KINGSWAY: ‘BUY’ Maintained on CHOW SANG SANG

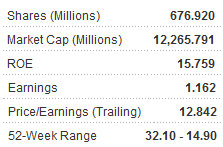

Kingsway Research said it is maintaining its ‘Buy’ recommendation on Chow Sang Sang (HK: 116) with a target price of 24.6 hkd (23% upside) after the jeweler showed recent signs of breaking away on the performance front from some of its major rivals.

“Chow Sang Sang (CSS) achieved 18% SSSG (same store sales growth) in Hong Kong over the Chinese New Year holiday, significantly higher than Luk Fook’s 4%. For January 2012, CSS’s Hong Kong and China SSSG were 20% and 40% y-o-y, respectively,” Kingsway said.

The brokerage said Chow Sang Sang enjoys a higher China store growth rate than its peers.

“We expect CSS’s China store count to grow 22% and 18% in 2012 and 2013, respectively, above 13-15% for Chow Tai Fook and Luk Fook. With only 193 stores in China in June 2011, CSS has significant room for further expansion.”

Kingsway added that “differentiation” is key to Chow Sang Sang’s success.

“We believe CSS’s differentiation strategy may attract a slightly different customer group compared with CTF and LF, reducing impact from direct competition. Its average store size in Hong Kong is 50-90% larger than peers with spacious product counters, creating a more enjoyable shopping environment. It also offers more jewelry products through collaborations with international brands such as Gucci, V&A and Regalo.”

The brokerage added that new store contribution helps cushion the jeweler from near-term macroeconomic headwinds.

“New store contribution will likely mitigate near-term weakness in same-store-sales and drive higher growth in 2013.”

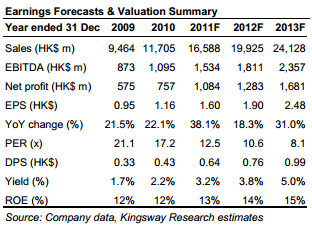

Kingsway forecasts net income growth for Chow Sang Sang to accelerate to 31% in 2013 after slowing to 19% in 2012 driven by store expansion.

“We expect China sales to account for 46% of total retail sales in 2013 versus 33% in 2010. CSS has risen by 14% since our initiation in early January, 2012. It also outperformed its peers recently driven by resilient SSSG figures.”

See also:

PRC RETAIL, PROPERTY: The Good And The Ugly

OSK Stays ‘Buy’ On BAOFENG; BOCI Cuts CHOW SANG SANG Target

HK Jewelry Retailers: 'Buy CHOW SANG SANG, LUK FOOK On Weakness'

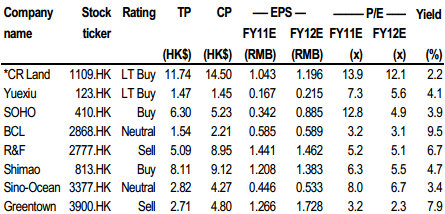

BOCOM: Initiating HK PROPERTY ‘OUTPERFORM’

Bocom International said it is beginning coverage of Hong Kong’s all-important real estate sector with an ‘Outperform’ recommendation on expectations of a turnaround in the sector.

“There is a breakthrough in transactions in sight. Transactions have rebounded sharply recently with 35 housing estates’ weekly volume surging four times compared with January 2012, the strongest since January 2011. We believe this is the beginning of a volume recovery rather than just a short lift,” Bocom said.

It added that judging from the heavy transactions that took place in the first half of last year, it expects transaction volume to rebound in the next three months, when more sellers may soften their asking prices as they cross the one-year holding period under the special stamp duty (SSD) rule.

“At the same time, one should not underestimate the household income growth, given more buyers can afford property purchases even at current prices. All this should help to narrow the price gap between buyers and sellers, and the more active transaction volume should also support property prices as well as market confidence.”

Bocom said that new land supply does not represent a major threat.

The latest budget speech listed 30,000 units of land supply available for sale.

“We estimate 20,000 of them will be sold in FY12/13, in line with the previous policy address. We see this as a reasonable target and the market should be able to absorb the supply, as it accounts for only 2% of the existing housing stock in Hong Kong.

“The larger supply is also necessary and backed by the replacement demand, as we estimate >20% of the existing stock is over 40 years old,” Bocom said.

On the other hand, developers might be able to replenish their landbank at more reasonable costs, when they are regaining bargaining power from the government, the brokerage added.

“We estimate developers can still earn >30% margin at current prices. The share prices of Hong Kong developers have risen 15% YTD, versus the Hang Seng Index by 13%. However, their valuations are still attractive at 40% 2012E NAV discount versus the historical average of 21% discount.

"We believe the Hong Kong property market is still healthy and asset values remains solid, so valuations should at least return to their averages.”

Among the major developers, Bocom said it prefers Sun Hung Kai Properties Ltd (HK: 16; ‘buy’) and Cheung Kong (HK: 1; ‘buy’) given their better new launch pipelines and superior balance sheets to finance land banks, at a time when developers are regaining bargaining power from the government.

See also:

Hong Kong Developers On PRC Bargain Hunting Spree

LISTED PRC HOTELS: Hot Bet On Domestic Push

PROPERTY SURVEY II: Settling Down In Shenzhen