have a transition period of two years for management handover. Q: During July to October 2013, Binder Group’s profit after tax was 95% of what it generated in FY2013 (June year-end). What was the earnings driver? I would guard against drawing linear interpolations, especially in the process of an M&A. The attraction of Binder to MTQ is what we can do with its assets, such as its 50%-owned manufacturing facility in Indonesia. One of the big drivers for Binder's earnings during the last couple of months was Gorgon's project in Australia. Binder has more campaigns, unlike MTQ which has more recurring jobs. Q: Is Binder’s business capital intensive? The capex required will more likely be for upgrading and replacement of existing facilities, rather than capacity ramp-up. Binder's product range is more basic compared to MTQ, and requires less skilled labor.  Neptune Marine Services CEO Robin King. NextInsight photo Neptune Marine Services CEO Robin King. NextInsight photo

NEPTUNE Q: Do you face pressure from rising charter rates for your ROVs (remotely operated vessels)? No one wants to send divers underwater unless it is for something that an unmanned vessel can’t do. Welding needs the human element, but sooner or later, only ROVs will be used for straight forward jobs like pipeline inspection. Q: What is your ROV utilization? Our ROV utilization is the best in Southeast Asia. It is now the best we've had in 3 years. |