HSBC: CHOW SANG SANG Initiated ‘Neutral’

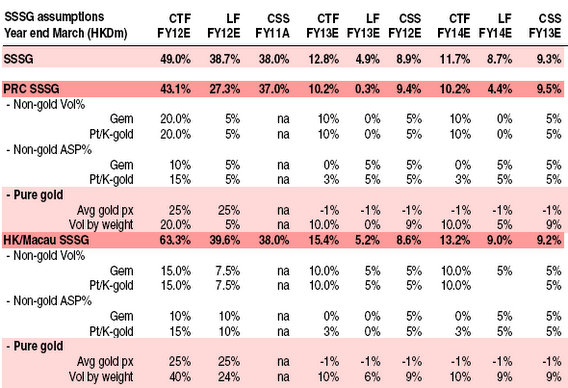

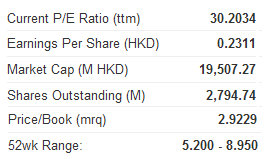

HSBC, the world’s biggest financial institution, has issued an initial “Neutral” call on jeweler Chow Sang Sang (HK: 116; CSS) and a target price of 17.5 hkd, based on a P/E of 13.5x.

“We like Chow Sang Sang for its 100% direct retail model and brand strength in the gem-set market segment,” HSBC said.

The UK-based bank said that it thinks Chow Sang Sang has a “prudent solid business model" and is a "well run company.”

Chow Sang Sang is the third largest jewelry retailer in Hong Kong and Macau with an 8.7% market share and the 12th largest player in China.

Chow Sang Sang operates 232 stores in China and 77 stores in Hong Kong/Macau and Taiwan as of end-2011. All of CSS stores are directly managed.

Its major competitors include Chow Tai Fook (HK: 1929; CTF) and Luk Fook (HK: 590; LF).

The company runs two brands, the Emphasis brand (Taiwan, Hong Kong and Macau) and Chow Sang Sang brands. Emphasis is a small scale brand, accounting for only about 1% of revenue and is sold outside of China. It also has licensed international brands in its stores to build a high-end store image.

The company was listed on the Hong Kong stock exchange in 1973 and has four businesses: (1) jewelry retail, (2) precious metal wholesale, (3) securities brokerage and (4) other investments.

Jewelry retail is the core business, accounting for 74% of revenue and 95% of profit in 2011.

HSBC said it forecasts a 13% and 10% y-o-y growth in total revenue for Chow Sang Sang to HK19.5 bln and 21.4 bln in FY12e and FY13e, respectively.

“We expect retail revenue to grow 18% and 13% to HKD14.9 bln and HKD16.9 bln sales in FY12e and FY13e, respectively.”

See also:

CHOW SANG SANG Sales Surge; Move Over, India?

CHOW SANG SANG Kept At ‘Buy’, HK Property Initiated ‘Outperform’

OSK Stays ‘Buy’ On BAOFENG; BOCI Cuts CHOW SANG SANG Target

HK Jewelry Retailers: 'Buy CHOW SANG SANG, LUK FOOK On Weakness'

Photo: Nipic

Kingston: CHINA FOODS Popping Corks With Great Wall

Kingston Securities said China Foods (HK: 506) will reap benefits from its heavy focus on high-profile wine brand “Great Wall.”

“China recently planned to reform the wine industry, which may raise the entry barrier. China Foods’ ‘Great Wall’ wine just won the title as an iconic brand of China’s wine industry,” Kingston said.

The research house added that the combination of the two news items will positively affect China Foods.

“After the acquisition of wineries in Chile and France, the Group claimed that it will further invest around US$8 mln to US$30 mln to purchase wineries in Australia and California, increasing its pace in implementing the globalization strategy of the Great Wall wines.

“Moreover, the Group is expanding its production capacity in (China’s) Ningxia and Xinjiang production bases, broadening its sales coverage and improving its operational efficiency.”

In order to place its brands in the high-end market, Kingston said China Foods has continuously adjusted its product mix and eliminated products with low GPM, causing the sales volume to fall in recent years.

“Yet, the wine products still achieved segment results of HK$633 mln last year, up 73.4% yoy, and accounting for approximately half of the Group’s profit.”

China Foods is also considering developing its white wine business for customers with varying tastes.

“It has been reported that the Group has already seen a profit turnaround in its confectionary products and further asset injections from its parent company is still looked forward to.”

See also:

Juice Wars: PRESIDENT Squeezing HUIYUAN'S Hold Over China

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

VITASOY: Stronger Revenue/Profit Growth Expected From 1Q12 Onwards

FOOD FOR THOUGHT: WANT WANT, TINGYI Noodle Blue-Chip Bound