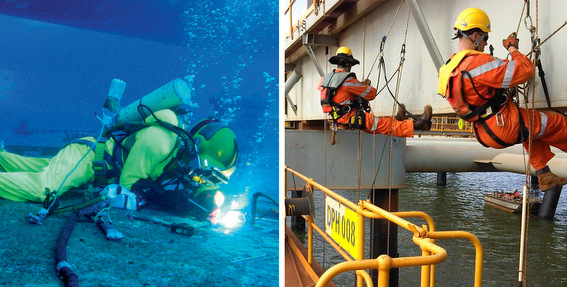

MTQ's newly-acquired subsidiary in Australia, Neptune Marine Services, provides diving services and "asset integrity services". High levels of oilfield activity has helped boost MTQ's FY2013 net profit attributable to shareholders by earnings by 48%. Company photos

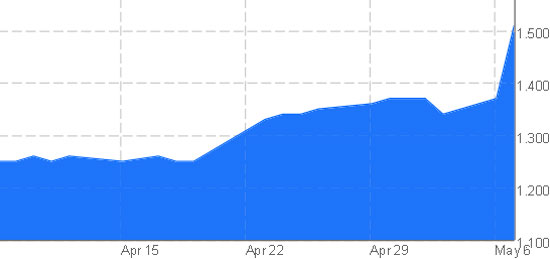

MTQ's newly-acquired subsidiary in Australia, Neptune Marine Services, provides diving services and "asset integrity services". High levels of oilfield activity has helped boost MTQ's FY2013 net profit attributable to shareholders by earnings by 48%. Company photos MTQ'S STOCK PRICE jumped 11% yesterday (7 May) after it announced an increased dividend payout and a 48% surge in net profit attributable to shareholders to S$21.6 million for FY2013.

The stock rose from S$1.37 on Mon to close at S$1.52 the next day after it said it is paying a final cash / scrip dividend of 2.0 cents per share plus one bonus share for every 4 existing shares held. New bonus shares would be entitled to the final 2-cent dividend.

Group CEO Kuah Boon Wee.

Group CEO Kuah Boon Wee.

NextInsight file photo”Older oilfield equipment is being taken off service. That is helping utilization and charter rates for oilrigs,” said Group CEO Kuah Boon Wee at an investor briefing on Monday evening.

The oilfield equipment solutions provider posted a 63% increase in revenue to reach S$208.7 million.

Oilfield engineering remained the highest contributor, with a 27.8% increase in revenue to S$94.7 million because of the following reasons:

> Full-year revenue was recognized for its oilfield engineering subsidiary, Premier Group, compared to 9 months in FY2012.

> Engine Systems recorded S$55.2 million in revenue, a marginal increase of 1.1% year-on-year.

> Neptune, an ASX-listed 86.8%-owned subsidiary providing subsea services, made its first revenue contribution of S$58.9 million in 4QFY2013.

Gross profit margin for the Group declined slightly to 35.0% in FY2013 from 36.6% in FY2012 due to changes in the product mix after the acquisition of Neptune.OSK-DMG analyst Lee Yue Jer yesterday raised his FY14F/15F estimates by 20%/23%.

"Rolling over to FY14F valuations, we raise our target price to SGD2.10 (from SGD1.66) at the same 8x P/E. Maintain BUY and recommend taking scrip dividends."

As for the Bahrain facility of MTQ, the analyst noted that revenue jumped to $4.8m from $1.1m a year ago. "We estimate cash breakeven at SGD6m and accounting breakeven at SGD7.5m, which are within reach in the current year."

Below is a summary of questions raised at MTQ’s investor briefing and the answers provided by Mr Kuah and Group CFO Dominic Siu.

CFO Domnic Siu. Company photoQ: Does the 4QFY2013 revenue contribution of about S$60 million from Neptune represent its full capacity?

CFO Domnic Siu. Company photoQ: Does the 4QFY2013 revenue contribution of about S$60 million from Neptune represent its full capacity?

Neptune’s service business model is different from our Singapore workshop, where manpower is permanent and you can’t really scale up. For example, Neptune’s diving service relies on contract labor, and there is room for scaling up.

Q: How is the your Bahrain facility performing?

The level of enquiries is very healthy because of the level of oilfield activity there. Our challenge is not so much about generating sales.

Our challenge is in execution. We are not as efficient as we would like to be, so there is room for margin improvement. The workers have been there for about 2 years or less and there's still a learning curve. We are still losing money on the Bahrain facility because our margin per job is lower than it should be.

Finding people to go there is also a challenge.

Q: Who are your customers in the Middle East?

We do work for the global drilling contractors and oil services companies such as Ensco, Transocean and Saipem. We also do work for original equipment manufacturers like GE Oil & Gas.

Q: Do you see a slowdown in the Australian economy?

I'm a little concerned about the cost of operating in Australia. The Aussie government wants to impose worker levies but its economy may not be able to support it. MTQ stock price surged over 11% yesterday on strong profit figures and dividend cum bonus issues. Bloomberg data

MTQ stock price surged over 11% yesterday on strong profit figures and dividend cum bonus issues. Bloomberg data

Related stories:

TIONG SENG HOLDINGS, MTQ CORP: Latest Good News

MTQ: 9M2013 Net Profit Up 30% At S$13.8m On Firm Oil Prices

NMS acquisition really changed the whole valuation of the company.

It also makes the Company that much harder to analyse.

NMS is an order-book based business, hence projecting revenues/cash flows would be much more difficult. I suspect NMS' capex requirements may be higher than MTQ's core Oilfield Engineering business, which is why the analyst from DMG OSK used $13m as his capex assumption.

As to the $40m OCF generated every year, this seems rather optimistic as MTQ has traditionally generated just $20m of OCF and about $16m of FCF.

Note that the Balance Sheet of the Group has also been altered; gearing is now a prominent feature and we need more details on the cost of debt and debt maturity profiles to get a better sense of when they need to refinance, and how much finance costs will rise by. Trade Receivables is also very high, thus bringing up the question of collectability; though this may be a timing difference, I prefer to err on the side of caution.

Finally, Bahrain is still a question-mark. The analyst seems quite positive on Bahrain based on what Management has said but I prefer to be prudent and assume no breakeven until at least FY 2015.

This may cause the valuation of the company to be more muted, but I want to factor in scenarios which are pessimistic so as to understand what the downside risks are.

I actually find the first 2 key points - on the Bahrain facility fast achieving operational cash break-even, and Neptune Marine Services (NMS)'s improving profit margins - in OSK/DMG's 8May13 report very good and useful.....

http://mail.dmg.com.sg/dmgnew/dmgrshnew....130509.pdf

, and I feel their FY14 Revenue and NP forecasts - $280.0m and $27.5m, respectively - are rather conservative. I think we have to bear in mind that: (1) there is a lot of business opportunities for MTQ's types of oilfield engineering services in the Middle-East, and sooner or later, business volume and profits of the Bahrain facility will take off; and (2) NMS has gone through a lot of revamp and down-sizing in the last 2 years, and is now lean and mean and well placed to grow business volume of its diversified specialised sub-sea services on a profitable basis.

Is OSK/DMG's revised TP of $2.20 too aggressive therefore unrealistic? Well, I believe given enough time, this is entirely possible, as we have to bear in mind that MTQ is a very well managed business group, and its relatively small size makes it a potential acquisition target for other bigger players in the same or related trades. If we assume a slightly higher NP forecast of $30.0m for FY14, and a very reasonable PER of 8.0x would give a fair value estimate of $240.0m, or $2.40 a share (based on the latest 100.168m issued shares).

Today (9May13), continuous buying raised MTQ by another $0.08, or 5%, to close at another record high of $1.68, with 753 lots transacted. Mr Market has again proven wrong those shareholders who chose to sell out in the last 2 days, as MTQ has risen continuously by a total of 23% in the last 3 market-days.