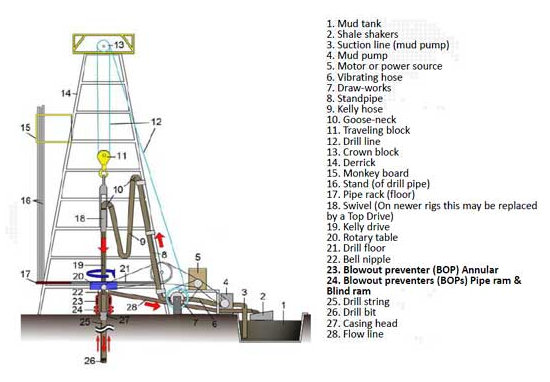

FIRM OIL PRICES have been fueling drilling activities and this has benefited oilfield engineering solutions provider MTQ.

Oil exploration & production spending over 2011-2015 is expected to grow at a CAGR of 10.8% in selected offshore regions, according to MTQ.

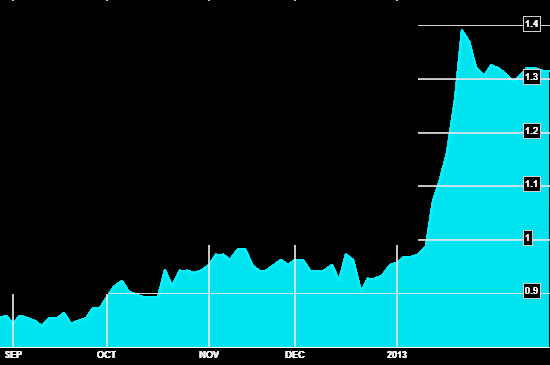

Riding on this, the company recently posted a good set of earnings for 9M2013 (year end March).

>> 9M2013 revenue was up 21% year-on-year at S$115.1 million

>> 9M2013 net profit was up 30% year-on-year at S$13.8 million

>> Cash balance was S$42 million as at 31 December

However, 3Q2013 net profit was down 34% because of a high base in 3Q2012, when there was a one-off write-back on overprovision for taxes amounting to S$3.4 million.

MTQ’s 9M2013 results had consolidated the balance sheet of its new acquisition of 83% in ASX-listed Neptune Marine.

Neptune posted FY2012 revenue of A$116.3 million (S$150.0 million) and a net loss after tax from continuing operations of A$33.8 million (S$43.6 million).

Read its press release for details of its financial results.

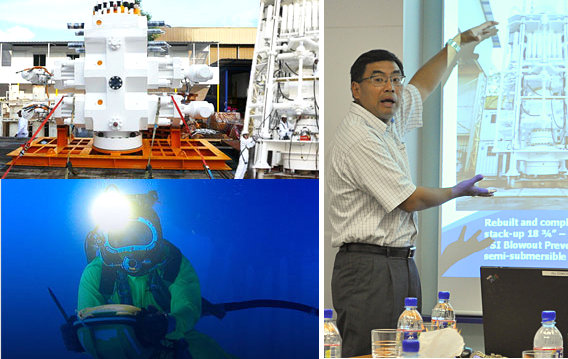

CEO Kuah Boon Wee was in a teleconference with analysts and fund managers on Thu to discuss the company’s corporate developments. Below is a summary of the questions raised, and the replies provided by Mr Kuah:

Q: How does a strong USD versus SGD affect you?

Our cost and revenue are in USD. Only our reporting currency is SGD. Thus, the impact is more of a translation effect on our financial statements.

Q: Can you give more details of what's happening in Bahrain, such as capacity or headcount trend?

The Bahrain outfit had about 50 to 60 people in Jun 2012. Now it has 92 people and expects to increase to about 100 people by this year.

It has sizable orders but needs additional capacity to deliver. I am encouraged by the demand.

Q: What opportunities are there in Bahrain compared to in Singapore?

Based on the number of jackup rigs in operation, the market for servicing the oil & gas sector in the Middle East is at least double that in Southeast Asia.

Every time a new drilling program kicks off, there is new demand for equipment and services.

The political environment there has not affected us with the exception of recruitment of senior staff.

Q: Assuming you are operating at full tilt, how much revenue can you generate out of the Bahrain facility?

Investments by Saudi ARAMCO are increasing. Internally, We are still completing phase one of our Bahrain facility, which has resources of about 40% of our Singapore operations.

Q: What opportunities are there for Neptune?

Neptune is a subsea services provider, with revenue driven by on-going operating expenditure for oil & gas drilling and extraction.

It currently has projects off Perth, as well as in the North Sea. It provides subsea services such as diving and underwater maintenance, remotely operated vehicle (ROV), marine survey and geotechnical services as well as subsea stabilization.

With MTQ’s footprint in Southeast Asia and the Middle East, there are opportunities to take Neptune’s services to new markets.

Q: At what percentage ownership of Neptune will you be required to make a compulsory buyout of the minority shareholders?

We now own 83% in Neptune and need to hold 90% to initiate an offer to delist it.

The trading volume is very low, but the minority shareholders are not willing to sell at current price of 3.2 Aussie cents.

If we take the option to delist Neptune, we have the option to buy up to 3% of its outstanding issued capital every 6 months after the takeover offer closes.

Q: What synergy is there of your engine business in Australia with the rest of the Group?

Our engine system business is non-core in the sense that it is not in subsea sector, but it is profitable.

We have a tremendous amount of knowledge about drilling services and the subsea sector.

I believe we can find complementary services that we can cross-sell to our subsea customers.

Recent stories:

@ MTQ AGM: Insights Into Bahrain And Neptune Prospects

MTQ, SINO GRANDNESS: What analysts now say...